Switzerland has long established itself as one of the world’s leading economic and financial centers, attracting the attention of global businesses and investors. Choosing this country as a place to invest is a strategic step that takes advantage of the outstanding advantages that the Swiss economy and business environment offer. With a combination of political stability, a strong economy along with a competitive tax policy and a highly skilled workforce, Switzerland is an ideal place for growth, innovation, and access to international markets. This is why Switzerland has become a “landing place” for many businesses and investors in the international market. The procedure for establishing a company in Switzerland will become fast, time-saving and cost-saving if investors understand the process, Viet An Law would like to provide some information about the procedure for establishing a company in Switzerland through the article below.

Table of contents

You need to choose which type of company is most suitable for the nature of business activities, the number of founders, financial capacity (expected capital size). You can refer to some information below:

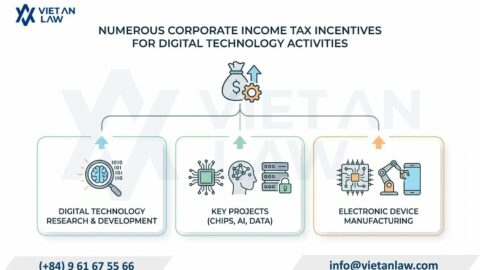

Deciding which canton of Switzerland the company will register and operate in is a profound influencing factor, especially in terms of taxation. Although there is a generally applicable Federal tax law, each of Switzerland’s 26 cantons has the autonomy to set its own laws and tax rates (as well as the tax coefficients of its affiliated communes). As a result, corporate income tax and capital tax rates can vary from state to state.

Based on recently updated figures, the combined effective tax rate (Federal + Canton + Commune) for corporate income tax in Switzerland is as follows:

According to Swiss law, a firm name must be unique and clearly distinguishable from all other business names registered and published in the Commercial Register throughout the Federal territory. The company name must also not be misleading about the nature of the business’s operations, size or affiliation. In addition, the name of the company registered in the Trade Register must clearly include the suffix indicating the legal type at the end of the name, e.g. “ABC Consulting GmbH”, “Global Trade AG”, “Swiss Innovation Sàrl”, “Pharma SA”.

To make sure the name you choose meets the above requirements, you need to conduct an availability lookup. This inspection is carried out through the Federal Commercial Registry Office’s system.

The company’s charter is a document detailing core information such as business name and objectives, charter capital and division, organizational and management structure, regulations on meetings of owners/shareholders, rights and obligations of the board of directors, etc. etc. The company’s charter needs to be notarized in order for the company registration dossier to be considered by the Commercial Registration Authority.

You will then need to open a freezing account at a bank in Switzerland. This account is temporarily blocked. The purpose is to ensure that the charter capital is already available and reserved for the new company, which cannot be used for any other purpose before the company officially has legal status and is incorporated. Once the capital has been deposited into the deposit account, the bank will issue an official document confirming this as a Capital Margin Certificate – this certificate will be required by the Commercial Registry to be included in the company incorporation dossier to prove that you have met the initial charter capital requirement in accordance with Swiss law Si before proceeding to the next steps of establishment.

Next, you need to proceed with the appointment of the right individuals to the top management positions of the company. For a Joint Stock Company(AG/SA), this position is the Board of Directors – the body responsible for monitoring and making strategic decisions. In addition, with a Limited Liability Company (GmbH / Sàrl), you will appoint members of the Management Board – the day-to-day management team.

Note that you need to make sure that at least one of the members of the Board of Directors (for AGs) or the Board of Management (for GmbH) must simultaneously meet two important criteria:

Representatives will be empowered to sign papers and work with state agencies on behalf of the company.

The company incorporation application will be filed at the Commercial Register (Handelsregister) of the state where you have chosen to locate the company’s headquarters. The Commercial Registry will review the records to ensure the completeness, accuracy, and validity of the documents in accordance with Federal and state law.

Once the application is fully validated, the Commercial Registry will officially register your new company name in the state Register of Commerce. Information about the formation of the company, including the name, head office address, legal type, charter capital and personal information of the members of the management/directors authorized to represent, will be published publicly in the Swiss Official Gazette of Commerce (SHAB / SHAB / FOSC / FUSC).