Dong Nai is a province in the Southeast region based on the merging of two old provinces, Bien Hoa and Long Khanh, Vietnam. This is the 5th most populous province in the country after Ho Chi Minh City, Hanoi Capital, Thanh Hoa province, and Nghe An province.

Dong Nai is a gateway province to the Southeast economic region – the most developed and dynamic economic region in the country. In particular, Dong Nai is one of three sharp corners of the development triangle of Ho Chi Minh City – Binh Duong – Dong Nai. Dong Nai has many traditional industrial clusters and more than 32 industrial parks approved and put into operation by the Prime Minister such as Long Thanh, An Phuoc, Nhon Trach II, Bien Hoa II, and Amata.

That is why Viet An Law Firm has been receiving a lot of attention and requests to apply for Investment Certificates as well as adjust Investment Certificates for businesses and projects with investment capital from domestic and abroad in Dong Nai province.

On the Dong Nai map, Bien Hoa City currently has 30 commune-level administrative units including Long Hung commune and 29 wards: An Binh, An Hoa, Binh Da, Buu Hoa, Buu Long, Hiep Hoa, Hoa An, Hoa Binh, Ho Nai, Long Binh, Long Binh Tan, Phuoc Tan, Quang Vinh, Quyet Thang, Tam Hiep, Tam Hoa, Tam Phuoc, Tan Bien, Tan Hanh, Tan Hoa, Tan Hiep, Tan Mai, Tan Phong, Tan Tien, Tan Van, Thanh Binh, Thong Nhat, Trang Dai, Trung Dung.

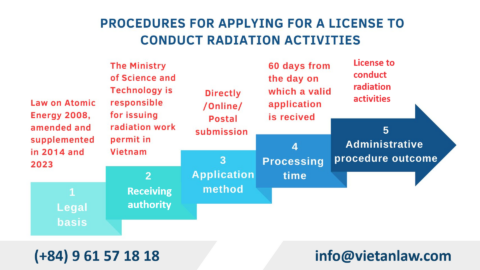

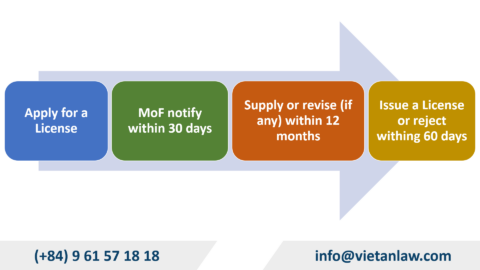

Procedures for adjusting the Investment Registration Certificate are carried out according to the following steps:

The time limit for implementing investment certificate adjustment procedures

Normally within 10 working days from the date of receipt of valid documents.

For enterprises that have not yet carried out the procedure to separate the Investment Certificate into an Enterprise Registration Certificate, they must separate the Investment Certificate.

After an enterprise adjusts its Investment Certificate, it needs to carry out several procedures to avoid unwanted legal procedures as follows:

Businesses invest in Dong Nai province, an area with a dynamic economy and strong development in the southern region in recent years. Accordingly, to meet these changes and developments, domestic and foreign investors must make changes or adjustments to information on the Investment Certificate to suit the current situation and structure of the business. Viet An Law Firm provides investment certificate adjustment services in Dong Nai province in particular and nationwide in general. Please contact us for the best support..

Hanoi Head-office

#3rd Floor, 125 Hoang Ngan, Hoang Ngan Plaza, Trung Hoa, Cau Giay, Hanoi, Vietnam

Ho Chi Minh city office

Room 04.68 vs 04.70, 4th Floor, River Gate Residence, 151 – 155 Ben Van Don Street, District 4, HCM, Viet Nam

SPEAK TO OUR LAWYER

English speaking: (+84) 9 61 57 18 18 - Lawyer Dong Van Thuc ( Alex) (Zalo, Viber, Whatsapp)

Vietnamese speaking: (+84) 9 61 37 18 18 - Dr. Lawyer Do Thi Thu Ha (Zalo, Viber, Whatsapp)