There are some noticable information and procedures that representative office of foreign traders have to pay attention to after establishing in Vietnam.

Table of contents

A representative office is an affiliated unit of an enterprise, which has the task of representing by authorization for the interests of the enterprise and protecting those interests.

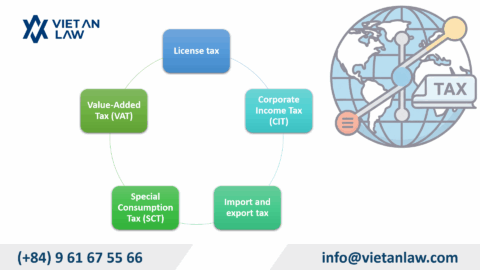

Representative offices are responsible for withholding, declaring and paying personal income tax on income from wages and salaries of representative office employees as prescribed in Articles 24 and 25 of Circular No. 111 /2013/TT-BTC dated August 15, 2013 of the Ministry of Finance guiding the implementation of the Law on Personal Income Tax, the Law amending and supplementing a number of articles of the Law on Personal Income Tax and Decree No. 65/2013/ND-CP ; procedures and dossiers for declaration and payment of personal income tax shall comply with the guidance in Article 16 of the Circular No. 156/2013/TT-BTC dated November 6, 2013 of the Ministry of Finance guiding the implementation of a number of articles of Law on Tax Administration and Decree No. 83/2013/ND-CP.

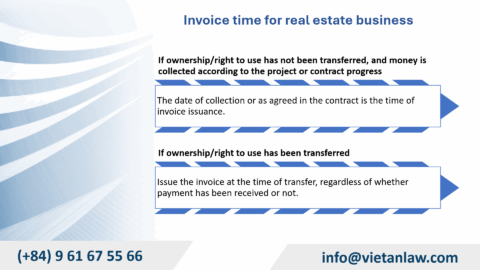

Representative offices do not have business functions, have no income from selling goods or providing services, so they do not have to issue and use invoices;

Representative offices must submit monthly (quarterly) tax returns for taxes incurred by the representative office that must be paid or payable on behalf of; taxes do not arise, representative offices do not have to file tax returns.

Implemented hanging signs at the branch.

The signboard has the following information: Name of representative office, head office address, phone number, governing body.

If there are any changes related to the operation content and the content shown on the Representative Office’s business registration, the procedures for change must be carried out.

During the operation of the business, it is inevitable that concerns and problems arise related to legal procedures.

For your information, refer to the article Adjustment of License for establishment of representative office in Vietnam of Viet An Law.

Customers who need to adjust the License for establishment of representative office or have related questions, please contact Viet An Law Firm for more details!