Alongside other Southeast Asia countries such as Malaysia, Thailand, and Indonesia, Vietnam is seen as an attractive destination for foreign direct investment (FDI). The year 2025 highlights an unremarkable stage in Vietnam’s FDI framework, with the economy maintaining stable growth momentum, predicted at 6.5–7% GDP, and an improving investment policy framework. In the first five months of 2025, the total registered capital (including new registrations and adjustments) reached USD 317.3 million, an increase of 2.3 times in the value of the same period last year. According to the World Bank (WB), Vietnam ranks among the most attractive emerging markets in Southeast Asia, thanks to its political stability, young population, and a vast network of 16 signed and implemented free trade agreements (FTAs). These data points strongly demonstrate the promising potential of Vietnam’s FDI market in the upcoming years.

Table of contents

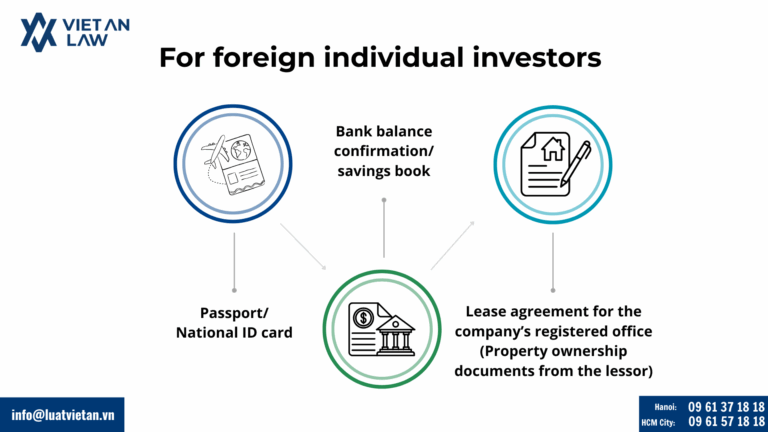

For investors who are foreign individuals, the following documents are required:

Required Documents for Foreign Individual Investors

For investors who are foreign organisations/entities, the following documents are required:

Required documents for Foreign Corporate Investors

To set up a 100% FDI company in Vietnam is becoming easier with more flexible investment options, which are designed to help foreign investors easily enter the Vietnamese market.

Foreign investors can set up a 100% FDI company in Vietnam through two main methods:

Step 1: Online Declaration of Investment Project Information

Before applying for the Investment Registration Certificate (IRC), the foreign investor must declare information about the investment project on the National Foreign Investment Information System.

Once the hard copy of the application is submitted, the investor will be granted an account to access the system and track the application’s progress. Investment Registration Authorities also use this system to receive, process, and issue results for investment registration applications and to assign project codes.

Step 2: Submit Application for the Investment Registration Certificate (IRC)

Required Documents for the IRC Application:

Step 3: Apply for the Enterprise Registration Certificate (ERC) and Make Company Seal

Step 4: (For Companies Engaging in Retail Activities Only)

If the FDI enterprise plans to conduct retail sales in Vietnam, it must apply for a Business License at the Department of Industry and Trade.

Step 5: Open a Direct Investment Capital Account

Step 6: Applicable only to companies exercising the right to retail goods

Apply for a Business License to the Department of Industry and Trade.

To smooth the process, foreign investors can choose to invest indirectly by contributing capital or purchasing shares in a Vietnamese company. The procedure is carried out as follows:

Step 1: Register the capital contribution or share purchase in a Vietnamese company

Step 2: Update the Enterprise Registration Certificate to add the Foreign Investor’s information

After receiving approval from the Investment Division of the Department of Finance for the foreign investor’s capital contribution or share acquisition, the investor must proceed to update the Enterprise Registration Certificate to reflect the new foreign shareholder/member.

