Value added tax (VAT) is a tax calculated on the added value of goods and services arising during the process of production, circulation, and consumption. So when paying tax late, what kind of penalty will the subjects obliged to pay value-added tax pay? In this article, Viet An Law Firm – Tax Agent will summarize the regulations on the penalty for late payment of value added tax (VAT) according to current Vietnamese law.

Table of contents

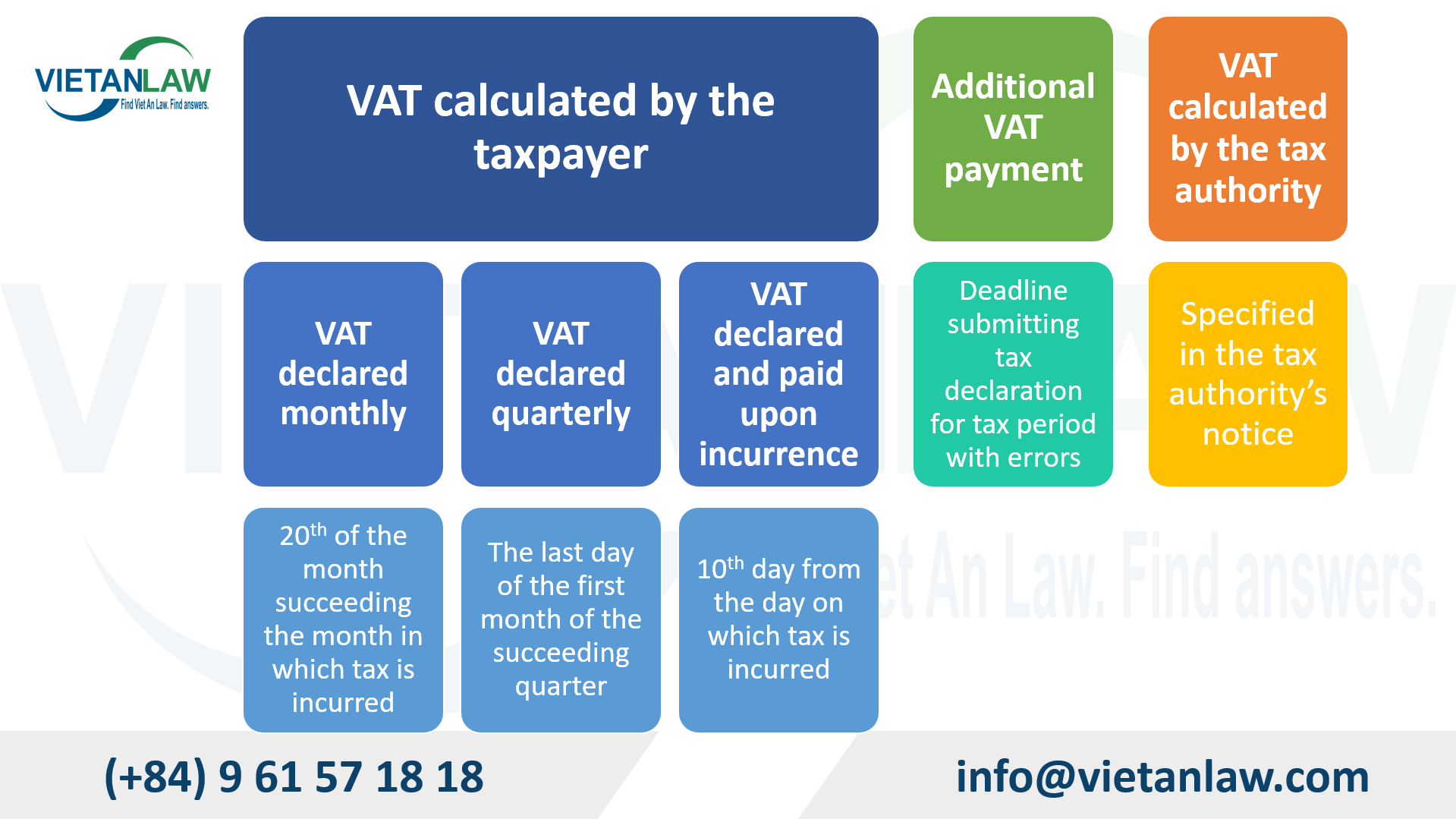

Article 44, 55 Law on Tax Administration 2019 (on tax payment deadline), Article 8 of Decree 126/2020/ND-CP (on taxes divided by tax declaration period), the current VAT payment deadline is prescribed as follows:

