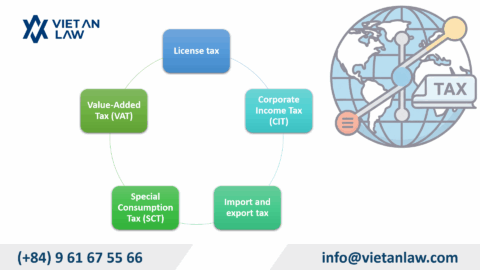

Tax is the state’s income which has huge effects on business entities and customers in the economy. One sort of tax which has widest governing scope is value-added tax paid by customers through purchasing goods or using services. Value-added tax is applied to goods and services and business entities providing goods and services shall add the value-added tax amount to the final price. Those business entities shall pay the value-added tax (VAT) amount to the state budget as their obligations.

There are two methods for VAT calculation: tax credit method and direct calculation method based on added value.

Tax credit method:

From the point of a company, they also need to purchase material or using services for manufacturing. Hence, there is input VAT which is the VAT amount the company paid to providers. When the company using these material for manufacturing products or providing services to their customers, the VAT amount charged in the final price is output VAT.

Payable VAT amount = Output VAT amount – Creditable input VAT amount

Output VAT amount = Total VAT amount of sold goods and services recording on VAT invoices

Creditable VAT amount = Total VAT amount recorded on VAT invoices of purchased goods or services, VAT documents of imported goods.

This method applied to enterprises complying with rules on accounting, invoices and documents and having annual revenue is from 1.000.000.000 VND or voluntarily choose this method.

Direct calculation method based on added value:

Payable VAT amount = Added value × VAT rate: Applied to gold, silver and gems trading activities.

Payable VAT amount = Rate × Revenue: Applied to enterprises having revenue under 1.000.000.000 VND (if they are not voluntarily register to use creditable VAT method do not comply with accounting, invoices and documents.

Regarding invoices and documents:

In case of creditable VAT method: Enterprises using creditable VAT method using VAT invoices; VAT invoices must record all required information including surcharge or additional charge (if any). In case of selling goods, services but VAT amount is not recorded on invoices, output VAT shall be determined as the price on invoices multiplied by VAT rate.

In case of direct calculation method based on added value: Using sale invoices.

Legal consulting services on enterprises and investment at Viet An Law Firm:

If you are looking for legal advice about enterprises and investment in Vietnam, please feel free to contact Viet An Law Firm for more information!