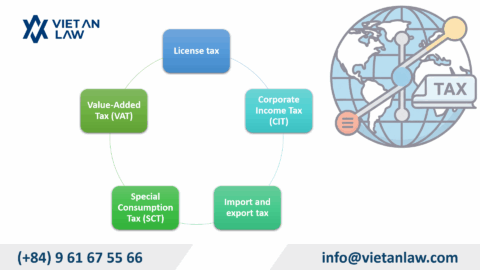

Vietnamese law strictly regulates businesses in submitting corporate income tax (CIT) finalization declarations. In particular, submitting tax finalization declarations on time is one of the requirements that businesses must comply with, or else they will be fined. When is the deadline for submitting the tax finalization declaration, and if it is late, what is the penalty? In the article below, Viet An Law will guide the penalty for late submission of CIT finalization declaration.

Corporate income tax finalization, also known as finalization declaration, refers to the business’s activities in declaring the total amount of corporate income tax that needs to be paid to the tax authority. Corporate income tax finalization declaration includes annual tax finalization declaration, declaration in case there is a decision on dissolution, consolidation, separation, merger, or conversion of the business type of the enterprise. There is also a conversion of ownership form and termination of operations, at which point the tax authority issues a settlement decision to the enterprise with the main purpose of collecting the enterprise’s income tax.

According to Article 8 of Decree 126/2020/ND-CP, corporate income tax is a tax that is settled quarterly, monthly, annually, or each time it arises in specific cases and depending on each business field.

In the case of annual declaration, based on Clause 2, Article 44 of the Law on Tax Administration, the deadline for submitting tax finalization declaration documents for taxes with annual tax periods is prescribed. CIT payment no later than the last day of the third month from the end of the calendar year or fiscal year. Previously, the deadline for corporate income tax finalization was the ninetieth (90th) day from the end of the calendar year (March 30). Thus, from the 2020 corporate income tax finalization period, the deadline for submitting annual corporate income tax finalization documents has been extended by 1 day compared to the previous regulations, i.e. March 31 every year.

In addition, Article 55 of the Law on Tax Administration stipulates that if a taxpayer calculates tax, the tax payment deadline is the last day of the tax declaration submission deadline. In case of additional tax declaration, the tax payment deadline is the tax declaration deadline for the tax period containing the error. Besides, in some special cases, the time limit for tax finalization is prescribed as follows:

Note: If the deadline for submitting tax finalization documents coincides with a prescribed holiday, the deadline for submitting tax finalization documents is the next working day. If an individual has a corporate income tax refund but is late in submitting the tax finalization declaration according to regulations, no penalty will be imposed for administrative violations of tax finalization declaration past the deadline.

| No | Violation | Form of sanction | Legal basis |

| 1 | Submit your tax return 1-5 days past the deadline and there are extenuating circumstances. | Caution. | Clause 1 Article 13 Decree 125/2020/ND-CP. |

| 2 | Submit tax declaration 1-30 days past the deadline, except for case (1). | Fine from 2,000,000 to 5,000,000 VND. | Clause 2, Article 13 of Decree 125/2020/ND-CP. |

| 3 | Submit your tax return 31-60 days beyond the prescribed time limit. | Fine from 5,000,000 to 8,000,000 VND. | Clause 3 Article 13 Decree 125/2020/ND-CP. |

| 4 | · Submitting tax declaration documents 61-90 days beyond the prescribed time limit;

· Submitting a tax declaration 91 days or more beyond the prescribed time limit but not incurring any tax payable; · Failure to submit tax declaration but no tax payable arises; · Failure to submit appendices according to regulations on tax administration for enterprises with associated transactions along with corporate income tax finalization dossiers. |

Fine from 8,000,000 to 15,000,000 VND. | Clause 4 Article 13 Decree 125/2020/ND-CP. |

| 5 | Submitting a tax declaration more than 90 days after the deadline for submitting the tax declaration, resulting in tax payable and the taxpayer has paid the full tax amount and late payment interest to the state budget before the deadline. The point where the tax authority announces the tax audit or tax inspection decision or before the tax authority makes a record of the late submission of tax declaration documents.

Note: In case the fine amount applied under this clause is greater than the tax amount incurred on the tax declaration, the maximum fine in this case is equal to the tax amount payable on the tax declaration. but not lower than 11.5 million VND. |

Fine from 15,000,000 to 25,000,000 VND. | Clause 5 Article 13 Decree 125/2020/ND-CP. |

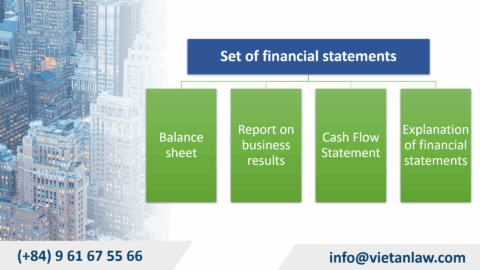

Vietnamese businesses conducting corporate income tax finalization need to fully prepare the following documents:

Enterprises operating in the fields of exploiting and selling natural gas and crude oil are required to prepare a set of documents including:

In addition to the above documents, the supplier needs to add:

Enterprises that pay tax according to the revenue-cost method when declaring annual corporate income tax (CIT) finalization, use the Corporate Income Tax finalization declaration according to Form 03/TNDN (stipulated in Appendix II issued together). according to Circular 80/2021/TT-BTC).

After receiving the penalty decision, the taxpayer is obliged to pay the fine on time in the decision. In case of late payment of fines, additional late payment fees will be charged. The level of late payment fines is specified in Article 42 of Decree 125/2020/ND-CP as follows:

1 day late payment interest = 0.05% x Late payment amount

Remedial measures for the above acts are specified in Clause 6, Article 13 of Decree 125/2020/ND-CP as follows:

Firstly, force the full payment of late tax payment amount into the state budget for violations specified in (1), (2), (3), (4), and (5) in case the payer delayed tax filing leads to late tax payment.

Forcibly requiring submission of tax declaration documents and attached appendices for the following acts:

Customers who need advice on the penalty for late submission of CIT finalization declaration, please contact Viet An Tax Agent for the best support.