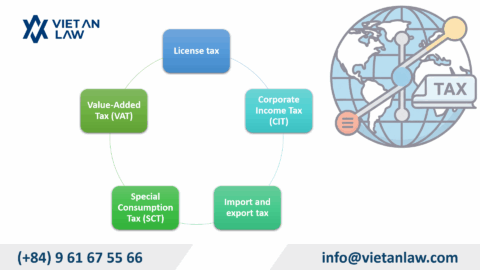

The value-added tax (VAT) is an indirect tax and is calculated on the added value of goods and services arising from the production and circulation process until it reaches the consumer; is one of the important taxes that helps balance the state budget and plays a major role in the national construction and development. Viet An Tax Agent provides package value-added tax services in Vietnam to consult and support enterprises to declare fully and accurately according to the law on tax.

Being organizations and individuals that produce and do business in goods and services subject to VAT in Vietnam, regardless of industry, form, business organizations, organizations and individuals that import goods and purchase services from abroad subject to VAT include:

The latest tax payment deadline is the last day of the tax declaration dossier submission deadline. In the case of additional tax declaration dossiers, the tax payment deadline is the tax declaration dossier submission deadline for the tax period containing errors or omissions.

Viet An reviews, checks, and consults on the reasonableness, validity, and legality of all invoices, output, and input documents of enterprises to prepare and submit VAT declarations on behalf of enterprises.

In case an enterprise submits a VAT declaration late, it will be fined administrative penalties according to the provisions of Article 13 of Decree No. 125/2020/ND-CP takes effect from December 5th, 2020.

In case an enterprise is late in paying VAT, it will be charged a late payment rate of 0.03%/day calculated on the late tax amount;

Enterprises declare the VAT quarterly, applicable to enterprises with total revenue from selling goods and providing services in the preceding year of VND 50 billion or less. Revenue from selling goods and providing services is determined as the total revenue on VAT declarations of tax periods in the calendar year.

In case an enterprise has just started operating and doing business, it can choose to declare the VAT quarterly. After the full 12 months of production and business, from the immediately following 12 full months will be based on the revenue level of the preceding calendar year (full 12 months) to perform a VAT declaration according to the monthly or quarterly tax period.

The General Department of Taxation has provided detailed instructions in section 5.1 of Official Dispatch 5189/TCT-TS2020 dated December 7th, 2020 as follows:

“New point 3: Amending the regulation that taxpayers may submit additional declaration dossiers for each tax declaration dossier if it is discovered that the first tax declaration dossier submitted to the tax authority has errors or omissions but the tax declaration dossier submission deadline has not yet expired. The tax declaration dossier for the tax period has errors or omissions (Clause 4, Article 7).

Previously: At Point a, Clause 5, Article 10 of Circular No. 156/2013/TT-BTC stipulated: After the deadline for submitting tax declarations according to regulations has expired, taxpayers discover that tax declaration dossiers have been submitted to the agency. If there are errors in the dossier, additional declarations can be performed in the tax declaration dossier.”

Thus, enterprises must submit additional declarations if they detect errors in the official declaration.

Customers wishing to use the value-added tax declaration service, please contact Viet An Tax Agent for support.