Decree 94/2021/ND-CP stipulates an 80% reduction in deposits for travel service businesses, effective at the end of 2023. Therfore, in 2024, regulations on deposits for international travel businesses will return the level as regulated in Decree 168/2017/ND-CP. What are the points that travel businesses need to pay attention to in the new regulations applied in 2024? In the following article, Viet An Law will summarize the relevant legal regulations of new deposits for international travel service in 2024.

International travel service business is the sale and organization of part or all of the travel program for international tourists coming to Vietnam and tourists going abroad.

Travel business in general and international travel in particular are becoming more and more popular, helping to attract tourists and promote the development of Vietnam’s tourism industry. This is a conditional business, so when investing in this field, you need to ensure that you comply with certain conditions prescribed by Vietnamese law, including deposit conditions when establishing. and activity.

Aiming to restore the tourism industry after the Covid pandemic, Decree 94/2021/ND-CP was issued, amending and supplementing Article 14 of Decree 168/2017/ND-CP dated December 31, 2017 of the Government. The Government regulates in detail a number of articles of the Law on Tourism on the deposit level for travel service business with content related to reducing the deposit level for international travel service business with the executive time from October 28, 2019. 2021 until December 31, 2023. Accordingly, Decree 94/2021/ND-CP stipulates an 80% reduction in deposits for travel service businesses. Specifically, according to this Decree, the deposit level is regulated as follows:

From January 1, 2024, enterprises depositing travel service business according to the provisions of this Decree must change the Certificate of deposit for travel service business according to the deposit level specified in Clause 1 and Clause 2 Article 14 of Decree No. 168/2017/ND-CP dated December 31, 2017 and sent to the agency competent to issue travel service business licenses within 30 days from the date of change.

Thus, businesses need to make an additional deposit and send it to the Department of Tourism. The deposit level for international travel services business in 2024 will return to the regulations applied under Decree 168/2017/ND-CP as follows:

| International travel service | From 2024 | 2021-2023 |

| Providing travel services for inbound tourists | 250,000,000 | 50,000,000 |

| Provision of travel services for outbound tourists | 500,000,000 | 100,000,000 |

| Provision of travel services for inbound and outbound tourists | 500,000,000 | 100,000,000 |

Enterprises make deposits in Vietnamese Dong at commercial banks, cooperative banks or foreign bank branches established and operating in Vietnam and receive interest rates according to the agreement between the enterprise and the bank in accordance with the provisions of law. The deposit must be maintained throughout the time the business operates travel services.

Refund the deposit to the bank in the following cases:

Therefore, to ensure international travel business operations, travel businesses that are granted a License according to the provisions of Decree 94/2021/ND-CP need to make an additional deposit and return the additional deposit certificate to the Tourism Department (no need to renew travel service license).

In addition to the conditions for granting an international travel service business license before conducting business similar to Vietnamese investors, foreign investors also need to meet market access conditions as prescribed in Vietnam’s WTO Commitment Schedule and other international commitments such as CPTPP, specifically:

In the WTO commitment schedule, in the field of travel service business, Vietnam only allows foreign investors to enter into joint ventures with Vietnamese investors to do international travel service for inbound tourist in Vietnam, but has not yet aloow market access to outbound toursists. Although there is no capital restriction, foreign investors need to meet the following additional conditions:

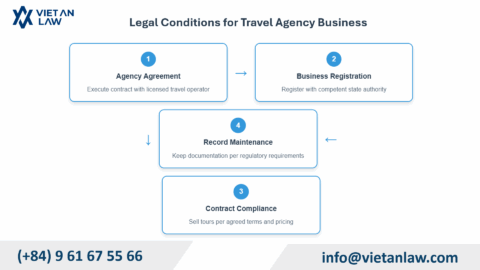

Deposit is one of the conditions for granting an international travel service license. In addition to deposit, according to the provisions of the Law on Tourism 2017 and its guiding documents, international travel service businesses to be eligible for a License also need to meet the following conditions:

Above are some regulations on new deposit for international travel service in 2024. Clients need advice on establishing an international travel business, supplementing deposits according to regulations, please contact Viet An Law for the best support!