Copyright transfer is when the author or copyright owner (assignor) agrees to let other organizations and individuals (assignee) repurchase the copyrighted property. The transfer is based on a written transfer contract. Copyright transfer is mentioned when the author or copyright owner wants to transfer the right to exploit the work to other organizations or individuals. Therefore, how to transfer of copyright in Vietnam regulated by law? In the article below, Viet An Law Firm will advise you on copyright transfer under current Vietnamese IP Law.

Table of contents

Normally, for many goods and products, when transferred, it is the transfer of everything related to those goods and products. However, copyright is a special type of property, so some rights cannot be transferred to other subjects.

According to Article 45 of Vietnam Vietnam IP Law 2005, as amended and supplemented in 2009, 2019, and 2022, the contents of rights that can be transferred and cannot be transferred are as follows:

The groups of rights to be transferred are the groups of property rights specified in Article 20, Clause 3, Article 29, Article 30, and Article 31 of Vietnam IP Law. Exceptionally, the only moral right that can be transferred is the right to publish the work or allow others to publish the work as stipulated in Clause 3, Article 19 of Vietnam IP Law.

The groups of non-transferable rights are the group of moral rights specified in Article 19 (except the right to publish works) and Clause 2, Article 29 of Vietnam IP Law.

Note:

Although the right to name a work is not transferable, the author can transfer the rights to use this right to the organization or individual being transferee specified in Clause 1, Article 20 of Vietnam IP Law.

Pursuant to Clause 1, Article 39 of Decree 17/2023/ND-CP guiding IP Law on copyright, in case the copyright of transferred work has not been registered, the copyright transfer registration dossier is the copyright registration dossier, including documents following documents:

Organizations and individuals request copyright registration after transfer to the Copyright Office. The information in the documents provided by organizations and individuals must be accurate, truthful, and fully responsible for the declared information. According to the new IP law, only the copyright owner has the right to sign the application for copyright registration.

Under Decree 17/2023/ND-CP, applicant can submit documents in the following ways:

