On December 11, 2025, during the 10th Session of the 15th National Assembly, the Investment Law 2025 was officially ratified. This law is scheduled to take effect on March 1, 2026, with specific provisions becoming enforceable as of July 1, 2026. The Investment Law 2025 represents a landmark advancement in the refinement of Vietnam’s legal framework. By prioritizing administrative streamlining and enhancing institutional transparency, the Law aims to cultivate a more favorable and robust business environment for both domestic and international investors. To ensure legal compliance and strategic alignment for enterprises, Viet An Law hereby provides an in-depth analysis of Vietnam’s new Investment Law 2025: key changes & insights.

Table of contents

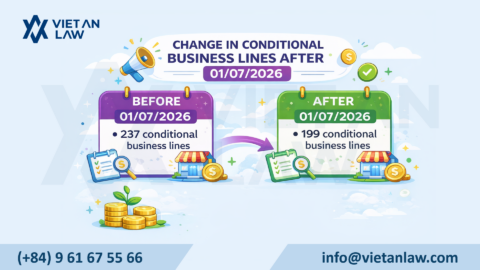

The latest Investment Law 2025, No. 143/2025/QH15, includes new regulations on the list of conditional investment and business sectors in Appendix IV. Accordingly, 38 conditional business lines have been abolished, and the scope of 20 other sectors has been updated and adjusted.

Therefore, from July 1st, 2026, only 199 business lines will be subject to conditional licensing.

This regulation aims to shift strongly from pre-approval to post-approval, from “licensing” to “registration” or “notification”, towards a standards-based management model for important sectors requiring state regulation. Enterprises will save time and initial licensing costs, making it easier to enter the market. This stimulates competition, innovation, and accelerates entrepreneurship.

Article 24 of the Investment Law 2025 specifically lists 20 types of projects that require approval of investment policy as a basis for implementation.

Accordingly, investment projects for infrastructure development in certain important and sensitive sectors such as seaports, airports, telecommunications, publishing, and journalism; projects proposing land use or sea area use; projects with significant environmental impacts, potential for serious environmental impacts, or implemented in areas affecting national defense and security… will require approval of investment policy procedures.

Previously, the Investment Law 2020 did not directly specify which project groups required investment policy approval, but only stipulated it according to the authority of each agency. The new approach helps to make the regulations clearer, more consistent, and easier to apply.

Regarding the authority to approve investment policies, Article 25 of the Investment Law 2025 stipulates:

Thus, the new law has further decentralized the authority to approve investment policies from the National Assembly to the Prime Minister and from the Prime Minister to the chairmen of provincial People’s Committees, aiming to reform administrative procedures and expedite the investment policy approval process.

Strong decentralization from the National Assembly to the Chairman of the Provincial People’s Committee

Compared to the Investment Law 2020, Article 33 of the Investment Law 2025 has removed two cases for adjusting investment projects:

The Investment Law 2025 retains only 5 cases where enterprises must adjust their investment policies, including:

This new regulation has simplified procedures, facilitated investment, and avoided the need to amend the investment policy even for minor adjustments.

According to Article 28 of the Investment Law 2025, investors have the right to choose to register their investment under special investment procedures for investment projects in industrial parks, export processing zones, high-tech zones, concentrated digital technology zones, free trade zones, international financial centers, and functional zones within economic zones, except for projects requiring investment policy approval as stipulated by the Government.

Investment projects registered under special investment procedures are exempt from procedures for investment policy approval, technology assessment, environmental impact assessment report preparation, detailed planning, construction permit issuance, and other procedures for approval and authorization in the fields of construction and fire prevention and fighting.

Investors only need to commit to meeting standards and regulations and submit a project proposal. The competent authority will conduct post-audits instead of pre-audits.

Thus, compared to the Investment Law 2020, the law has further expanded the scope of entities eligible for the green channel mechanism to maximize administrative facilitation in these areas.

The latest Investment Law of 2025, No. 143/2025/QH15, has amended and supplemented regulations on investment-incentive sectors in Articles 15 and 16, defining investment-incentive sectors as those prioritized for investment attraction to develop science and technology, innovation, digital transformation, digital technology industry, and semiconductor industry; develop green economy, circular economy, sharing economy, digital economy, and new economic models; develop industry clusters and value chains, attract investment in modern management, high added value, spillover effects, and connect global production and supply chains; develop renewable energy, new energy, and clean energy; and ensure national energy security.

This regulation aims to ensure consistency with the law’s development orientation, which only “stipulates framework issues and fundamental principles within the authority of the National Assembly”, thereby giving the Government the autonomy to determine investment-incentive sectors and professions appropriate for each period.

The new law amends and supplements the regulations on special investment incentives and support in Article 17 of the Investment Law to entrust the Government with specifying the scale of investment capital and disbursement schedule of projects eligible for special investment incentives, in accordance with the specific characteristics of each industry and sector.

This contributes to resolving difficulties and obstacles for projects that are behind schedule due to objective reasons; it also supplements regulations on project duration in cases where an investment project is transferred but the remaining project term does not meet the financial plan or business investment plan of the transferee investor, helping to release and unlock resources for society.

This regulation is particularly significant for real estate projects (such as projects using land for commercial and service purposes, or land for constructing condotels) where the investor sells the construction project along with the land use rights; the buyer will be granted land lease rights corresponding to the project’s term.

Clause 2 of Article 19 of the Investment Law 2025 allows foreign investors to establish enterprises without a prior investment project, but they must meet market access conditions.

Compared to the Investment Law 2020 (which required a project before an enterprise could be established), this is a major change that makes the investment environment more open; promotes FDI attraction and ensures equality between domestic and foreign investors.

The latest Investment Law 2025, No. 143/2025/QH15, has abolished the procedure for approving investment policies abroad (authority of the National Assembly and the Prime Minister) as stipulated in the previous Investment Law 2020.

Based on the provisions of Article 42 of the Investment Law 2025, the Law 2025 has narrowed the scope of projects that require the issuance of a certificate of registration for overseas investment. Specifically:

Thus, the new regulations have simplified the procedures for overseas investment, abolishing the procedure for approving overseas investment policies and narrowing the scope of projects that require the issuance of an overseas investment certificate.

The above are the critical updates to Law No. 143/2025/QH15 regarding Vietnam’s new Investment Law 2025: key changes & insights. For any inquiries or legal assistance with investment procedures and licensing, please contact Viet An Law for the most effective support!