Corporate income tax is a basic tax, mandatory for businesses operating with business registration. In Vietnam, corporate income tax is mandatory and there are clear regulations for each type of business. FDI enterprises are a type of foreign-invested organization that is increasingly developing in Vietnam. So how does tax apply to foreign companies? In the article below, Viet An Law Firm will provide detailed information to help you better understand about Corporate income tax in Vietnam, especially for foreign company.

FDI (Foreign Direct Investment) means an enterprise with foreign investment capital. In international business, this term is commonly used. However, in reality, Vietnamese law still does not have clear regulations for this type of business.

Pursuant to Clause 22, Article 3 of the Investment Law 2020, there is a general explanation about economic organizations with foreign investment capital, accordingly, economic organizations with foreign investment capital are economic organizations with foreign investors as members or shareholders.

Therefore, based on the provisions in Clause 22, Article 3 of the Investment Law 2020, FDI enterprises are considered economic organizations with foreign investment capital.

According to Article 3 of the Law on Corporate Income Tax, regulations on taxable income are as follows: “Taxable income includes income from production and trading of goods and services and other income specified in Clause 2 of this Article.” In particular, corporate income tax is a tax that the state directly collects into the state budget calculated on the taxable income of enterprises and organizations engaged in the production and trading of goods and services.

Pursuant to Article 2 of the Law on Corporate Income Tax 2008, taxpayers are regulated as follows:

Corporate income taxpayers are organizations engaged in the production and trading of goods and services with taxable income according to the provisions of this Law, including:

Enterprises with taxable income specified in Article 3 of this Law must pay corporate income tax as follows: for taxable income arising in Vietnam and taxable income arising outside Vietnam;

In particular, FDI enterprises are established and operate according to the provisions of the Investment Law 2020. Therefore, FDI enterprises are subject to corporate income tax according to the provisions of Vietnamese law.

FDI corporate income tax is calculated as follows:

Corporate income tax payable = (Taxable income – Scientific and technological fund appropriation) x Corporate income tax rate

If the enterprise does not set up a science and technology development fund, the tax calculation formula is as follows:

Corporate income tax payable (A) = Taxable income (B) x Corporate income tax rate (C)

In which, income subject to corporate income tax is determined as follows:

Taxable income (A) = Taxable income (a) – Tax-free income (b) + Losses carried forward (c).

In particular, taxable income includes income from production and trading of goods and services and other income determined as follows:

Taxable income (a) = Revenue (a1) – Deductible expenses (a2) + Other income (a3)

For enterprises with many production and business activities applying many different tax rates, the enterprise will have to separately calculate the income of each activity multiplied by the corresponding tax rate.

For corporate income tax rate, it is determined according to the provisions of Circular 96/2015/TT-BTC. The tax rate of corporate income tax also depends on tax incentives for businesses.

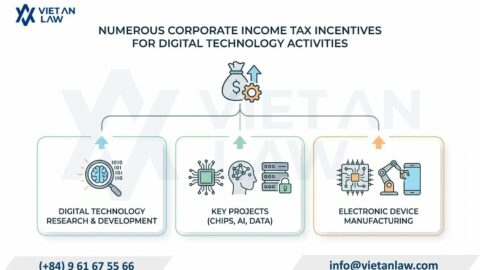

FDI enterprises enjoy foreign corporate tax incentives when implementing investment projects in industries or areas with investment incentives according to the provisions of the law.

In Article 19, Circular 96/2015/TT-BTC stipulates preferential tax rates as follows:

Regarding tax exemption from corporate income tax for FDI enterprises, based on Article 20 of Circular 78/2014/TT-BTC of the Ministry of Finance amended in Circular 96/2015/TT-BTC:

Income tax of enterprises from implementing new investment projects in the field of socialization in areas that are not on the list of areas with difficult or especially difficult socio-economic conditions.

Above is information to note about the corporate income tax in Vietnam. If you have any questions or need answers, please contact Viet An Law Firm to receive the best support. Best regards!