Cultural products and services not only play an important role in economic development, and perform entertainment functions but also contribute to the performance of educational functions, fostering aesthetic values, continuity function, and historical development… Recognizing that importance, in recent years, cultural products and services in our country have been focused on development. In Vietnam, there are also specific commitments to establish a company in Vietnam to produce and distribute cultural products, including video recordings.

may not exercise the right to distribute recorded items.

Services: Film production (CPC 96112, excluding videotapes), film distribution (CPC 96113, excluding videotapes), film screening (CPC 96121)

Film screening service (CPC 96121)

Culture houses, film screening venues, public film screening clubs and associations, and mobile film screening teams of Vietnam are not allowed to enter into business cooperation contracts or joint ventures with foreign service suppliers

This industry is on the list of Most Favored Nation exemptions under the WTO Commitments.

Restrictions on publications: (i) Publishing of books, music books and other publications (ISIC 2211); (ii) Publishing of newspapers, magazines, periodicals (ISIC 2212); (iii) Publishing of video tapes (ISIC 2213); (iv) Other types of publication (ISIC 2219).

Appendix NCM I-VN-9

For film production (CPC 96112), film distribution (CPC 96113) and projection (CPC 96121):

Theaters must show Vietnamese films on major national holidays. The ratio of Vietnamese films per the total number of films shown annually will not be less than 20%. Theaters must show at least one Vietnamese film between 18:00-22:00.

Appendix NCM I-VN-25

Foreign investment is prohibited in Vietnam’s state-owned commercial enterprises that are currently allowed to import certain video products, as indicated in Table 8c in the Working Party Report on Vietnam’s accession to the WTO. For greater certainty and to be consistent with Article 9.11.1.c (Forwards only, not backward), the liberalization of a state-owned commercial enterprise does not result in the requirement to liberalize all state-owned commercial enterprises. .

Appendix NCM II-VN-14

For the sound recording sub-sector: Vietnam reserves the right to adopt and maintain any measure related to sound recording services except allowing foreign ownership of up to 51% of an enterprise operating in the sound recording industry.

Appendix NCM II-VN-20

For the video tape production and distribution industry: Vietnam reserves the right to adopt and maintain any measure related to the investment in the production and distribution of video tapes on any material.

(Appendix 8-C): Vietnam may adopt or maintain any measure relating to the operation of an enterprise as defined in points 1(e) and 1(m) of Article 8.2 (Definitions) which is inconsistent with Clause 2 of Article 8.5 (National Treatment), provided that the measure is not inconsistent with the commitments set out in Appendix 8-B (Vietnam’s Schedule of Specific Commitments).

Foreign organizations and individuals may distribute phonograms and video recordings with the content of art performances in the Vietnamese territory in accordance with the provisions of Decree 144/2020/ND-CP dated December 14th, 2020 of the Government stipulating the performance art activity and other relevant provisions of law that are not contrary to international treaties to which the Socialist Republic of Vietnam is a contracting party.

Conditions for the circulation of phonograms and video recordings with art performance content for commercial purposes are specified in Article 22 of Decree 144/2020/ND-CP:

Foreign organizations and individuals are not allowed to directly distribute video recordings with the content of art performances in the Vietnamese territory.

According to the above regulations, foreign investors who want to invest in the production and distribution of cultural products, including video recordings, can only choose three forms:

If projects do not use land (without direct land lease from the state) that do not use technologies on the list of restricted transfers, the procedures for approval of investment policies are not required. Foreign investors carry out the procedures for applying for an Investment Registration Certificate.

Dossier for issuance of the Investment Registration Certificate to a foreign-invested company:

The agency that submits the dossier for the Investment Registration Certificate for the company with 100% foreign capital at the investment registration agency

After obtaining an Investment Registration Certificate, investors need to prepare the dossier to set up an enterprise.

Dossier of establishment of a foreign-invested company

The agency that submits the dossier for an enterprise registration certificate to companies with 100% foreign capital

Business Registration Agency – Provincial Department of Planning and Investment.

Duration to issue the Enterprise Registration Certificate for companies with 100% foreign capital

05 working days from the date of receiving the complete and valid dossier.

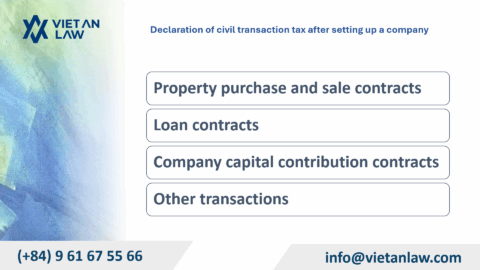

After an enterprise is granted an Enterprise Registration Certificate, it must make a public announcement on the National Portal of Business Registration according to the order and procedures and pay fees as prescribed.

The content to be announced includes the contents of the Enterprise Registration Certificate and the following information:

Executing agency: Reporting division of the Business Registration Authority – Provincial Department of Planning and Investment.

After obtaining the Enterprise Registration Certificate and having posted the enterprise establishment statement. The enterprise engraves the seal at one of the licensed seal engraving units. Enterprises decide by themselves the number and form of seals within the scope permitted by law.

Customers wishing to establish a foreign-invested company, and provide legal consultation during the implementation of an investment project in Vietnam, please contact Viet An Law Firm for the best support!