Along with the development of the economy and society, airline are increasingly becoming a popular and safe means of passenger transport. In that context, air ticket sales companies were born, acting as a bridge between customers and airlines. However, the business of selling airline tickets is one of the conditional businesses regulated by law. Therefore, businesses need to meet the conditions for setting a business in Vietnam for airline ticket trading, which is presented in this article below by Viet An Law.

Table of contents

An airline ticket company is essentially an airline ticket sales agency that conducts transactions and sells airline tickets when customers need to buy tickets but do not need to go directly to the airline to buy. It can be understood that air ticket companies are authorized units to sell tickets directly from the airline and are granted the right to sell air tickets from the airline’s website at competitive prices.

For a company that sells airline tickets, the product being sold will be airline tickets provided by airlines to distribute to the market to meet customers’ needs for using flight services. Companies that sell airline tickets will often act as agents for many different airlines.

It can be seen that the current Enterprise Law 2020 allows any individual or organization to have the right to establish an airline ticket selling business. However, according to Clause 2, Article 17 of the Enterprise Law 2020, the law also prohibits the following entities from establishing and managing enterprises, including:

Basically, the company selling airline tickets will be the commercial agent for the airlines. Therefore, according to the Commercial Law 2005, the commercial agency is an activity to make a profit whereby the principal and the agent will agree for the agent to purchase on their behalf, sell goods to the principal, or provide the principal’s services to customers to receive remuneration.

Therefore, for each airline when signing an agency contract with an airline ticket selling company, there will be requirements for specific conditions in the agency contract. These conditions will depend entirely on the airline, as long as they do not violate the law.

Clients can refer to some common conditions that airlines in Vietnam require an airline ticketing company to meet before becoming their agent below:

Therefore, the conditions for setting a business in Vietnam for airline ticket trading will include general conditions to establish a legal business and specific conditions for each different airline company. A company selling airline tickets needs to meet both of these conditions so that the business can operate following the law.

In Vietnam’s schedule of service commitments in the WTO, the aviation product sales and marketing services group stipulates the mode of commercial presence: Foreign airlines are allowed to provide services in Vietnam through ticket offices or agents in Vietnam. Regarding the method of presence of natural persons, Vietnam has not made any commitments, except for general commitments.

The dossier to establish an airline ticket sales company will include the following documents:

After fully preparing the above documents, Viet An Law Firm will proceed to apply for an Enterprise Registration Certificate through the National Business Registration Portal.

In case the dossier is complete and valid, the company will receive an Enterprise Registration Certificate within 3 working days.

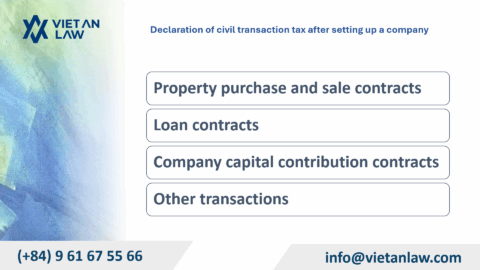

After obtaining the Enterprise Registration Certificate, the airline ticket sales company performs the following tasks:

To be able to sign an airline ticket agency contract, the airline ticketing company needs to clearly understand the conditions to be able to act as an airline ticket agency for each specific airline.

If you have any other questions related to the conditions for setting a business in Vietnam for airline ticket trading in particular and other types of businesses in general, please contact Viet An Law Firm for support!