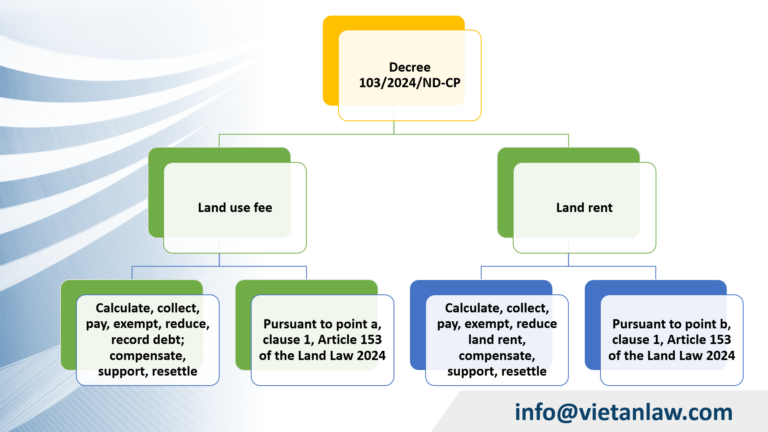

One of the financial obligations of land users is the obligation to pay land use fees and land rent. Recently, the Government has issued new regulations on land use fees and land rent in Decree 103/2024/ND-CP to guide the new regime effective under Land Law 2024 in Vietnam. Below, Viet An Law will analyze some notable contents in Decree 103/2024/ND-CP regulating land use fees and land rents.

Table of contents

Decree 103/2024/ND-CP has specified the provisions of the Land Law 2024 on land use fees and land rents, specifically:

Accordingly: Land use fees are applied to entities to whom the state allocates land, while land rent is applied to entities to whom the state leases land and has obligations.

The following cases are specified:

The Land Law 2024 has made major changes related to land finance, including land use fees and land rents. The main changes of the Land Law 2024 affecting land finance include:

To specify the new regulations of the Land Law 2024, Decree 103/2024/ND-CP regulating land use fees and land rents with detailed regulations on land use fees and land rents was issued.

Article 6 of Decree 103/2024/ND-CP specifically stipulates the formula for calculating land use fees when the State allocates land. Clause 2, Article 6 of the Decree stipulates that in cases where the State allocates land with land use fees collected to build resettlement housing, which is a multi-storey house, allocated to many users, the land use fees are allocated to each user by the provisions of the law on land use fee collection according to the Land Law 2013, Decree No. 45/2014/ND-CP and instructions in Circular No. 76/2014/TT-BTC.

Articles 7, 8, and 34 of Decree 103/2024/ND-CP stipulate the calculation of land use fees when changing land use purposes in the spirit of the provisions of Articles 121 and 156 of the Land Law. Specifically, when changing land use purposes, land users must pay land use fees and land rent as follows:

In addition, in practice, to implement the project, investors must receive the transfer of many different types of land (residential land, production and business land, commercial land, service land, and agricultural land), and then complete procedures to be permitted to change the land use purpose to implement the investment project according to the approved land use plan, but current law does not have regulations on land use fee collection and land rent collection in this case. Therefore, the Decree supplements regulations on handling cases of mixed land use projects in this case, specifically:

One of the notable contents of Decree 103/2024/ND-CP is the regulation on calculating land use fees when granting certificates of land use rights and ownership of assets attached to land to households and individuals.

The Land Law 2024 has provisions on granting land use certificates to households, individuals, and residential communities using land in cases where there are or are no documents on land use rights as prescribed; the origin violates land law before July 1, 2014; the origin is allocated without proper authority; accordingly, there are provisions on several cases where financial obligations regarding land must be paid when a land use certificate is granted.

Articles 9, 10, 11, and 12 of the Decree specifically stipulate the collection rate for each case of being granted a Land use right certificate under the Land Law in the direction of inheriting the provisions on land use fee collection rates according to the provisions of the law on land use fee collection under the Land Law 2013. However, there are adjustments to balance between land use cases according to land use time and land origin; the land price for calculating land use fee is the land price on the land price list according to the provisions of the Land Law.

