Foreign-invested enterprises usually have to deal with a lot of challenges in complying with legal regulations on accounting and taxation in Vietnam. Grasping and implementing these regulations not only helps businesses operate efficiently but also prevents unnecessary legal risks. As a result, professional tax accounting consulting services have become an optimal solution, supporting foreign-invested enterprises in building a solid financial foundation and achieving sustainable development in the Vietnamese market. The following article by Viet An Law will provide essential information on tax accounting consulting services for foreign-invested enterprises.

Taxation is a crucial tool for the government to increase budget revenue as well as to manage and limit negative limbs within the economy. At the same time, tax represents an obligation of enterprises to give back to the community that has created chances for their business operations and profitability.

Table of contents

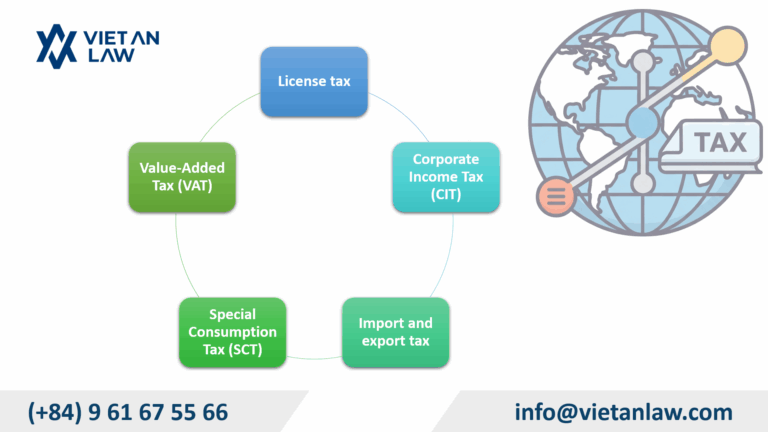

Fundamentally, the tax obligations of a foreign-invested enterprise include the following types of taxes:

Applicable taxes for enterprises in Vietnam

The license tax is specifically regulated under Article 4 of Decree 139/2016/ ND-CP (amended and supplemented by Decree 22/2020/ND-CP) and Article 4 of Circular 302/2016/TT-BTC (amended and supplemented by Circular 65/2020/TT-BTC).

For foreign-invested enterprises, the registering capital is determined as the investment capital, and depending on the amount recorded in the Investment License, different license tax rates will apply.

Applicable license tax rates on the production and trading of goods and services:

| No. | Basis for tax assessment | Annual license tax rate |

| 1 | Organizations with charter capital or investment capital exceeding VND 10 billion | 3.000.000 VND/ year |

| 2 | Organizations with charter capital or investment capital of VND 10 billion or less | VND 2.000.000/ year |

| 3 | Branches, representative offices, business locations, public service units, and other economic organizations | VND 1.000.000/year |

Notes:

Corporate income tax is imposed on the income generated from business and production activities, as well as other income sources of an enterprise. Other income usually includes income from the transfer of assets and property rights.

Tax calculation:

As of January 1st, 2016, the standard corporate income tax rate applicable is 20%.

Value-Added Tax is levied on the added value of goods and services throughout the processes of production, circulation, and distribution. However, not all goods and services are subject to VAT.

There are two ways of VAT calculation:

VAT payable = Input VAT – Creditable output VAT

VAT payable = Added value of goods/ services sold x Applicable VAT rate

These are three VAT rates currently in effect: 0%, 5%, and 10%, depending on the nature of the goods and services as prescribed by law.

Special Consumption Tax is an indirect tax imposed on consumers of luxury goods and services that are not essential for daily life, or on sectors the State seeks to restrict. A foreign-invested enterprise must pay this tax if it conducts business involving goods or services listed in Article 2 of the Law on Special Consumption Tax.

Tax calculation:

The SCT rate varies from 15% to 65% depending on the types of goods and services.

Foreign-invested enterprises are obligated to pay import and export tax if they engage in the export or import of goods.

There are three ways for calculating import and export tax:

Currently, many foreign-invested enterprises in Vietnam opt for full-service accounting packages provided by international firms in order to optimize costs and ensure service quality. However, selecting an unreliable accounting service provider may pose significant risks due to language barriers, legal complexities, and intricate financial issues arising from cross-border operations.

Failure to stay up to date with legal and regulatory may result in accounting errors such as incorrect tax declarations, inaccurate financial statements, or improper handling of documentation and intra-company transactions. Such errors may expose enterprises to the risk of tax arrears. Moreover, inaccurate translations are also potential risks.

Additionally, lacking of signatures, incomplete tax information on invoices, or non-compliance with local accounting standards may cause severe consequences, for example, unexpected costs and administrative penalties. As a result, foreign-invested enterprises need to choose accounting service with deep expertise in international accounting practices and substantial practical experience to ensure smooth and compliant business operations.

Small and medium-sized foreign-invested enterprises in Vietnam often prefer outsourced accounting services due to their outstanding advantages, such as cost-efficiency, high regulatory compliance, and clear, accurate, on-time reports. For most businesses, they consider accounting services for foreign-invested enterprises are optimal solutions to maximize economic benefits.

Tax accounting consulting services for foreign-invested enterprises of Viet An Tax Agent

Establishing an in-house accounting department is not a big challenge to large corporations but it is a significant financial and administrative burden for small and medium-sized enterprises. These businesses must cover monthly salaries, employee benefits, and social insurance contributions. Furthermore, maintaining a high level of professional expertise among staff is always a concern, the higher qualified accountants demand higher salaries. Using tax and accounting services for foreign-invested enterprises, businesses can eliminate concerns related to employee turnover, handover of accounting records, and retraining of new staffs.

All-in accounting and tax consulting services ensure all tasks will be done precisely and on time. When choosing such services, enterprises are supported by top professionals in the field of accounting who possess necessary skills and experience to handle unexpected issues. They are experts in problem solving and providing effective corporate management solutions. As a result, foreign-invested enterprises can confidently entrust their accounting functions to a service provider specializing in cross-border and international accounting practices.

The article above constitutes Viet An Law’s consultancy scope under its tax accounting consulting services for foreign-invested enterprises. If you have any questions or require any support, please do not hesitate to contact Viet An Law for the most effective assistance.