The integrated economy is increasingly developing, leading to many foreign individuals establishing companies in Vietnam. However, establishing a company profile is very complicated. To answer questions from customers, Viet An law firm provides an article about the profile of a foreign individual to set up a company in Vietnam below.

Foreign individuals establishing a company in Vietnam is the process by which an individual without Vietnamese nationality establishes and operates a business in this country. Establishing a company requires compliance with regulations and legal procedures prescribed by Vietnamese law.

Pursuant to the provisions of the Investment Law 2020, foreign individuals are allowed to establish companies in Vietnam. However, before establishing a company in Vietnam, foreign individuals must have an investment project and carry out procedures to apply for an investment registration certificate. In addition, foreign individuals must meet the following conditions:

Firstly, regarding the charter capital ownership ratio, foreign investors are allowed to own charter capital in Vietnamese companies without restrictions, except in the following cases:

Second, foreigners implementing various forms of investment and scope of activities must meet the conditions prescribed by the Investment Law, relevant legal documents, and other conditions as prescribed by the Law on Investment, international treaties to which the Socialist Republic of Vietnam is a member.

According to the provisions of the Enterprise Law 2020, foreigners can establish partnerships, limited liability companies, and joint stock companies in Vietnam.

In addition, to establish a company in Vietnam, foreigners first need to carry out procedures to apply for an investment certificate according to the provisions of the Investment Law 2020. After obtaining the investment registration certificate, foreigners submit business registration documents to the competent authority.

Note: Business registration documents depend on different types of businesses.

The business registration dossier of a partnership includes the following documents:

Business registration documents for limited liability companies and joint stock companies include the following documents:

Foreign individuals need to determine the company form that suits their business needs. There are two common forms of company: LLC (Limited Liability Company) and Joint Stock Company.

Foreign individuals need to learn about legal regulations related to establishing a company in Vietnam.

This process begins with registering your business with the local regulatory agency. Foreign individuals need to prepare the necessary documents and papers. Business registration processing time can take from 3 – 7 working days.

Foreign individuals must commit the initial charter capital to the company. The amount to commit depends on the form of company and business line. Committing charter capital is an important step to ensure the company’s transparency and financial responsibility.

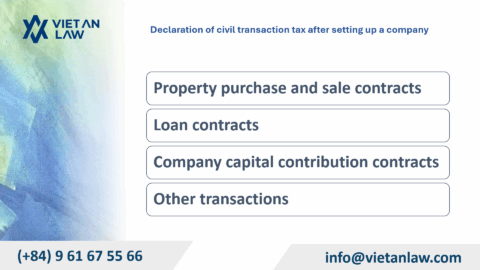

Foreign individuals need to comply with tax and accounting regulations in Vietnam. They need to register for a tax code, pay taxes, and make quarterly and annual tax reports. In addition, it is necessary to prepare a set of accounting books, and financial reports and comply with accounting regulations according to the law.

During company operations, foreign individuals need to work with state agencies. This includes labor registration for foreign employees, import and export procedures for goods, and compliance with regulations on labor safety and environmental protection.

If a foreign individual decides to terminate company operations in Vietnam, they need to comply with the termination regulations as prescribed by law. This includes announcing the termination of company operations, liquidating assets, and resolving financial obligations while ensuring compliance with legal regulations.

Foreign individuals must comply with minimum charter capital regulations as prescribed by Vietnamese law depending on the company’s field of operation.

Foreign individuals can enjoy tax benefits such as special tax incentives for foreign investors and tax benefits according to the provisions of the law.

Decree 152/2020/ND-CP According to regulations, there are 2 cases where investors are exempt from work permits:

Both of the above cases require investor capital of VND 3 billion or more. That means foreign investors with a capital of less than 3 billion VND will not be exempt from work permits. This means that they must go through the procedure for applying for a work permit as usual.

Customers need advice about the profile of a foreign individual to set up a company in Vietnam, please contact Viet An Company for the best support.