Social insurance is a partial compensation for employees’ income when they are sick, pregnant, have a work accident, or occupational disease, reach the end of their working age, or die. In particular, the one-time social insurance regime due to serious illness is one of the benefits that social insurance participants enjoy. The article below Viet An Law will provide information related to receiving one time social insurance in case of serious illness.

According to Circular No. 18/2022/TT-BYT, from February 15, 2023, some cases of serious illness are entitled to one time social insurance, divided into 2 cases:

Records include the original or a valid copy of the hospital discharge certificate or summary of medical records showing the above illness. The application documents for this case have been greatly streamlined based on Circular 18/2022/TT-BYT of the Ministry of Health effective from February 15. According to the new regulations, groups of workers with diseases such as cancer, polio, cirrhosis, ascites, leprosy, severe tuberculosis, and HIV infection that have progressed to the AIDS stage will be entitled to one-time social insurance benefits.

This regulation removes the accompanying condition of “not having self-control or not being able to independently perform the activities of walking, dressing, personal hygiene and other things that serve daily personal needs that are necessary.” “People are watching, assisting, and taking care of you completely” like before. This creates more favorable conditions for workers with serious illnesses to receive one-time social insurance.

The dossier is a medical examination record that must conclude that you have diseases and disabilities that reduce your working capacity by 81% or more and are unable to self-control or perform self-service activities. Daily personal needs that require someone to monitor, assist, and take full care of.

Note: When suffering from these diseases, those people cannot control or perform the activities of walking, dressing, personal hygiene, and other activities that serve daily personal needs. They need someone to monitor, assist, and take care of for one-time social insurance benefits.

If the patient does not suffer from the listed diseases but is in poor health, carry out the procedure for expertising the level of work capacity decline as follows:

According to Clause 6, Article 5, Circular 56/2017/TT-BYT, the appraisal dossier includes:

From February 15, 2023, in addition to the above documents, employees can also use originals or copies of other documents:

The application to withdraw one-time social insurance is an important procedure, beneficiaries need to prepare all necessary documents when submitted to the Provincial Medical Examination Council.

The application dossier for receiving one-time social insurance will be different between Vietnamese workers and foreign workers.

For Vietnamese workers

For foreign workers

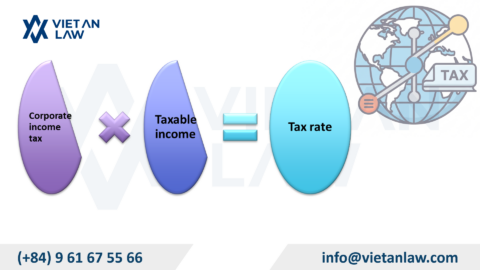

Pursuant to Clause 4, Article 19, Circular 59/2015/TT-BLDTBXH stipulates that one-time social insurance benefits are paid based on the time the employee participates in social insurance and the average monthly salary. social insurance contribution.

The formula for calculating the one-time social insurance benefit is as follows:

Benefit level = (1.5 x Average salary x time participating in social insurance before 2014) + (2 x average salary x time participating in social insurance since 2014)

Note :

However, the average salary of the employee will depend on whether the employee is paying social insurance according to the state coefficient or according to the salary level of the private employer.

Average salary = Total monthly salary paid for social insurance (coefficient x base salary) of the last T years before quitting /(Tx12 months)

| Time to start participating in social insurance | The last number of years to calculate the average salary paid for social insurance (T) |

| Before January 1, 1995 | 5 years |

| From January 1, 1995 to December 31, 2000 | 6 years |

| From January 1, 2001 to December 31, 2006 | 8 years |

| From January 1, 2007 to December 31, 2015 | 10 years |

| From January 1, 2016 to December 31, 2019 | 15 years |

| From January 1, 2020 to December 31, 2024 | 20 years |

| From January 1, 2025 | The entire period of social insurance payment |

Average salary = Total monthly salary paid for social insurance/Total number of months paid for social insurance.

Thus, with the one-time social insurance calculation as shared above, employees can be more proactive in calculating the one-time social insurance benefit if withdrawn. Besides, employees can also use the online one-time social insurance calculation system to calculate quickly and accurately.

Clients who need advice on the regulation or support to calculate one time social insurance in case of serious illness, please get in touch with Viet An Law Firm for the best support.