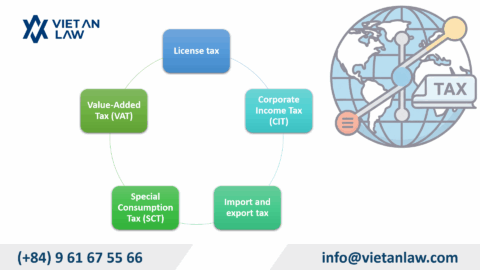

Enterprise income tax is a kind of tax calculated based on incomes form business activities of enterprises and other incomes, which are often incomes earned from property transfer.

Formula:

Payable enterprise income tax = [Taxable incomes – (Tax-exempt incomes + Losses carried forward from the previous year)] × Tax rate

Taxable incomes = Revenue – Deductible expense + Other incomes

From January 1, 2016, enterprise income tax rate is 20%.

Tax declaration:

Enterprise income tax declaration are procedures for provisionally calculating the amount of tax that enterprise may have to pay. This is a duty belongs to enterprises to create grounds for tax assessment.

Enterprises have obligations to declare tax and submit the quarterly tax declaration form to tax agencies on the 30th day of the first month of the quarter at the latest.

If an enterprise has just been established, it has to determine its revenue, costs, taxable income, annual payable tax, quarterly payable tax and declare tax at the tax agencies all by itself. The deadline is the 20th day of the next month at the latest, from the issue day of the Certificate of Business Registration.

Submit the enterprise income tax declaration form:

Enterprises temporarily pay the tax quarterly based on the declaration form or the amount assessed by the tax agencies.

Enterprise income tax audit:

Enterprises have to submit the enterprise income tax audit form to the direct supervisory tax agencies within 90 days from the last day of the calendar year or the fiscal year.

If clients have any question or concern about enterprise income tax, please feel free to contact Viet An Law Firm. We are willing to give you legal advice about enterprise income tax and other taxes, as well as relevant procedures and provide services at a reasonable price!