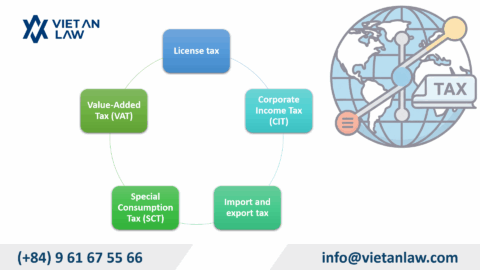

During the operation of the business, one of the tasks that the business must perform in full and on time is tax declaration and tax payment (if any). In normal businesses, they must declare taxes and tax obligations quarterly, annually, and on a certain deadline. When a business is late in declaring taxes by even one day compared to regulations, the business is considered to be in violation of its tax declaration obligation and incurs a fine. The longer it is delayed, the higher the fine can be. closed tax code. In order to support the difficulties of businesses, Viet An Tax Agent provides comprehensive tax declaration services with reasonable service costs so that any business can use the Agent’s tax declaration services. Viet An tax with the most peace of mind and confidence to develop the most effective business activities.

Note: If an enterprise does not generate input or output invoices, the company still has to submit a VAT declaration and personal income tax declaration by the deadline if it generates income subject to personal income tax during the period:

Report on invoice usage for the first quarter submitted no later than April 30; The second quarter must be paid no later than July 30, the third quarter must be paid no later than October 30, and the fourth quarter must be paid no later than January 30 of the following year.

Note for businesses that have submitted notices of invoice issuance, every quarter, organizations, households, and individuals selling goods and services (except those who are issued invoices by tax authorities) are responsible for submitting the Report Status of using invoices for direct tax authorities, including periods when invoices are not used.

Report on the use of invoices submitted monthly applies to subjects who are issued invoices by the tax authority or have high risks of invoices according to the tax authority’s decision.

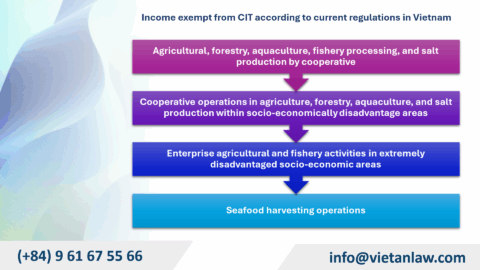

According to Decree 52/2021/ND-CP extending the deadline for paying corporate income tax in 2021 for businesses with tax payable as follows:

Enterprises self-balance the provisional corporate income tax rate and then at the end of the year synthesize revenue and expenses to finalize the total corporate income tax payable in the year (if any).

Enterprises should note that even if the company does not conduct business activities, it still must prepare and submit financial reports for the year of operation. No later than the last day of the 3rd month from the end of the calendar year or fiscal year.

License fee payers (except business households and individual businesses) are newly established (including small and medium-sized enterprises transferred from business households) or have established additional dependent units, business locations or When starting production and business activities, submit the license fee declaration no later than January 30 of the year following the year of establishment or commencement of production and business activities.

In case there is a change in capital during the year, the license fee payer shall submit the license fee declaration no later than January 30 of the year following the year in which the change information occurred.

For acts of submitting tax declaration documents to the tax authority beyond the prescribed deadline, fines will be applied according to Article 13 of Decree 125/2020/ND-CP effective from December 5, 2020.

During the period, even though the company does not generate output or input invoices, it still must declare taxes fully and on time.

Similar to the VAT declaration, reporting on the use of invoices (for companies that have issued VAT invoices), even if no revenue is generated, at the end of the fiscal year the company must still prepare a financial report and submit financial reports. The deadline for submission is the last day of the 3rd month from the end of the calendar year or fiscal year.

After the first year of establishment, whether or not there is revenue, the company still has to pay license tax (business fees) according to the company’s charter capital. The deadline for paying license tax is January 30 every year.

Company license tax must be paid based on the registered company charter capital as follows:

If you have any questions related to tax declaration service in Vietnam, please contact Tax Agent – Viet An Law Firm for the fastest and best support!