The current legal framework has not fully caught up with the rapid development of fintech. Issues such as information security, consumer protection, risk management, or cryptocurrency regulations are hot issues that need to be addressed. Therefore, seeking consultancy from legal experts on fintech is necessary for fintech enterprises to operate safely and effectively. The following article by Viet An Law will provide legal consultancy on financial technology (fintech) in Vietnam.

Table of contents

The State Bank is drafting a Decree regulating the Controlled testing mechanism in the banking sector, which includes the concept of Fintech companies.

According to the draft, financial technology solutions (hereinafter referred to as Fintech solutions) in the banking sector are creative and modern innovations in products, services, and new business models based on technological solutions applied in the banking sector.

A financial technology company (hereinafter referred to as a Fintech company) is an organization that is not a credit institution or a foreign bank branch, having a license to establish or legally register to do business in Vietnam, independently providing Fintech solutions or through cooperation with a credit institution or foreign bank branch to provide Fintech solutions to the market.

Fintech includes technology-based solutions in the financial sector, from online payments, e-wallets, peer-to-peer lending (P2P lending), and asset management, to blockchain and cryptocurrencies. This innovation helps customers and enterprises optimize services, save costs, and increase efficiency.

Although Fintech opens up many great opportunities, enterprises operating in this field are facing a series of complex legal challenges. In Vietnam, the legal system related to Fintech is still in the process of being completed, with many regulations related to the fields of finance, banking, and information security. Fintech enterprises must comply with regulations from the Law on Credit Institutions, the Law on E-Commerce, the Law on Consumer Protection to regulations of the State Bank.

One of the biggest challenges is meeting strict requirements for customer information security. In addition, Fintech enterprises also face issues such as risk management in financial transactions, transparency in operations, and handling of disputes. Any failure to comply with legal regulations can lead to legal risks, financial losses, or loss of reputation in the market.

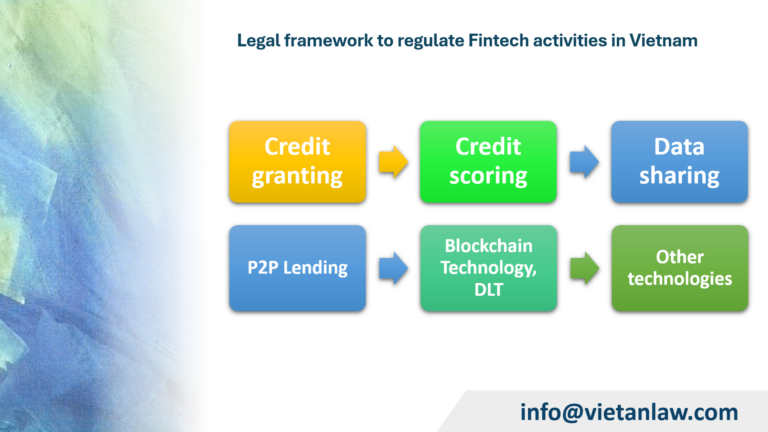

The need for a legal framework to regulate Fintech activities

With the current rapid development, management and control of this activity is necessary, and is also a problem for competent authorities.

To implement Resolution No. 100/NQ-CP dated September 6, 2021, of the Government on approving the proposal to develop a decree on a controlled testing mechanism for financial technology activities in the banking sector, ensuring the implementation of the State’s policy towards comprehensive development of the digital government, the State Bank of Vietnam is currently the agency assigned to preside over the development of the Government’s Draft Decree on a controlled testing mechanism for fintech activities in the banking sector (“Draft Decree”).

Accordingly, the Draft Decree is expected to test the regulation and control of Fintech activities limited to the banking sector. In particular, Article 7 of the Draft Decree has proposed 06 Fintech solutions to be tested, which according to the State Bank are basic Fintech solutions that have been deployed by many organizations in the market, including:

In addition, the Draft also sets limits on the testing period, the number of customers using the service, as well as the conditions for credit institutions and Fintech companies to participate in the test.

With a team of experienced lawyers and legal experts, Viet An Law is proud to be a trusted partner of many Fintech enterprises in Vietnam. We are not only knowledgeable about the law but also grasp the latest technology trends, thereby providing effective legal solutions that are suitable for the actual needs of each customer.

Viet An Law is committed to providing high-quality legal consultancy on financial technology (fintech) services, helping enterprises confidently develop and achieve success in this potential field.

We provide comprehensive legal consulting services for Fintech enterprises, including:

Fintech legal consulting services not only help enterprises avoid legal risks but also optimize business operations. Legal experts will ensure that enterprises:

Above is the advice of Viet An Law on the issue of legal consultancy on financial technology (fintech). If you have any related questions or need support, please contact Viet An Law for the best support!