This change is made at the Business Registration Office of the Department of Finance (previously the Department of Planning and Investment, now merged with the Department of Finance), under Vietnamese legal regulations.

|

Option |

Capital contribution, share purchase, or acquisition of capital contributions in an existing Vietnamese company |

Establishing a new company |

|

Procedures

|

Register a Vietnamese company (if forming one for this purpose) | Apply for Investment Registration Certificate (IRC) |

| Submit dossier for capital/share acquisition | Apply for Enterprise Registration Certificate (ERC) | |

| Apply for business registration change | ||

| Duration

(Working days exclude Saturday, Sunday and other public holidays under the regulations of the State) |

30–35 working days From the day Viet An Law receives full and valid documents from the client Note: Excludes time for opening the indirect investment capital account and transferring capital. |

30–35 working days From the day Viet An Law receives full and valid documents from the client Note: Excludes time for opening the direct investment capital account and transferring capital. |

| Results | Notice of Approval for Registration of Capital Contribution/Share Purchase | Investment Registration Certificate (IRC) |

| Updated Enterprise Registration Certificate | Enterprise Registration Certificate (ERC) | |

| Required Documents | 1. Legal documents of the investor:

– For individuals: Legalized and notarized Vietnamese translation. – For companies: · Legalized original Business Registration Certificate (BRC) + notarized Vietnamese translation · Certified copy of full passport (all pages) of capital manager, legalized + translated; |

1. Legal documents of the investor:

– For individuals: Legalized and notarized Vietnamese translation. – For companies: · Legalized original Business Registration Certificate (BRC) + notarized Vietnamese translation 2. Proof of financial capacity: – Bank balance confirmation/ audited financial statements for the past 2 consecutive years. 3. Office address documentation |

| Investment capital account | – Direct Investment Capital Account: Required if the investor acquires more than 50% of the company’s charter capital.

– Indirect Investment Capital Account: Used if the investor acquires 50% or less of the company’s charter capital. |

Direct Investment Capital Account: Required after company establishment. |

| Capital Contribution | – Must comply with Vietnam’s foreign exchange regulations

– Foreign investor must transfer funds via bank transfer |

– Investor must transfer capital via direct investment account

– Contribution must be made within 90 days from issuance of ERC |

| Pros | – Company is already established and ready to operate immediately.

– No need to apply for an Investment Registration Certificate (IRC). – Vietnamese and foreign individuals do not have to prove financial capacity (though foreign investors must still have sufficient funds to transfer). – Vietnamese individuals can contribute capital in cash. – No need to submit proof of business premises (already legally established). |

– Full ownership and control from the start

– Clear compliance with investment laws from the outset |

| Cons | – Foreign investors must show proof of sufficient funds in a bank account.

– If acquiring more than 50% of charter capital, the transaction must go through the company’s direct investment capital account. – If 50% or less, payment must go through the foreign investor’s indirect investment account. |

– Must obtain both the Investment Registration Certificate (IRC) and Enterprise Registration Certificate (ERC).

– Foreign capital must be transferred within 90 days after ERC issuance. – Capital contributions must be made via bank transfer (for both Vietnamese and foreign investors). – Must provide documents proving legal business premises (e.g., lease agreement, notarized land use right certificate) |

Note: When a Foreign Investor participates in capital contribution or investment, the company’s business lines must be declared by Vietnam’s commitments under the WTO. Any business lines not listed in these commitments must be removed. The investor may only conduct business activities that comply with the conditions stipulated in the WTO Commitments and other relevant specialised legal regulations.

Basic types of Taxes applicable to FDI companies in Vietnam

According to the Ministry of Finance, Vietnam witnessed positive growth in foreign direct investment (FDI) during the first five months of 2025. Total registered FDI reached USD 18.39 billion, marking a strong increase of 51.2% compared to the same period in 2024. This growth highlights Vietnam’s continued appeal as a dynamic and competitive destination for foreign investors.

Among 65 countries and territories with newly registered FDI projects in Vietnam, the leading investors were:

| Country/ Territory | Investment amount (USD) | Share of total new FDI (%) |

| Singapore | 2.12 billion | 30.2 |

| China | 1.81 billion | 25.8 |

| Japan | 753.4 million | 10.7 |

| Hong Kong (China) | 607.7 million | 8.7 |

In the first five months of 2025, foreign investors injected capital into 52 provinces and cities across Vietnam. The top localities attracting the most FDI are:

When it comes to the number of FDI projects, Ho Chi Minh City leads the nation in:

Viet An Law is proud to be a trusted legal consulting firm for FDI company establishment in Vietnam, having supported thousands of foreign investors. We are committed to delivering the most professional, efficient, and cost-effective FDI setup services in the shortest possible time. Contact us for more details!