Recently, the Government has issued Decree No. 71/2024/ND-CP, introducing new regulations on new land prices regime in 2024 in accordance with the Land Law 2024. Decree 71/2024/ND-CP on new land prices regime in 2024 provides more specific regulations on land prices, methods, and procedures for determining land prices for each method. Additionally, the Decree supplements the provisions on the operating conditions of training institutions for land valuation. This change is entirely consistent with the current dynamic land situation. Therefore, what do clients need to pay attention to regarding the new regulations on land prices in Decree 71/2024/ND-CP on new land prices regime in 2024? To help you understand the implications of these changes, Viet An Law Firm presents a comprehensive overview.

Table of contents

This Decree details the contents of land prices in accordance with the Land Law 2024, including:

Compared to the previous Decree 12/2024/ND-CP, Decree 71/2024/ND-CP provides more specific guidance on the procedures and content of land valuation for each valuation method through detailed regulations on formulas, calculation methods, and factors affecting land prices. These detailed regulations help ensure that land prices are determined accurately and closely reflect market prices.

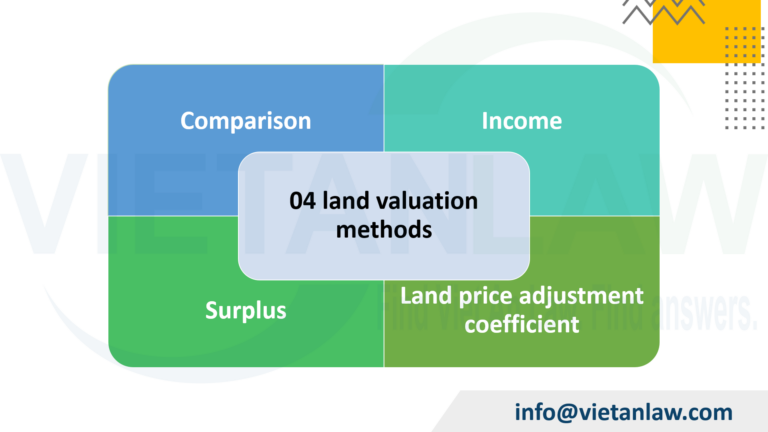

Based on the four land valuation methods listed in Clause 5, Article 158 of the 2024 Land Law, Decree 71/2024/ND-CP has detailed the procedures and content of land valuation for each method. Specifically:

| Price of the land use right of the comparable parcel | = | Price of the comparable parcel | – | The value of land-attached assets at the time of successful transfer or winning of auction of the land use rights |

|

Area of the comparable parcel |

||||

| Value of the land use right of the land parcel to be valuated | = | Average annual net income |

|

Average savings deposit interest rate |

| Value of the land use right of the land parcel or plot to be valuated | = | Total development revenue | – | Total development cost |

| Estimated land price of the land parcel or land plot to be valuated according to each comparable parcel | = | Price of each comparable parcel | ± | Price adjustment from factors affecting the land price of each comparable parcel with the land parcel to be valuated |

| Price of the land parcel to be valuated | = | Value of the land use right of the land parcel to be valuated |

|

Area of the land parcel to be valuated |

| Price of the land parcel to be valuated | = | Value of the land use right of the land parcel to be valuated |

|

Area of the land parcel to be valuated |

| Price of the land parcel to be valuated | = | Price in the land price list of the land parcel to be valuated | x | Land price adjustment coefficient |

Decree 71/2024/ND-CP, which introduces new regulations on land prices under the Land Law 2024, has added provisions regarding the provision of information for land valuation purposes. Accordingly, agencies, organizations, and units are required to provide the necessary information within 05 working days from the date of receiving a written request from the land valuation organization. This information can be provided in written form or electronically. This provision ensures that agencies, organizations, and individuals involved in land valuation activities have access to complete and accurate information.

Land price-affecting factors listed in Article 8 of this Decree include:

Additionally, this Decree stipulates that the People’s Committee of the province shall be responsible for specifying the factors affecting land prices, the maximum difference of each factor affecting land price to determine a certain level of similarity, and the adjustment method for each level of difference of each factor affecting land price.

The development, adjustment, amendment, and supplementation of land price lists must be based on the land valuation methods mentioned in Article 158 of the Land Law, Articles 4, 5, 6, and 7 of this Decree, and the following factors:

The initial land price list under the new Land Law will be announced as prescribed and will take effect from January 01, 2026. However, due to the new provisions on the early effective date of the Land Law 2024, the regulations on land prices may be adjusted and applied earlier than the original provision.

Additionally, according to Article 16 of this Decree, adjustments, amendments, and supplements shall be made annually (instead of every five years as under the current Land Law 2013) and shall be announced and applied from January 01 of the following year or during the year.

This annual adjustment of land prices is necessary and appropriate for the current situation. Previously, the infrequent adjustment of land price lists (every 05 years) led to a significant gap between the land prices in the list and the market prices. Meanwhile, the land price list is an important basis for compensating people for land expropriation, calculating land rent, and land use fees when the State allocates or leases land,… This not only affects the rights of people but also affects the State budget revenue.

The People’s Committee of the province shall submit the draft land price list to the People’s Council of the same level for decision, public announcement, and updating in the national land database, based on the draft land price list previously submitted to the People’s Committee by the Department of Natural Resources and Environment.

Pursuant to Clause 3, Article 36 of this Decree, a land price-related professional training and further training institution must meet the following conditions:

The addition of operating conditions for land price-related professional training and further training institutions enables competent authorities to easily inspect and manage their activities. This contributes to improving the effectiveness of land valuation education and training.

The above are the key contents of Decree 71/2024/ND-CP on new land prices regime in 2024. If you have any questions or require advice on land valuation regulations or land law, please contact Viet An Law Firm for the best support.