Double taxation is a term referred to levying of taxes on the same income of a taxpayer in two different countries or above.

This is a common issue many individuals and companies earning money in many countries are dealing with, especially in the trend of trade liberalization.

If an income is taxed twice, in the country it was earrned and in the courntry of origin, the total amount of tax they have to pay shall be really high and bring troubles to investment activities, trade liberalization.

In order to avoid double taxation as well as its negative effects, governments of many countries have signed Double Taxation Treaties paving a fair way for individuals and companies of each country.

Besides that, taxation is also the tax revenue of governments. Hence, those Double Taxation Treaties shall help separate taxation power of each Party and avoid conflict of interest.

Among South-East Asia, Vietnam has signed 8 agreements on avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income with the following countries: Thailand (1992), Singapore (1994), Laos (1996), Indonesia (1997), Myanmar (2000), Philippines (2001), Brunei (2007).

On December 24th, 2013, the Ministry of Finance issued the Circular No.205/2013/TT-BTC, guiding the implementation of the agreement on double taxation avoidance and prevention of fiscal evasion with respect to tax on income and property between Vietnam and other states or territories and in force in Vietnam.

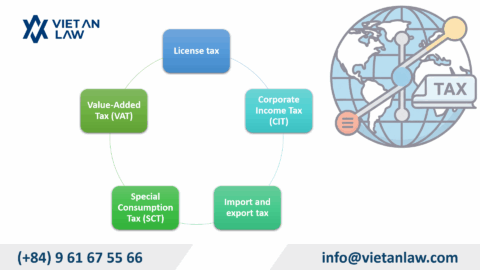

Generally, in accordance with these agreement and Circular 205/2013/TT-BTC, those taxes covered are income taxes such as: personal income tax, corporate income tax, profit tax, profit remittance tax…

Some agreements regulate on specific type of taxes such as petroleum income tax. The subjects of application of these agreements are individuals and organizations who are residences of one or both of the signing Parties.

Table of contents

In accordance with Article 1 Circular 205/2013/TT-BTC, an individual is regarded as a resident of Vietnam in the following cases:

Regarding organizations, those are established and operated under the laws of Vietnam are regarded as residents of Vietnam.

In case an individual or an organization is deemed as resident of two countries, their residence position shall be determine following the priority order to avoid tax liability in both countries.

In accordance with Circular No.205/2013/TT-BTC, when an individual or an organization is deemed as a resident of Vietnam and other countries, they shall be the resident of Vietnam in the following cases:

When an individual or an organization determine in which country they are deemed as resident, their tax liabilities shall follow the laws of that country.

In order to do this, the taxpayer shall base on the agreement on double tax avoidance between Vietnam and that country along with Circular No.205/2013/TT-BTC.

If you are looking for advice on legal issues and procedures related to enterprises and foreign investment in Vietnam, please do not hesitate to contact Viet An Law Firm for further information!