As of January 1, 2026, Business Households will officially transition from the presumptive tax method to the declaration and self-payment method. This is considered an important step in tax administration, aimed at clarifying financial obligations, increasing autonomy for Business Households, and aligning with the modernization trend of the tax sector. Thus, how is the Calculating Business Household Tax in Vietnam 2026 implemented? Below, Viet An Law will provide detailed consultation and guidance on this issue.

Table of contents

On May 4, 2025, the Politburo issued Resolution 68-NQ/TW on private economic development, in which one of the proposed solutions is “Abolishing the presumptive tax form for Business Households by 2026 at the latest“.

To implement Resolution 68-NQ/TW, the National Assembly issued Resolution 198/2025/QH15 on May 17, 2025, regarding several special mechanisms and policies to develop the private economy. This Resolution applies to enterprises, Business Households, business individuals, and other relevant organizations and individuals. Specifically, Clause 6, Article 10 of Resolution 198/2025/QH15 stipulates as follows: “…6. Business Households and business individuals shall not apply the tax presumption method from January 1, 2026. Business Households and business individuals shall pay tax in accordance with the law on tax administration.”

Previously, Business Households could pay tax under the declaration method and the presumptive method. However, the presumptive method revealed many drawbacks such as:

Therefore, from January 1, 2026, the presumptive tax regime for Business Households is officially abolished. The elimination of the presumptive tax regime is expected to create a “revolution” in tax administration, contributing to ensuring transparency of income and expenses, ensuring fair tax obligations with other types of business, and avoiding tax loss.

Before 2026, Business Households would pay 03 types of taxes and fees when operating, including:

However, Article 10 of Resolution 198/2025/QH15 officially abolished licensing fees from January 1, 2026. Therefore, from 2026, Business Households only have to pay 02 types of taxes and fees: VAT and PIT.

Besides, in Table 2 issued together with Decision 3389/QĐ-BTC in 2025, the General Department of Taxation proposed a management model for Business Households based on revenue and tax rates of each tax type (or revenue thresholds and tax rates of each tax category), including 03 groups following:

After promulgation, according to the proposal and practical income of current Business Households, the Government and the Ministry of Finance proposed in Official Dispatch 18491/BTC-CST in 2025 to adjust and raise the non-taxable revenue threshold for PIT from VND 200 million/year to VND 500 million/year. Simultaneously, this level of VND 500 million/year is also the deductible level before paying tax based on the percentage of revenue.

Thus, after the proposal in Official Dispatch 18491/BTC-CST in 2025 is approved to amend Decision 3389/QĐ-BTC in 2025 of the General Department of Taxation, the tax payment responsibility of Business Households in 2026 will be implemented specifically as follows:

According to Table 2 of the tax management model for business households and individuals in the Project accompanying Decision 3389/QĐ-BTC in 2025, there is guidance on the detailed calculation when moving from presumptive tax to declaration and self-payment for 03 groups of Business Households.

Accordingly, the detailed calculating business household tax in Vietnam 2026 is as follows:

Not required to pay Value Added Tax or Personal Income Tax.

For Business Households and business individuals with revenue from over VND 500 million to under or equal to VND 3 billion/year, it is mandatory to pay tax under the direct method based on % of revenue, and they may voluntarily register for the credit method if eligible. Accordingly:

Different business lines will have different % rates according to Appendix I attached to Circular 40/2021/TT-BTC as follows:

| Sector | VAT Rate | PIT Rate |

| Commercial sector, sales of goods | 1% | 0.5% |

| Service sector, construction excluding materials | 5% | 2% |

| Production sector, services attached to goods, transport, construction including materials | 3% | 1.5% |

| Service sector, production of products subject to 5% VAT rate under credit method and other sectors not belonging to the above groups | 2% | 1% |

Example: A small grocery Business Household has a revenue of VND 700 million/year. The tax calculation is as follows:

Thus, the total tax the grocery Business Household must pay in 2026 is VND 10.5 million.

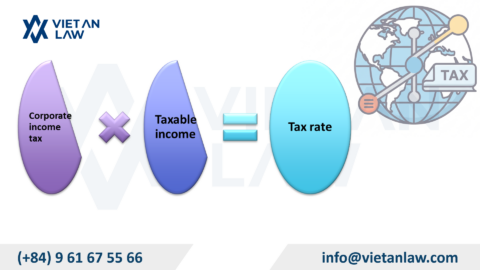

This is the group applying the credit method, managed similarly to micro or small enterprises. In which the Business Household will pay tax as follows:

Example: Mechanical Joint Stock Company A has a revenue of VND 4 billion/year, and reasonable expenses that can be proven are VND 3.5 billion. The tax calculation is as follows:

Thus, Company A must pay VND 150 million of VAT and VND 85 million of PIT. The total tax payable in 2026 is VND 235 million.

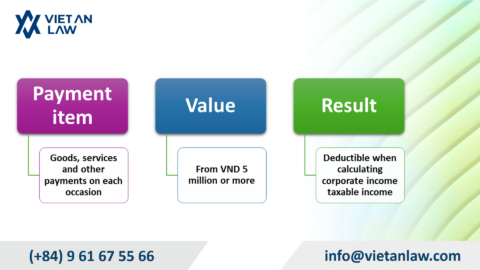

If the platform has a payment function:

If the platform does not have a payment function, Individuals must self-declare and pay tax upon each occurrence, monthly or quarterly.

The above is the consultation on Calculating Business Household Tax in Vietnam 2026. If customers have related questions or need advice on tax and accounting, please contact the Tax Agent – Viet An Law Firm for the best advice and support!