Tax is a compulsory contribution to state revenue as well as a tool for economy management. Tax is also an obligation of enterprises to repay society.

Basically, a foreign enterprise in Vietnam have to pay the following taxes:

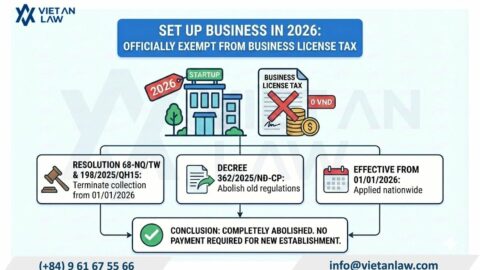

License tax:

License tax is a kind of tax which is paid per year. Besides increasing state revenue, it helps state agencies create data for managing business entities. License tax is regulated in Circular No. 43/2003/TT-BTC issued by the Ministry of Finance on May 7, 2003.

License tax of a foreign enterprise shall be determined according to registered capital (investment capital). License tax level is based on capital level, as showed in the table below:

| License tax level | Registered capital | The amount of license tax per year |

| Level 1 | More than 10 billion VND | 3.000.000 VND |

| Level 2 | From 5 billion VND to 10 billion VND | 2.000.000 VND |

| Level 3 | From 2 billion VND to under 5 billion VND | 1.500.000 VND |

| Level 4 | Under 2 billion VND | 1.000.000 VND |

Enterprise income tax:

Enterprise income tax is a kind of tax calculated based on incomes form business activities of enterprises and other incomes, which are often incomes earned from property transfer.

Formula:

Payable enterprise income tax = [Taxable incomes – (Tax-exempt incomes + Losses carried forward from the previous year)] × Tax rate

Taxable incomes = Revenue – Deductible expense + Other incomes

From January 1, 2016, enterprise income tax rate is 20%.

Value-added tax (VAT):

Value-added tax is a kind of tax calculated based on the additional value of goods and services during the process of production and distribution. However, not all of goods and services are subject to VAT. Goods and services at Article 5 of the Law of value-added tax:

There are two calculating methods:

Tax credit method:

Payable VAT = Output VAT – Deducted input VAT

Direct calculation on additional value method:

Payable VAT = Additional value of sold goods and services × VAT rate

There are three VAT rate levels: 0%, 5% and 10%, depending on each group of goods and services as regulated in Article 10 of the Law on value-added tax.

Excise tax:

Excise tax is an indirect tax passed on to consumers consuming luxury goods or services. The State also use excise tax as a tool to limit some business sectors. If a foreign enterprise purchase or sell goods or services regulated in Article 2 of the Law on Excise tax shall have to pay it.

Calculating method:

Payable excise tax = Taxed price × Tax rate

Taxed price of a good or service is the selling price or service charge without excise price, environment tax, value-added tax. Excise tax rate fluctuates from 15% – 65%, depending on each kind of goods or services.

Export and import taxes:

If a foreign enterprise import and/or export goods, it has duties to pay export and/or import taxes.

There are three calculating methods:

Proportional method: calculating tax as a percentage of the taxable value of imported/exported goods.

Payable import/export tax = Taxable value × Tax rate

Preferential rates and special preferential rates are regulated in tax commitment tables between Vietnam and other countries (if any). Ordinary rates are regulated in detail in Decision No. 36/2016. If a good is not belong to the ordinary rate table, the applied rate shall be 150%.

Fixed method: calculating tax as a certain amount of tax imposed upon a unit of imported/exported goods.

Payable import/export tax = Actual quantity of imported/exported goods × and the amount of duty per unit of goods at the time of tax calculation

Mixed method: using the two methods above.

Payable import/export tax are the sum of payable import/export tax calculated by proportional method and fixed method.

Legal consulting services for foreign enterprises at Viet An Law Firm:

Tax duty is a huge problem of enterprises; especially foreign enterprises, due to the complicated jurisdiction of Vietnam. There are many kind of taxes and procedures to comply with. If clients have any question and concerns about tax, accounting, tax audit and procedures, please feel free to contact Viet An Law Firm for more information!