Cambodia is increasingly asserting its position as a potential investment destination in Southeast Asia, attracting the attention of a large number of international investors. This comes from many favorable factors. First of all, the business environment in Cambodia is considered stable with clear and transparent policies to encourage foreign investment, along with an attractive tax incentive system, especially competitive corporate income tax rates and tax exemption and reduction policies for businesses operating in special economic zones (SEZs). Cambodia’s strategic geographical location, located in the heart of Southeast Asia and bordering major markets such as Thailand, Laos, and Vietnam, facilitates connectivity and trade in the region, opening up opportunities to access vast markets, including China. In addition, the Cambodian government is focusing on investing heavily in infrastructure development, improving the transportation and logistics system, making the transportation of goods more convenient and efficient. All these factors combined have made Cambodia an ideal choice for investors looking for opportunities to expand their business and exploit the potential in the Southeast Asian market. Viet An Law would like to guide you through the procedures for establishing a company in Cambodia through the article below.

Table of contents

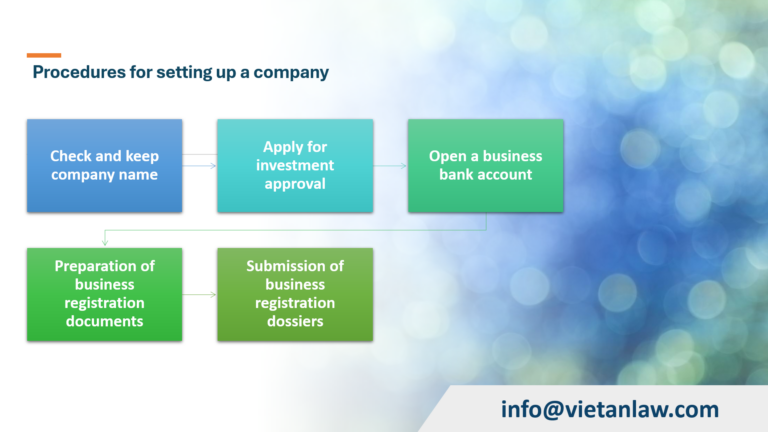

Procedures for setting up a company

Choosing the right type of business is the most important first step in the process of establishing a company. In Cambodia, there are several popular types of businesses that you can choose from, including:

For a private limited liability company (private limited company), the minimum requirement is a director. Meanwhile, a public limited liability company (public limited company) needs to have at least three directors. Cambodian law does not impose any restrictions on the nationality of directors.

In terms of the number of shareholders, a private limited company needs to have between 2 and 30 shareholders. However, the law also allows a single individual to set up a single-member private limited liability company.

Every company in Cambodia is required to have a legal representative (also known as a registered representative). This person must be an individual with full civil act capacity as prescribed by Cambodian law and must reside in Cambodia. The main role of a legal representative is to receive official legal documents and papers, especially from the court, on behalf of the company.

The company’s charter is the most important document, regulating the organization and operation of the company. This charter should include the following details:

If the company is headquartered in Phnom Penh, it needs to register its address with the Phnom Penh City Office. Similarly, if located in Siem Reap, the company needs to register with the Siem Reap City Office.

The address registration dossier includes

After completing the above preparation step, you will proceed to officially register the company with the competent authorities of the Cambodian government.

The registration of the establishment of the company is required to be done online through the Online Registration Service System of the Cambodian Data Exchange System (CamDX) of the Ministry of Economy and Finance (MEF). To use this system, you need to create a user account.

After choosing the right type of company, the next step is to register the company name. You need to enter the expected name in Khmer so that the system automatically checks for validity. The company name can also be registered in another language, the most common being English. Next, you need to determine the type of business that the company intends to carry out. The registration fee for reserving the company name is 40,000 KHR. Once the payment is completed, the company name will be reserved and no other organization is allowed to use it.

The period to hold the company name after approval is two weeks from the date of approval. If you want to extend this period, you need to pay an additional fee to renew it for another two weeks. Prior to October 1, 2020, the reservation period was three months, but according to the Ministry of Commerce (MoC) Notice No. 2993, this period has been adjusted to two weeks.

Next, you need to select the business lines according to the Standard Industrial Classification (SIC code), submit a lease for the registered office, and provide detailed information about the shareholders and directors.

Once the application is approved by the Ministry of Commerce, you will receive a Certificate of Registration, which can be obtained directly at the Registry or downloaded online.

The registration fee is KHR 2,155,000.

The list of documents and dossiers of company establishment when registering with the Ministry of Trade includes:

If you need to support the procedure for establishing a company in Cambodia, please contact Viet An Law for the earliest support!