In the context of international economic integration, transactions in foreign currencies are becoming more and more popular for businesses in Vietnam. This entails the handling of issues related to exchange rates in accounting and tax declaration becoming increasingly complex and important. The correct application of the exchange rate when recording revenue, expenses and tax obligations not only affects business results but can also lead to tax risks if businesses implement regulations incorrectly. One of the prominent issues is the exchange rate difference arising in the process of tax recognition and finalization, especially value-added tax and corporate income tax. Viet An Tax Agent will clarify concepts related to exchange rates and exchange rate differences in tax declaration, and analyze current legal regulations as well as give some notes for businesses in practice.

Table of contents

Exchange rate difference is a common concept in the field of finance, economics, and international trade, which refers to the difference in value between two currencies of different countries. This difference is usually determined through comparing exchange rates – i.e. the conversion rate of one currency to another – at different times or between different sources.

According to Point 1.1, Clause 1, Article 69 of Circular 200/2014/TT-BTC, the exchange rate difference is the difference that arises when the same amount of foreign currency is converted into an accounting currency unit but at different exchange rates at different times or from different sources.

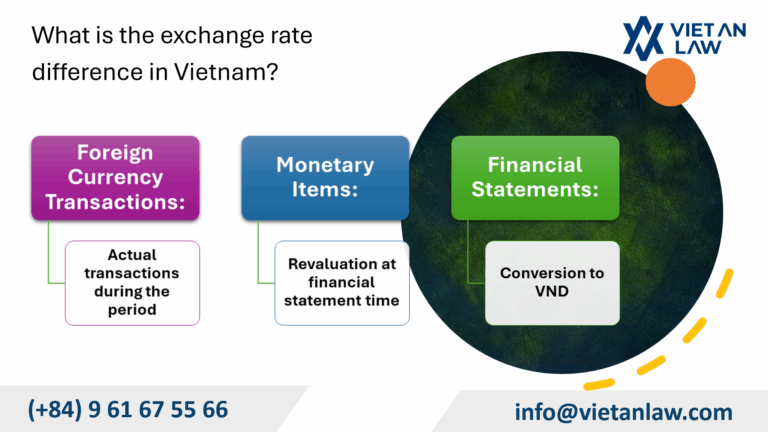

Exchange rate differences usually appear in the following cases:

In essence, exchange rate differences reflect the volatility of the foreign exchange market, which can be due to the impact of factors such as foreign currency supply and demand, monetary policy, macroeconomic or geopolitical situation between countries. When the exchange rate of one currency changes against another, this not only affects the value of the business’s assets and liabilities, but also directly impacts the results of business operations through exchange rate gains or losses.

Actual exchange rate when buying and selling foreign currencies (including contracts for purchase and sale of foreign currencies in spots, forwards, futures, options, swaps): means the exchange rate agreed upon in the foreign currency purchase and sale contract between the enterprise and the commercial bank. In case the contract does not specify the payment exchange rate, the enterprise shall apply the actual transaction rate to record the accounting books as follows:

In addition, enterprises can choose to apply the actual transaction rate, which is approximately the exchange rate with the average transfer buying and selling rate of the commercial bank that the enterprise regularly transacts.The approximate exchange rate must ensure that the difference does not exceed ±1% compared to the average transfer buying and selling rate, determined by day, week or month, based on the average of the average between the buying rate and the daily transfer selling rate of that bank.

The application of the approximate exchange rate must ensure that it does not materially affect the financial situation and business results of the accounting period.

The actual exchange rate when revaluating currency items of foreign currency origin classified as assets: is the foreign currency purchase rate of the commercial bank where the enterprise regularly transacts, at the time of making financial statements. Particularly for foreign currency deposits at banks, the actual exchange rate used is the purchase rate of the bank where the enterprise opens the foreign currency account.

The actual exchange rate when revaluating currency items of foreign currency origin classified as liabilities: is the foreign currency selling rate of the commercial bank where the enterprise regularly transacts, at the time of making the financial statements.

For internal transactions within the group, member units are allowed to uniformly apply an exchange rate set by the parent company to re-evaluate monetary items of foreign currency origin arising from internal transactions. This exchange rate must ensure that it closely reflects the actual transaction rate at the time of re-evaluation.

In case the enterprise applies the approximate exchange rate (specified at Point a of this Clause) to account transactions in foreign currencies arising in the period. At the end of the accounting period, the enterprise uses the transfer rate of the commercial bank where transactions often arise to re-evaluate monetary items of foreign currency origin. This rate can be:

According to the provisions of Article 4 of Circular No. 96/2015/TT-BTC amending and supplementing Article 6 of Circular No. 78/2014/TT-BTC:

“Loss on exchange rate differences due to revaluation of currency items of foreign currency origin at the end of the tax period, including exchange rate differences due to the revaluation of the year-end balance is: cash, deposits, money in transit, receivables of foreign currency origin (except for exchange rate losses due to the revaluation of liabilities of foreign currency origin at the end of the tax period).”

According to the provisions of Article 5 of Circular No. 96/2015/TT-BTC amending and supplementing Article 7 of Circular No. 78/2014/TT-BTC:

“In the year of enterprise tax, there is an exchange rate difference arising in the period and exchange rate difference due to the revaluation of liabilities of foreign currency origin at the end of the fiscal year, period:

For receivables and loans of foreign currency origin arising in the period, the exchange rate difference shall be included in the deductible expenses or income is the difference between the exchange rate at the time of debt recovery or loan recovery and the exchange rate at the time of recognition of the receivable debt or the original loan.

The above-mentioned exchange rate differences do not include exchange rate differences due to the revaluation of year-end balances such as: cash, deposits, money in transit, receivables of foreign currency origin.”

Thus, the exchange rate difference loss due to the revaluation of currency items of foreign currency origin at the end of the tax period, including the exchange rate difference due to the revaluation of the year-end balance, which is: cash, deposits, money in transit, receivables of foreign currency origin are not included in the deductible expenses when determining taxable income CIT.

Interest on exchange rate differences due to the revaluation of currency items of foreign currency origin at the end of the tax period includes exchange rate differences due to the revaluation of the year-end balances of cash, deposits, money in transit, receivables of foreign currency origin not included in CIT taxable income.

According to the guidance of the General Department of Taxation on the declaration of CIT finalization, indicators B7 and B12 on the CIT finalization declaration are guided as follows:

In indicator B7 – Other adjustments that increase pre-tax profits, declare:

In indicator B12 – Other adjustments that reduce pre-tax profits, declare:

If you have any difficulties or questions related to exchange rates and exchange rate differences when declaring taxes, please contact Viet An Tax Agent for the most specific advice.