Opening a bank account in Vietnam is an essential step for both locals and foreigners looking to manage their finances, receive salary payments, or conduct business in the country. This comprehensive guide covers everything you need to know about the requirements, documentation, and step-by-step process for opening a full-service bank account with major Vietnamese banks. Whether you’re a Vietnamese citizen, expatriate worker, or foreign investor, understanding the account opening procedures and choosing the right bank will help ensure a smooth banking experience in Vietnam. Therefore, Viet An Tax Agent will provide businesses, customers and partners with utilities when using the package bank account opening service.

Table of contents

A bank account is an asset that a bank grants to customers for payment, savings and other financial activities. Each person can open multiple accounts, but to ensure safe account management, each person should only use a maximum of two accounts for personal use.

Banks now offer a variety of account types to meet the individual needs of each customer. Here are 4 common types of bank accounts that customers can refer to:

A current account is a type of demand deposit account that customers can use for daily trading purposes such as buying and selling, paying bills, transferring money quickly, receiving salaries, paying insurance, and other expenses. The minimum deposit balance will depend on the bank in each period, usually ranging from 50,000 VND – 100,000 VND. In addition, customers can also choose unique payment accounts according to their nickname, feng shui number, lucky number, … to suit the needs and create their own personality for the owner.

A savings account is a type of account that is created when a customer deposits money at an interest rate set by the bank from time to time. This is a financial option suitable for customers who have idle money and have not yet identified a specific investment channel

Customers can choose to send savings in two forms, including: Non-term or fixed-term (from 1 month to 36 months). In particular, term deposits often bring higher returns than demand deposits.

A credit card account is an account that is granted a limit that allows customers to spend within a limit set by the bank (even if there is no balance in the account). By the date of the statement, customers need to refund the amount advanced by the bank for previous spending transactions.

In case the customer does not pay the full amount when due, the bank will charge an additional interest rate according to separate regulations. Information such as payment due date, limit maintenance period and interest rate within the term will be clearly stated in the bank’s contract.

A loan account is a type of account provided by a bank to customers to monitor and manage loans. Through this account, customers can view details about the loan including the loan amount, repayment term and related information previously agreed with the bank.

A bank account will usually include the following information:

When logging into a bank account, customers can quickly grasp their expenses, income, and remaining balances to build a more reasonable financial plan. In addition, bank accounts also bring utilities such as:

With the variety of products, services and preferential packages today, customers should consider the following notes before deciding to open a bank account

According to the State Bank’s regulations, all Vietnamese citizens can open a bank account. However, age and cognitive capacity are two important factors that determine whether a customer can open a bank account on their own or needs to open it through a legal guardian.

Understanding and managing related costs well will help customers limit unnecessary fees and ensure the effective use of bank accounts. In the process of opening and using a bank account, customers often incur a number of fees as follows:

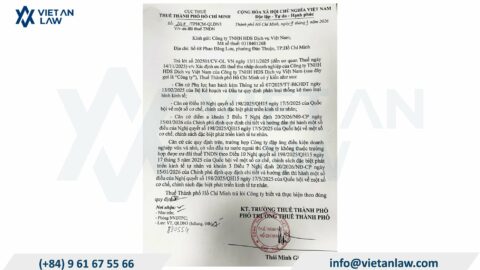

If you have any difficulties or questions related to the package bank account opening service, please contact Viet An Tax Agent for the most specific advice.