Enterprise have demand to conduct retail activities in Vietnam, foreign investors need to satisfy certain conditions. According to Decree No. 09/2018/ND-CP, foreign-invested economic organizations that want to set up retail establishments in Vietnam need to be granted a license to set up retail establishments.

Table of contents

As prescribed by law, when setting up a retail establishment other than the first retail establishment, investors must carry out an economic needs test (ENT), unless the retail establishment has an area of less than 500m2, set up in a commercial center and not in the type of convenience store, mini supermarket. Thus, depending on each case, investors need to satisfy different conditions to be granted a license to set up a retail establishment:

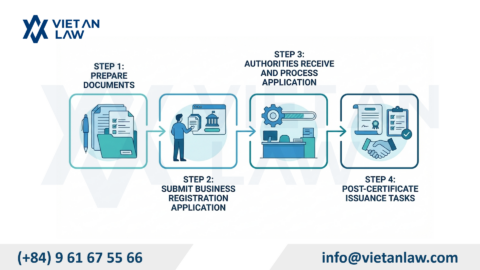

The dossier shall be submitted to the Department of Industry and Trade where the foreign-invested economic organization is headquartered. Depending on the cases prescribed by law, the Department of Industry and Trade shall grant permits to dossiers after satisfying all conditions or after consulting the Ministry of Industry and Trade or other related Ministries.

The investor sends the dossier to the Department of Industry and Trade where the foreign-invested economic organization has a retail establishment. If the dossier satisfies the conditions, the Licensing Agency shall send the dossier to the Ministry of Industry and Trade for opinions and only grant the license to establish a retail establishment to the investor after obtaining the written approval of the Ministry of Industry and Trade.

Upon receipt of a qualified dossier, the Licensing Agency proposes to establish an ENT Council. After obtaining the written conclusion of the license proposal from the Chairman of the ENT Council, the Department of Industry and Trade has the authority to send the dossier together with the written opinion of the Ministry of Industry and Trade. The Department of Industry and Trade shall issue licenses to investors after receiving the written approval from the Ministry of Industry and Trade.

A license to set up a retail establishment has the following contents:

Our related article on set up a retail establishment license for a foreign-invested company in Vietnam include License for retail distribution of goods of foreign-invested companies in Vietnam and Business license for retail distributions in Vietnam. Kindly refer to achieve more information or contact us.

If you have any questions regarding the issuance of a license to set up a retail establishment and carry out investment procedures in a foreign-invested company, please contact Viet An Law Firm for detailed advice!