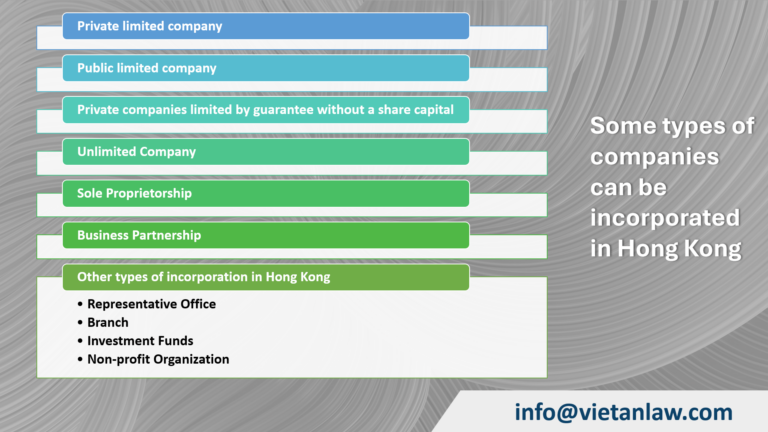

Hong Kong, with its transparent legal system and many preferential tax policies, has long been one of the most attractive places for foreign investors. Setting up a company here is not only simple but also opens up countless business opportunities. With its favorable geographical location, Hong Kong is the perfect bridge for businesses to access the huge market of China and Asian countries, and enjoy the benefits of attractive tax policies such as exemption from certain taxes and low corporate tax rates. Compared to many other countries, Hong Kong stands out as an ideal destination for businesses to start and grow. However, there are many types of companies to establish in Hong Kong, Viet An Law would like to introduce the types of companies that can be established in Hong Kong through the article below.

Table of contents

A private limited company is a type of enterprise with charter capital divided into shares. These shares are issued to shareholders, and the shareholder’s liability will be limited to the amount owed for the purchase of shares. This is the most suitable form for for-profit businesses. A Private Limited Company has the following characteristics:

A public company is a company that issues shares and bonds to the public. A company is considered a public company if it is a limited liability company but is not within the scope of a private limited company or a limited liability company by capital contribution. Many public companies are listed on the Hong Kong Stock Exchange, and the legal requirements for a public company are usually stricter because it raises capital from the public. A medium and large private limited company may decide to transform its corporate structure into a public joint stock company (so that the number of participating shareholders will be increased) when achieving significant growth in the industry.

A private limited company by contributed capital is a special type of business in Hong Kong. Unlike ordinary limited liability companies, this type does not have share capital. Instead, the liability of the members is determined by the amount of money they commit to contribute if the company is dissolved. A private limited liability company by contributed capital has the following main characteristics:

Unlimited Company is a rare form of business, especially in developed countries such as Hong Kong. In this type of company, the liability of the members for the company’s debts is unlimited. This means that if the company is in financial difficulty, the owners may have to use their personal assets to pay off their debts. Although not common, Hong Kong law still allows for limitless company formation. However, due to the limitations and risks involved, this type of company is usually only chosen in some special cases, such as:

Why is infinite company less popular?

Sole proprietorship is a simple and popular form of business, especially for small businesses. In this type, there is only one owner, who will be responsible for the entire business. The main characteristics of a private enterprise:

A business partnership is a business agreement in which two or more people work together to share profits.

Hong Kong recognizes two main types of business cooperation:

General partnership

In a joint business partnership, the partners own all property rights and are personally responsible for the debts and obligations of the business partnership.

Limited partnership

In a limited business partnership, at least one general partner must manage the business partnership and be fully liable for the debt. In addition, there may be one or more limited partners, whose liability is limited to the amount of capital they contribute to the business partnership. Limited partners do not need to have authority to manage or supervise the operation of the business partnership. Registration of limited business cooperation with the Company Registry and application for a business registration certificate is mandatory.

Business partnerships offer distinct advantages over companies, as they are often easier to establish, maintain, and dissolve. This type is subject to fewer regulatory compliance requirements. Furthermore, business partnerships can be very effective in attracting talent, as individuals with valuable skills, knowledge, and expertise may have the opportunity to advance to become partners.

In addition to the common types of companies such as limited liability companies, private enterprises and business partnerships mentioned in Viet An Law, Hong Kong also allows the registration of several other types of businesses to meet the diverse needs of businesses. Here are some notable types:

Choosing the right type of company in Hong Kong is an important decision, which directly affects the success of the business. Each type of company has its own advantages and disadvantages, suitable for different business goals and scales. Factors to Consider When Choosing a Hong Kong Incorporation

If you need support to set up a company in Hong Kong, please contact Viet An Law Firm for quick support!