Foreign investment tendency in Vietnam is growing fast and is considered as the main motivation of the economy. During the current years, Vietnam’s jurisdiction has many new regulations opening the market for foreign investors. Besides procedures, investment incentives, especially, investment tax incentives for foreign investment projects in Vietnam also help attracting the flow of foreign capital. Viet An Law Firm collects and provides our Clients some information related to investment tax incentives for foreign projects in Vietnam as follows:

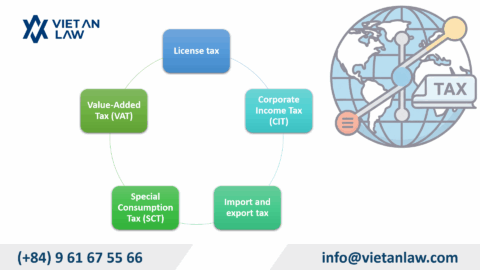

Corporate income tax incentives: Apply a lower tax rate for a certain time or throughout the project execution; exemption, reduction or corporate income tax, corporate income tax exemption or reduction.

Import tax incentives: Exempt import tax for imported goods as fixed assets; raw material; supplies and parts used for the project.

Land levy incentives: Exempt, reduce land levy, land rents.

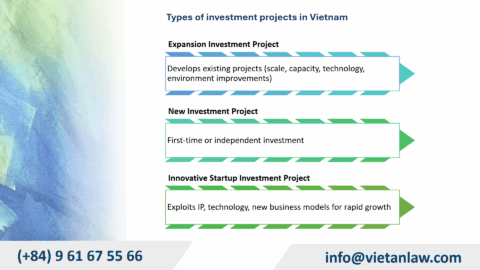

Investment projects subjected to investment incentives are:

If a project is eligible for many investment incentives, it may choose the highest one.

Procedures for investment incentives:

Almost foreign investment projects in Vietnam are subjected to Investment Registration Certificate or decision on investment policy. Therefore, during preparing the application, investors should research and require investment incentives in the proposal for investment project. Investors shall rely on incentives recorded in the Investment Registration Certificate or decision on investment policy to take these incentives. If a project is not subjected to the Investment Registration Certificate or decision on investment policy, investors shall determine investment incentives and perform the procedures at competent agencies.

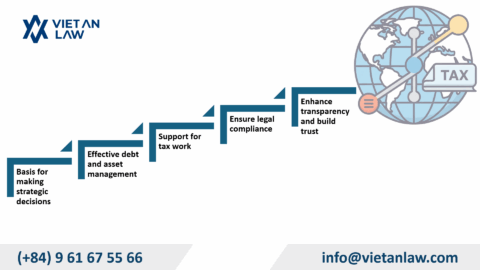

Legal consulting services on enterprises and investment at Viet An Law Firm:

If you are looking for regulations and procedures related to enterprises and foreign investment in Vietnam, please feel free to contact Viet An Law Firm for more information!