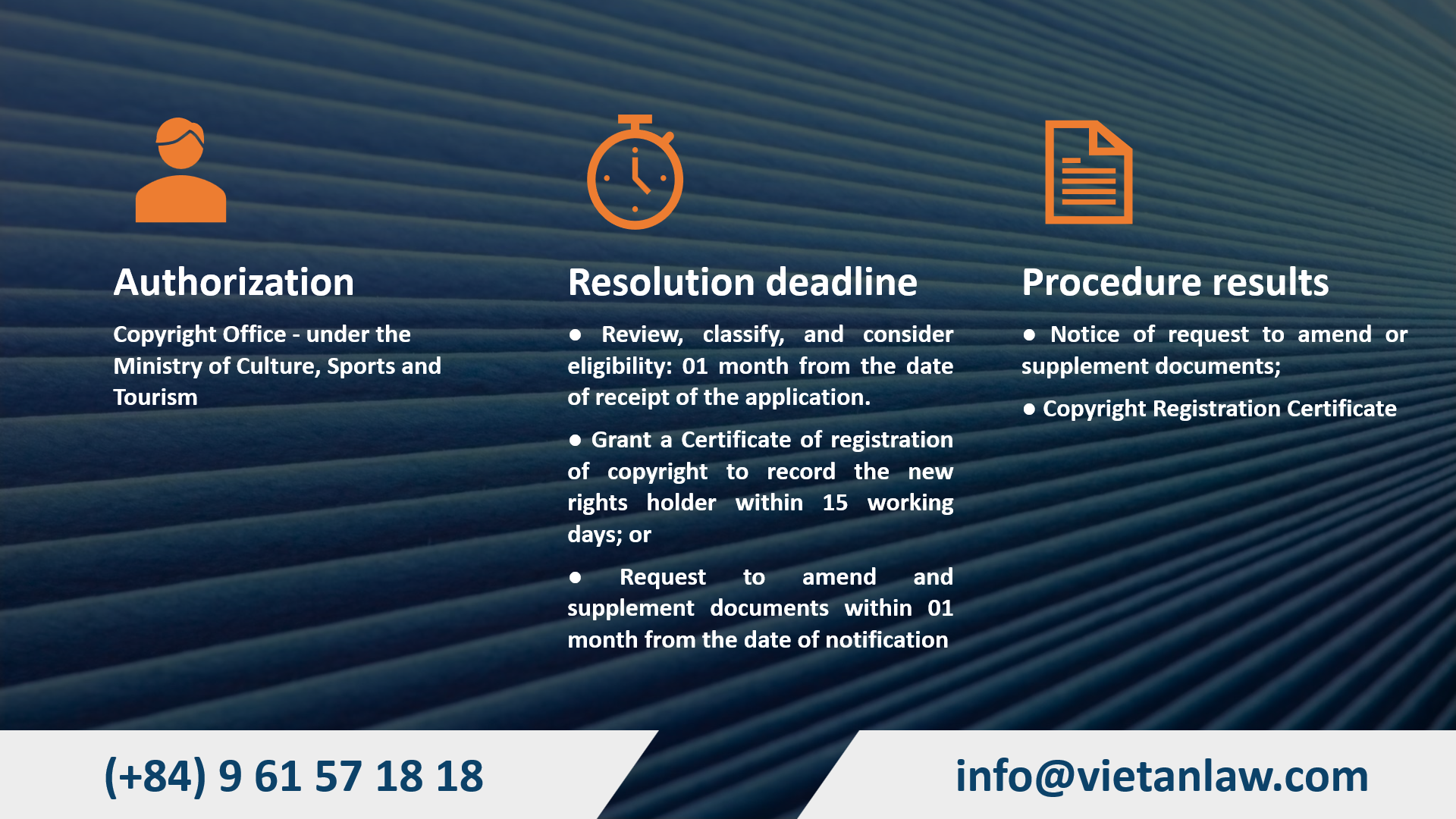

The Copyright Office considers and issues a Notice requesting amendments and supplements to documents or issuance of a Copyright Registration Certificate.

Receive results and pay the fee for issuing the Copyright Registration Certificate.

According to Clause 1, Article 41 of Decree 17/2023/ND-CP, the revision of Copyright Registration Certificates and Registered Related Rights Registration Certificates is applied in cases of change of copyright owner, or related rights owner.

Note:

The transfer must be proven by the legal form of the transfer contract. The purpose of registration is to record the change of copyright owner in the database of state agencies, ensuring accuracy and transparency in identifying the owner of copyright and related rights to the work.

Receiving agency: Vietnam National Copyright Office

The transfer of copyright is carried out according to the fee rate applied to the fee when granting the Copyright Registration Certificate for each type of work under Circular 211/2016/TT-BTC.

For example, for literary, scientific works, textbooks, course books, and other works expressed in writing or other characters (collectively referred to as types of written works), copyright registration fees The price according to current regulations is 100,000 VND/work.

According to Clause 1, Article 6 of Vietnam IP Law: ” Copyright shall arise at the moment a work is created and fixed in a certain material form, irrespective of its content, quality, form, mode and language and irrespective of whether or not such work has been published or registered”. Therefore, the author has full ownership of the work he or she has created and has the right to transfer it to another entity even without completing registration procedures at the Copyright Office. Procedures for transfer without registration are guided above.

Under Article 46 of the current Vietnam IP Law, copyright and related rights transfer contracts must be made in writing and include the following main contents:

According to Clause 7, Article 3 of the Law on Personal Income Tax and Clause 2, Article 3 of the Law on Corporate Income Tax 2008, amended and supplemented in 2013 and 2014, income from the transfer of intellectual property rights in general and copyright, in particular, are taxable income when organizations and individuals transfer it to other entities.

According to Clause 2, Article 13 of Circular 111/2013/TT-BTC, the personal income tax rate for income from copyright applies according to the Full Tax Schedule with a tax rate of 5%.

Using the services of consulting organizations, copyright, and related rights services not only helps organizations and individuals complete tasks quickly but also saves time and cost.

Viet An Law is recognized as a legal consulting and service organization for copyright and related rights by the Copyright Office according to the provisions of Decree 17/2023/ND-CP. Viet An Law will support and represent clients to perform the following tasks:

If you have any questions about transfer of copyright in Vietnam, please contact Viet An Law Firm for advice and the best support!