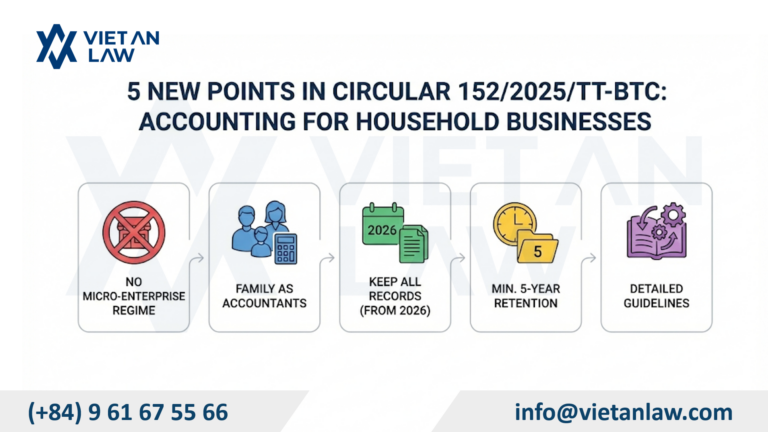

On December 31, 2025, the Ministry of Finance officially issued Circular 152/2025/TT-BTC, introducing a revised accounting regime for business households and individuals. Effective from January 1, 2026, this new regulation will replace Circular 88/2021/TT-BTC. Below, Viet An Law highlights the 5 key takeaways regarding Vietnam household business accounting: New guidelines under Circular 152/2025/TT-BTC.

Table of contents

Previously, Clause 2, Article 3 of Circular 88/2021/TT-BTC stipulated:

“Household businesses and individual business owners shall implement the accounting regime guided in this Circular or may choose to apply the micro-enterprise accounting regime to suit their management needs and the characteristics of their production and business activities.”

Accordingly, Circular 88/2021/TT-BTC stipulates that household businesses and individual businesses shall implement the accounting regime guided in Circular 88/2021/TT-BTC or may choose to apply the micro-enterprise accounting regime to suit their management needs and the characteristics of their production and business activities.

However, according to the new regulations in Clause 2, Article 3 of Circular 88/2021/TT-BTC on the organization of accounting work, household businesses will apply the accounting regime for household businesses as stipulated in Circular 152/2025/TT-BTC.

According to Article 2 of Circular 152/2025/TT-BTC, the representative of a household business or individual business may keep their own accounting records, or appoint an accountant, or hire accounting services for the household business or individual business in accordance with the law.

Notably, the representative of a household business or individual business can also appoint their biological father, biological mother, adoptive father, adoptive mother, spouse, biological child, adopted child, or sibling to act as the accountant for the household business or individual business.

Mandatory accounting records for all household businesses from 2026

Previously, according to Article 2 of Circular 88/2021/TT-BTC, household businesses and individuals paying taxes using the declaration method as prescribed by tax law were required to apply the accounting regime as stipulated in Circular 88/2021/TT-BTC. In addition, household businesses and individuals not subject to the accounting regime but wishing to implement it according to Circular 88/2021/TT-BTC were encouraged to do so.

However, according to Clause 2, Article 1 of Circular 152/2025/TT-BTC, the subjects to which Circular 152/2025/TT-BTC applies are household businesses and individual businesses (including business households/individual businesses with revenue less than 500 million VND/year).

Therefore, according to the new regulations, all household businesses will be required to keep accounting records starting from 2026.

However, the key new feature of Circular 152/2025/TT-BTC is the increased flexibility in accounting record keeping. Instead of being constrained by rigid forms, household businesses now have more autonomy:

The minimum retention period for accounting documents of household businesses and individual businesses is 5 years

To align with the national digital transformation roadmap, the new Circular allows individuals and household businesses to choose the most optimal storage method, namely storing accounting documents in traditional paper form or on electronic devices (cloud, hard drives, accounting software). This regulation facilitates the gradual transition of business households to electronic bookkeeping, in line with the trend of digitizing business operations.

Specifically regarding the retention period, Article 3 of Circular 152/2025/TT-BTC requires a minimum retention period of 5 years for accounting documents of household businesses and individual businesses. Previously, the retention period stipulated in Clause 3, Article 3 of Circular 88/2021/TT-BTC was not clearly defined.

This new regulation helps reduce the burden on storage space and makes it easier to retrieve data when needed.

Circular 152/2025/TT-BTC clearly categorizes the accounting system based on the tax obligations of each household business:

The purpose is simply to track revenue to determine whether it still falls within the tax-exempt category.

In addition, household businesses must also maintain the following types of accounting records:

This regulation helps household businesses reduce costs, making it suitable for small businesses and family-run enterprises.

Circular 152/2025/TT-BTC, issued in 2025, marks the completion of the accounting guidance framework for household businesses in the period from 2026 onwards. With regulations that are flexible and suitable to business realities while still ensuring tax management requirements, this Circular provides a basis for household businesses to proactively review their bookkeeping and document storage methods and prepare for the correct application of regulations from the time they come into effect.

Above is Vietnam household business accounting: New guidelines under Circular 152/2025/TT-BTC. If you have any related questions or require legal advice on tax and accounting, please contact Viet An Law – Tax Agency for the best advice and support!