The rate for calculating late payment of VAT and the time for calculating the fine for late payment of VAT are specified in Article 59 of the Law on Tax Administration 2019 as follows:

Formula to calculate the penalty for late payment of VAT:

Amount of late payment of VAT = Amount of late payment of VAT x 0.03% x Number of days of late payment

For example: Company A’s late payment of VAT is 100 million VND, the delay in payment is 150 days, then the amount of late payment of VAT is determined as follows: Amount of late payment of VAT = 100 million VND x 0.03% x 150 days = 4.5 million. Therefore, the fine for late payment of VAT according to the provisions of the Law on Tax Administration is 4.5 million VND.

Normally, when businesses submit tax declarations, they will also pay taxes to the state budget. Therefore, late tax payment is often a consequence of late submission of tax returns. In case late submission of tax declaration documents leads to late tax payment, Article 13 of Decree 125/2020/ND-CP stipulates the administrative penalties as follows:

| Fine level | Time for delay in submitting tax declaration documents |

| 2,000,000 – 5,000,000 VND | 01 day to 30 days, except in cases of late payment from 01 day to 05 days and there are extenuating circumstances. |

| 5,000,000 – 8,000,000 VND | 31 days to 60 days |

| 8,000,000 – 15,000,000 VND | · 61 days to 90 days; or

· 91 days or more but no tax payable arises; |

| 15,000,000 – 25,000,000 VND | Over 90 days, there is tax payable and the tax amount has been paid in full before the tax authority decides to inspect/sanction. |

Note:

In addition to the fine for late payment of VAT as above, in case of late payment of administrative fines according to the administrative penalty decision issued by the tax authority, the violator must also pay an additional late payment fee according to Clause 1, Article 42 of Decree 125/2020/ND-CP regulating penalties for administrative violations of taxes and invoices, amended and supplemented by Decree 102/2021/ND-CP stipulates as follows:

The formula for calculating late payment interest and late payment VAT fine:

Amount of late payment fine = Amount of late payment fine x 0.05 x Number of days of late payment

Article 21 of Circular 80/2021/TT-BTC, as amended and supplemented by Circular 13/2023/TT-BTC and Circular 43/2023/TT-BTC stipulates the handling of late payment of Value Added Tax increase as follows:

Determining the amount of late payment interest is based on the amount of late payment tax, the number of days of late payment, and the late payment interest rate specified in Article 59 of the Law on Tax Administration. The time for calculating late payment interest is calculated continuously from the day following the date of late payment interest to the day immediately preceding the date the taxpayer pays the tax debt to the state budget.

Every month, the tax authority notifies about the VAT amount of late payment along with a notice of tax debt (according to form No. 01/TTN issued with Appendix I of Circular 80/2021/TT–BTC) for taxpayers with the tax debt is 30 days or more past the payment deadline.

To handle administrative procedures for taxpayers or at the request of a competent state agency, the tax agency determines and notifies the tax debt up to the time the tax agency issues the notice (according to form no. 02/TTN issued with Appendix I Circular 80/2021/TT-BTC amended and supplemented by Circular 13/2023/TT-BTC and Circular 43/2023/TT-BTC).

Currently, the law stipulates several cases where tax payment and VAT declaration can be extended, including cases prescribed in Article 62 of the Law on Tax Administration 2019 or extended from time to time according to Government regulations to implement monetary policy, security, and order, and promote the economy (such as Decree 12/2023/ND-CP on extending tax payment deadlines). the added value applied in 2023 ).

For cases of extension according to law, Article 62 of the Law on Tax Administration 2019 has the following two cases:

Thus, in case of late tax payment, businesses may be subject to: (i) Fine for late payment of tax, (ii) Administrative fine for late payment, (iii) Penalty for late payment of administrative fine. To avoid the risk of violating VAT regulations, clients should use tax accounting service, please contact Viet An Law Firm – Viet Tax Agent for the fastest support!