A value-added invoice (VAT) is a type of invoice used to record information about the sale of goods or provision of services, and at the same time show the amount of VAT payable to the state budget. This type of invoice is applied to business organizations and individuals who are declaring VAT by the deduction method. VAT invoices, whether handwritten on paper invoices or written on electronic invoices, must be accurate and must not leave errors. Because if it is wrong, it will not be allowed to be corrected directly on that invoice but must carry out adjustment procedures. Therefore, to help write VAT invoices accurately and reduce errors, we need to know how to round the numbers correctly. Viet An Tax Agent will guide you on the regulations and how to round when writing a VAT invoice in Vietnam.

Table of contents

Article 4 of Decree No. 174/2016/ND-CP detailing several articles of the Accounting Law stipulates the monetary unit to be abbreviated and rounded when making financial statements as follows:

Regarding abbreviated monetary units:

“Accounting units in the business domain, when making general financial statements, consolidated financial statements from financial statements of subsidiaries, affiliated accounting units or superior accounting units in the field of state accounting, when making general financial statements, the annual total budget settlement report from the financial statements, the budget settlement report of subordinate units, if there is at least 1 indicator on the report with 9 digits or more, the abbreviated currency unit of 1,000 VND (1,000 VND) may be used, with 12 digits or more, the abbreviated currency of million VND (1,000,000 VND)” may be used.

In addition, when publicizing financial statements and budget settlement reports, accounting units may use abbreviated currency units as prescribed above.

Thus, normally, when making financial statements, the unit of calculation will be dong. However, if there is at least 1 indicator on the report that:

Regarding rounding numbers, according to Article 4 of Decree 174: “When using abbreviated monetary units, accounting units are allowed to round numerical units by: The digits after the digits of abbreviated monetary units, if they are equal to 5 or more, may be increased by 1 unit; if it is less than 5, it will not be counted”.

The rounding of value-added invoices is also of great interest to businesses because of the importance of this type of document. First of all, businesses need to learn some relevant regulations as follows:

At Point b, Clause 3, Article 10, Decree 123/2020/ND-CP stipulates:

“The digits displayed on the invoice are Arabic numerals: 0, 1, 2, 3, 4, 5, 6, 7, 8, 9. The seller is selected: after the digit of thousands, millions, billions, trillions, trillions, billions, billions must put a dot (.), if there is a digit written after the digit of the unit row, a comma (, ) after the digit of the unit row or use the natural number separator as a comma (,) after the digit of thousands, millions, billions, trillions, trillions, trillions, billions and use a dot vinegar (.) after the digit of the unit row on the accounting voucher.”

At Point c, Clause 13, Article 10 of Decree No. 123/2020/ND-CP it is clearly stated:

“The currency written on the invoice is Vietnam Dong, and the national symbol is “đ”.”

The value-added invoice includes the following indicators:

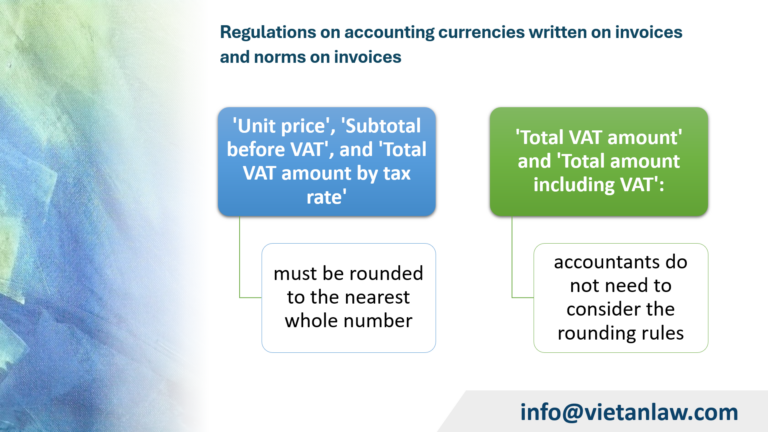

In the above-mentioned indicators, it is necessary to pay attention to the regulations on rounding the following indicators:

In summary, the guiding provisions of the law, the principles of rounding numbers when writing value-added invoices can be drawn as follows:

Also at Point c, Clause 13, Article 10 of Decree No. 123/2020/ND-CP, accountants also need to pay attention to the regulations on writing invoices in foreign currencies as follows:

“In case economic and financial operations arise in foreign currencies in accordance with the law on foreign exchange, the unit price, the amount of money, the total amount of value-added tax at each tax rate, the total amount of value-added tax, the total amount of payment shall be inscribed in the foreign currency, the currency in which the name of the foreign currency is inscribed. The seller concurrently shows on the invoice the foreign currency exchange rate with the Vietnamese Nma dong at the exchange rate in accordance with the Law on Tax Administration and guiding documents.”

Foreign currency symbol code according to international standards (Example: 13,800.25 USD – Thirteen thousand eight hundred US dollars and twenty-five cents; Example: 5,000.50 EUR – Five thousand euros and fifty cents)

In the case of selling goods arising in foreign currencies in accordance with the law on foreign exchange and being taxed in foreign currencies, the total payment amount shown on the invoice in foreign currency is not required to be converted into Vietnamese dong.

Therefore: If the value-added invoice needs to be written in a foreign currency, the indicators “Unit price”, “Cash without VAT”, and “Total value-added tax amount according to each tax rate”, are not dong, so they do not necessarily need to be rounded but according to professional reality. Later, when converting from foreign currency to dong for accounting purposes, the accountant can apply the principle of rounding numbers in accounting.

If you have any difficulties or questions related to how to round when writing a VAT invoice in Vietnam, please contact Viet An Tax Agent for the most specific advice.