The Land Law 2024 specifically stipulates cases where specific land prices are applied to calculate land rent, the land price list is applied to calculate land rent when the State leases land and collects annual land rent; specifically stipulates cases where the State leases land and collects land rent once for the entire lease term; leases land and collects annual rent in the remaining cases; the land price list is built according to area and location.

For areas with digital cadastral maps and land price databases, a land price list will be developed for each plot of land based on the value zone and standard plot of land. The land price list will be developed for the first time to be announced and applied from January 1, 2026, and will be adjusted, amended, and supplemented for announcement and application from January 1 of the following year.

Based on these regulations, Article 26 of Decree 103/2024/ND-CP stipulates the unit price for land rental payments annually. Accordingly:

Annual land rental price = Percentage (%) of land rental price multiplied by (x) Land price for calculating land rental fee

In which:

Decree 103/2024/ND-CP regulating land use fees and land rents clearly states that land use fees are exempted in the cases specified in Article 18 and land use fees are reduced in the cases specified in Article 19.

To strengthen post-inspection and handling after the State allows exemption or reduction of land use fees, Clause 8, Article 17 stipulates that in cases where competent state agencies discover that land users have been exempted or reduced from land use fees but do not meet the conditions for exemption or reduction but are not subject to land recovery, they must return to the state budget the amount of land use fees that have been exempted or reduced. This new regulation has added guidance on handling cases where competent state agencies discover that land users have been exempted or reduced from land use fees but do not meet the conditions for exemption or reduction of land use fees as prescribed.

Decree 103/2024/ND-CP specifically stipulates cases of land rent exemption in Article 39; designs land rent reduction levels according to investment incentive sectors and investment incentive locations according to the provisions of the law on investment, which are similar to the current regulations in Decree 46/2014/ND-CP (amended and supplemented in Decree 135/2016/ND-CP, Decree 123/2017/ND-CP).

Article 157 of the Land Law 2024 only stipulates exemption and reduction of land use fees and land rents for cases of land use for production and business purposes in investment incentive sectors or investment incentive areas (regardless of socialized sectors as in the Land Law 2013).

Therefore, Articles 39 and 40 of the Decree only provide general regulations on preferential levels of exemption and reduction of land use fees for projects in investment incentive sectors and areas without establishing separate incentives for projects using land to build public works for business purposes (socialization).

Article 257 of the Land Law 2024 stipulates transitional provisions for cases where there has been a decision on land allocation, land lease, permission to change land use purpose, permission to change from annual land lease to one-time land lease for the entire lease term, land use extension, adjustment of land use term, adjustment of detailed planning before the effective date of this Law but the land price has not been decided.

Article 50 and Article 51 of Decree 103/2024/ND-CP guide the amount of money that land users must pay in addition to the period when land prices have not been decided for the cases specified in Article 257 of the Land Law according to 04 options:

The amount of money that land users must pay additionally for the period not yet calculated for land use fees and land rent is calculated by:

The average deposit interest rate of 03 commercial banks in which the State owns more than 50% of the charter capital in the province or centrally-run city where the land is located for a term of 03 months is calculated on the amount of land use fee and land rent payable, determined according to the provisions of Clause 2, Article 257 of the Land Law 2024.

The amount of money that land users must pay additionally for the period not yet calculated for land use fees and land rent is calculated by:

The average deposit interest rate of 03 commercial banks in which the State owns more than 50% of charter capital in the province or centrally-run city where the land is located for a term of 01 year is calculated on the amount of land use fee and land rent payable.

The amount of money that land users must pay additionally for the period not yet calculated for land use fees and land rent is calculated by:

50% of the amount equivalent to late payment of land use fees according to the provisions of the law on land use fee collection, the law on tax management from time to time, calculated on the amount of land use fees and land rent payable.

The amount of money that land users must pay additionally for the period not yet calculated for land use fees and land rent is calculated by:

The amount is equivalent to the late payment of land use fees and land rent according to the provisions of the law on land use fee collection and the law on tax management from time to time, calculated on the amount of land use fees payable.

Above are the analyses of the notable contents of Decree 103/2024/ND-CP regulating land use fees and land rents. If you have any related questions or need advice on land use fees, land rents, or other land law regulations, please contact Viet An Law Firm for the best advice and support!