In the context of Vietnam increasingly attracting foreign direct investment (FDI), monitoring and transparentizing investment activities have become particularly crucial. To ensure efficient capital utilization, legal compliance, and risk mitigation, FDI enterprises must periodically submit investment monitoring reports in accordance with state regulations. However, preparing these reports requires a deep understanding of legal procedures and statistical forms, as well as skills in data synthesis and analysis. Therefore, the investment monitoring report preparation service for FDI companies emerges as an optimal support solution, helping businesses save time, ensure compliance, and enhance investment management efficiency. In the article below, Viet An Law will provide clients with FDI investment monitoring report services in Vietnam.

Table of contents

An investment monitoring report is a consolidated report document detailing planned or ad-hoc monitoring, inspection, and evaluation activities of an investment project.

FDI enterprises submit investment monitoring reports to the following competent state management authorities:

The receiving competent authority is responsible for checking, monitoring, and evaluating the project implementation progress and may request the investor to supplement information if necessary.

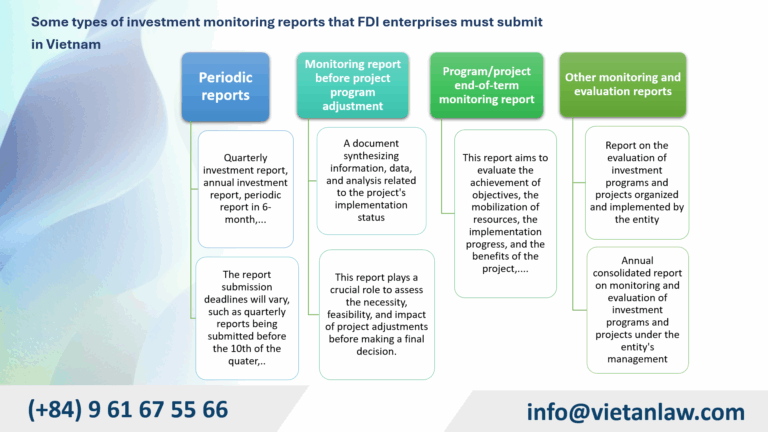

According to Clause 6, Article 100 of Decree 29/2021/ND-CP, FDI enterprises are required to prepare and submit several types of reports to the managing agency, the authority competent to decide on the investment, and the focal unit performing investment monitoring and evaluation, including the following:

Some types of periodic reports that businesses need to be aware of include:

This is a document synthesizing information, data, and analysis related to the project’s implementation status, serving as a basis for considering and proposing adjustments. This report plays a crucial role in providing grounds for relevant parties – including the investor, state management competent authorities, and competent units – to assess the necessity, feasibility, and impact of project adjustments before making a final decision.

This report aims to evaluate the achievement of objectives, the mobilization of resources, the implementation progress, and the benefits of the project.

Some monitoring reports include:

To ensure accuracy and compliance with legal regulations, investors need to understand the requirements for preparing investment monitoring reports. Below are important notes to help enterprises avoid errors and optimize the reporting process:

Before preparing a report, enterprises need to clearly understand what an investment monitoring report is and determine the appropriate type, including periodic reports (quarterly, annual) and reports for project adjustments.

A valid investment monitoring report must provide complete information on implementation progress, capital utilization, socio-economic impact, and difficulties encountered during deployment.

As mentioned above, submission times vary depending on the report type. Proactively submitting reports on time helps enterprises maintain credibility and facilitates related administrative procedures.

Investors can submit investment monitoring reports directly to the Department of Finance (formerly the Department of Planning and Investment), the Management Board of Industrial Parks, or online via the National Investment Monitoring Portal for convenience and speed.

According to regulations in Circular 25/2023/TT-BKHĐT and related legal documents, FDI enterprises must submit periodic annual investment monitoring reports, as well as before making project adjustments. Failure to prepare or submit reports according to regulations may result in administrative penalties, affecting the company’s reputation and legal operations in Vietnam.

Specifically, according to Article 15 of Decree 122/2021/NĐ-CP, a fine ranging from VND 20,000,000 to VND 30,000,000 (applied to organizations) shall be imposed for any of the following violations:

Professional services help businesses fulfill requirements fully and on time, minimizing the risk of violations.

Collecting data, synthesizing, analyzing, and presenting information according to prescribed forms can be very time-consuming for enterprises, especially when lacking an internal legal department or expert legal knowledge. Using services helps:

Investment monitoring reports are important components when enterprises make investment project adjustments. If a report contains errors, lacks information, or is not in the correct format, the adjustment dossier may be returned or the appraisal time prolonged.

Therefore, using a service can help ensure the report uses the correct standard forms, analyzes and presents data logically and understandably, and minimizes the risk of dossier rejection due to technical errors.

For FDI enterprises, language barriers and differences in administrative culture can be significant challenges when working with state management competent authorities. A professional team with practical experience can:

Above is the advice of Viet An Law on the issue of FDI Investment Monitoring Report Services in Vietnam. Clients who have related questions or need legal support, please contact Viet An Law Firm for the best support!