For foreign capital company, after being granted an investment certificate, foreign investors must open a foreign direct investment account (capital transfer account) at the Bank and contribute capital through that account within the time limit stated in the investment certificate.

The timely contribution of capital is considered extremely important because if it overdue according to the time limit for capital contribution specified on the Investment Certificate, the Bank will not allow to receive investment capital, the company will not be able to receive investment capital to conduct operations. However, being able to contribute capital on time depends on many factors and does not always happen on time. At this time, foreign investors are required to carry out procedures for extending the time limit for contributing investment capital (contents are recorded on the Investment Certificate) or procedures for adjusting the Investment Registration Certificate. This article Viet An Law Firm would like to provide contents related to the procedures to extend capital contribution of foreign capital company.

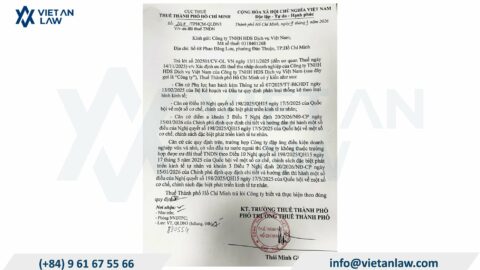

The time limit for capital contribution is specified in the Investment Certificate, in case the capital contribution is not on time, the enterprise needs to contact the inspection agency to carry out procedures for sanctioning violations. The Inspection Agency will issue a decision on penalties for failure to contribute sufficient capital.

After receiving the decision, the enterprise shall pay a fine and proceed to adjust the Investment Certificate to extend the time limit for capital contribution or reduce capital if it is unable to contribute capital according to the time limit recorded in the decision of the Inspection Department.

The person competent to sanction administrative violations must issue a decision to sanction administrative violations within 07 days from the date of making a record of administrative violations.

According to Article 13, Decree 50/2016/ND-CP stipulating violations of regulations on investment activities in Vietnam: A fine of VND 20,000,000 to VND 30,000,000 for one of the following acts:

Based on the explanation dossier and consideration of the violating contents, the inspection agency will decide on the appropriate fine.

A dossier of application to extend of investment capital contribution time limit includes the following documents:

Note: For projects subject to decision on investment policies, when adjusting investment projects related to investment objectives, locations, main technologies, increasing or decreasing investment capital by more than 10% of total investment capital, implementation duration, change of investor or change of conditions for investors (if any), The investment registration agency shall carry out the procedures for deciding on investment policies before adjusting the Investment Registration Certificate.

Investment registration agency as prescribed in Article 39 of the Law on Investment 2020.

Within 10 days from the date of receipt of a valid dossier, the Investment Registration Agency shall amend the Investment Registration Certificate for the investor to record the time limit for contributing new investment capital to the investor.

State fee: No.

The duration of capital contribution in a foreign investment company is specified on the investment registration certificate.

Normally, the time limit for capital contribution in a newly established foreign investment company is 90 days from the date of issuance of the enterprise registration certificate of the economic organization implementing the project.

Before the expiry of investment capital contribution, investors need to submit an application to extend of the time limit for capital contribution. In case of expiry of capital contribution, the extended investor may not be approved by the investment registration agency and must carry out inspection and sanction procedures for failure to comply with the project implementation schedule and failure to adjust the investment registration certificate.

Normally, when submitting an extension dossier, the investment registration agency considers the time to submit the application, in case the capital contribution is overdue, the investment registration agency sends the dossier to the inspection agency to handle violations. In case the enterprise knows that the capital contribution is beyond the time limit, it can make its own dossier to apply for the first handling of violations and carry out procedures to extend of the time limit faster.

Customers who are interested in the procedures for extending capital contribution of a foreign capital company, please contact Viet An Law Firm directly for detailed advice.