On June 30, 2025, the Ministry of Finance issued Circular 65/2025/TT-BTC, amending Circular 265/2016/TT-BTC, which regulates the collection rates, collection, payment, management, and use of fees for granting radio frequency licenses and radio frequency usage fees (amended in Circular 11/2022/TT-BTC). Accordingly, from July 1, 2025, taxes, state fees for granting certain licenses under Circular 65/2025/TT-BTC will be reduced. Below, Viet An Law will update the tax and license fee reduction under Circular 65/2025 in Vietnam.

Table of contents

Previously, Circular 265/2016/TT-BTC stipulated that the Radio Frequency Department (under the Ministry of Information and Communications) is the organization that collects state fees for granting radio frequency use licenses and using radio frequencies.

However, Circular 65/2025/TT-BTC has new regulations as follows: The competent state agency that grants licenses to use radio frequencies according to the provisions of the law on radio frequencies is the organization that collects state fees.

This regulation is to comply with the new regulations on the authority to grant licenses for the use of radio frequencies according to the provisions of the law on radio frequencies. Previously, this authority belonged to the Radio Frequency Department (under the Ministry of Information and Communications). However, according to the new regulations, in Articles 28 to 33 of Decree 133/2025/ND-CP, the granting of licenses for the use of radio frequencies and the use of radio frequencies from July 1, 2025 will be carried out by the People’s Committees at the provincial level.

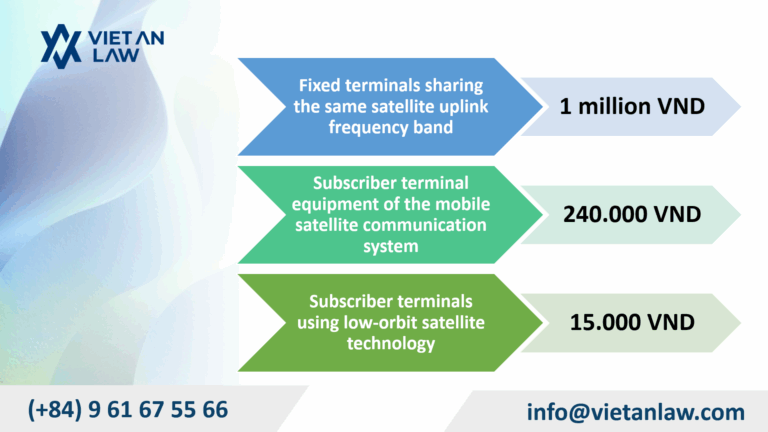

Circular 65/2025/TT-BTC has amended and supplemented points and clauses in the Table of fees for granting radio frequency licenses and annual radio frequency usage fees of Circular No. 265/2016/TT-BTC as follows:

| No. |

Expenditure |

Annual fee for 12 months (1,000 VND) |

| IV | FIXED SATELLITE SERVICES AND MOBILE SATELLITE SERVICES | |

| 1 | Earth Satellite Station | |

| 1.2 | Terminal equipment for fixed use sharing the satellite uplink frequency band, with variable transmission bandwidth depending on usage demand, belonging to the satellite multiple access system (except for Point 1.5, Clause 1, Section IV): Fee per terminal | 1.000 |

| 1.3 | Subscriber terminal equipment under mobile satellite communication systems (except for Point 1.5, Clause 1, Section IV): Fee per terminal | 240 |

| 1.5 | Subscriber terminal equipment using low Earth orbit (LEO) satellite technology: Fee per terminal | 15 |

Compared with Circular 265/2016/TT-BTC, the reduction of taxes, state fees for granting some licenses according to Circular 65/2025/TT-BTC is shown as follows:

Circular 65/2025/TT-BTC amended and supplemented Clause 2, Article 4 of Circular 265/2016/TT-BTC on license fees calculated for each radio frequency use license as follows:

Thus, if previously the fee for amending and supplementing license content was divided into: not having to re-determine the frequency, equal to 20% of the license fee; having to re-determine the frequency, equal to the license fee, the new regulation only stipulates the collection level equal to the license fee.

If previously, Circular 265/2016/TT-BTC only provided general regulations on cases exempted from fees, the new regulations in Circular 65/2025/TT-BTC have specifically regulated the subjects exempted from fees for granting radio frequency licenses and exempted from radio frequency usage fees:

If previously, the fee collection organization was allowed to deduct 50% (fifty percent) of the collected fee amount to cover the costs of management and fee collection according to the regime, then according to the new regulations in Circular 265/2016/TT-BTC, the fee collection organization is allowed to keep 40% of the collected fee amount to cover the costs of service provision and fee collection activities; and must pay 60% of the collected fee amount to the state budget according to the chapters and items of the current State Budget Table of Contents.

This regulation is to comply with Decree No. 82/2023/ND-CP, amending and supplementing a number of articles of Decree No. 120/2016/ND-CP detailing and guiding the implementation of a number of articles of the Law on State fees.

Circular 65/2025/TT-BTC has supplemented Point c, Clause 1, Article 6 of Circular No. 265/2016/TT-BTC. accordingly, enterprises granted licenses to use radio frequencies and equipment to pilot controlled telecommunications services using low-orbit satellite technology instead of granting licenses to use radio frequencies and equipment to terminal users must pay radio frequency usage fees as follows:

This content is in accordance with Decision No. 659/QD-TTg of the Prime Minister on allowing a controlled pilot implementation of telecommunications services using low-orbit satellite technology without limiting the percentage of share ownership, capital contribution or contribution ratio of foreign investors.

Above is an update on new regulations on tax and license fee reduction under Circular 65/2025 in Vietnam. If you have any related questions or need advice on licensing procedures, please contact Viet An Law for the best advice and support!