Currently, employees are paying more attention to the provisions of current labor laws to protect their legal rights and interests. Among the issues that concern employees the most is taking unpaid leave to handle personal matters. In the article below, Viet An Law would like to provide information to our clients about “Unpaid Leave and Annual Leave Entitlement in Vietnam”.

Table of contents

According to Article 115 of the Labor Code 2019, employees are entitled to paid leave in legally specified cases, such as when an employee gets married or when their biological or adopted child gets married.

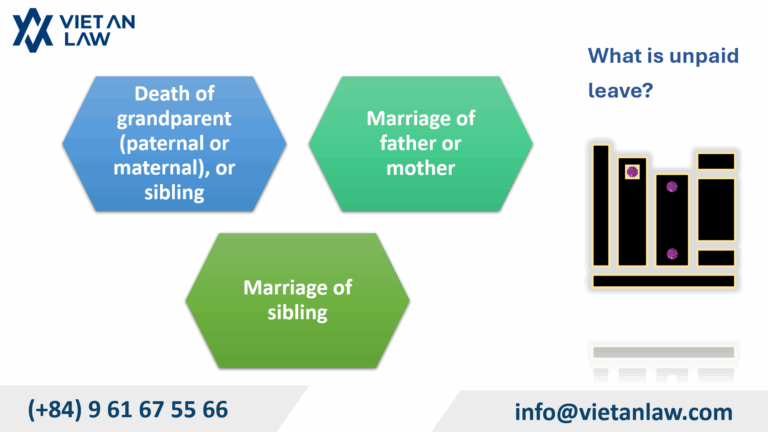

In addition to provisions for paid leave, employees also have the right to take unpaid leave, provided they inform and reach an agreement with their employer. Article 115 of the Labor Code 2019 specifies the cases in which employees are entitled to unpaid leave as follows:

For these three cases, employees are entitled to 01 day of unpaid leave and must inform their employer.

Additionally, employees can agree with their employer to take unpaid leave for other reasons.

Therefore, employees are not limited in the number of unpaid leave days they can take per year; they only need to reach an agreement with and receive approval from their employer to take unpaid leave.

According to Article 113 of the Labor Code 2019, employees are entitled to annual leave with full pay. The number of annual leave days depends on the employee’s length of service and the nature of their work. Specifically:

If an employee has worked for less than 12 months for an employer, the number of annual leave days will be calculated proportionally to the number of months worked.

Note: When taking annual leave, if an employee travels by road, rail, or waterway and the round-trip travel time exceeds 02 days, the travel time from the third day onwards will be counted in addition to their annual leave entitlement. This additional travel time is only granted once per year.

For every 5 years an employee works for the same employer, they will receive an additional 01 day of paid annual leave.

Article 65 of Decree 145/2020/ND-CP stipulates the periods considered as working time for calculating an employee’s annual leave entitlement. Specifically, the following periods are included in an employee’s annual leave calculation:

Therefore, an employee’s unpaid leave can be counted towards their annual leave entitlement if it falls under the conditions specified in Clause 4, Article 65 of Decree 145/2020/ND-CP.

Specifically, the conditions for unpaid leave to be counted towards annual leave are as follows:

Only when both of these conditions are met concurrently will the employee’s unpaid leave period be counted towards their annual leave entitlement. If only one condition is met, it will not be included in the annual leave calculation.

Therefore, employees need to pay attention to fulfilling the legally stipulated conditions to ensure their unpaid leave is counted towards annual leave by the employer.

If an employee’s cumulative unpaid leave period exceeds 01 month in a working year, or if the employee takes unpaid leave without the employer’s consent, that time will not be counted towards annual leave.

Furthermore, if an employee takes leave without the employer’s consent, they may also face various forms of labor disciplinary action.

This concludes Viet An Law’s consultation on unpaid leave and annual leave entitlement in Vietnam. If you need to learn more about general law or labor law in particular, please contact Viet An Law for timely advice.