On September 15, 2025, the State Bank of Vietnam issued Circular No. 27/2025/TT-NHNN guiding the implementation of a number of articles of the Law on Anti-Money Laundering 2022. This Circular takes effect from November 1, 2025, replacing and expanding the provisions of Circular No. 09/2023/TT-NHNN. Circular No. 27/2025/TT-NHNN marks an important step forward in legalizing and technicalizing anti-money laundering work in Vietnam. This Circular not only expands the scope of transaction monitoring and raises risk management standards, but also creates major challenges for banks, businesses and management agencies in the process of practical implementation. Below, Luat Viet An will clarify the notable content of Circular 27/2025/TT-NHNN: New Era for Anti-Money Laundering in Vietnam.

Table of contents

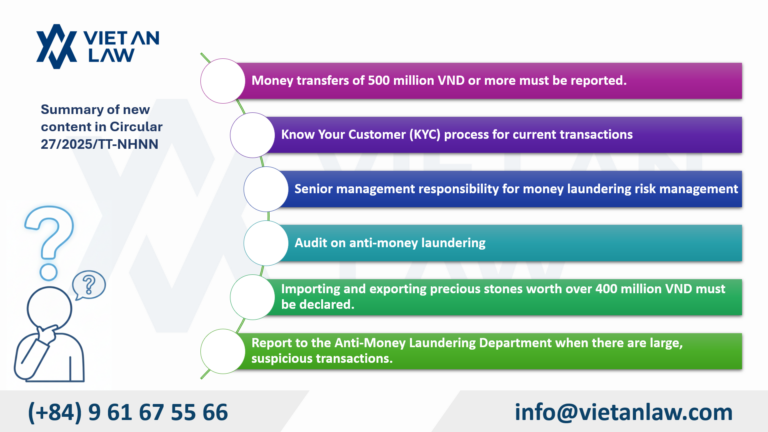

Circular 27/2025/TT-NHNN has made major changes in anti-money laundering in Vietnam, especially some notable new contents such as:

According to Point a, Clause 1, Article 9 of Circular 27/2025/TT-NHNN on reporting regime of electronic money transfer transactions as follows:

“ Article 9. Reporting regime for electronic money transfer transactions

… 1. The reporting entity is responsible for collecting information in Clause 3 of this Article and reporting to the Anti-Money Laundering Department using electronic data as prescribed in Clause 1, Article 10 of this Circular when conducting electronic money transfer transactions in the following cases:

…a) Electronic money transfer transactions in which all financial institutions participating in electronic money transfer transactions specified in Clause 1, Article 8 of this Circular are located in Vietnam (hereinafter referred to as domestic electronic money transfer transactions) have an electronic money transfer transaction value of 500,000,000 (five hundred million) VND or more or in foreign currency with equivalent value;

…b) Electronic money transfer transactions in which at least one of the financial institutions participating in the electronic money transfer transaction specified in Clause 1, Article 8 of this Circular in countries and territories outside Vietnam (hereinafter referred to as international electronic money transfer transactions) have an electronic money transfer transaction value of 1,000 (one thousand) US dollars or more or in other foreign currencies of equivalent value.”

Accordingly, entities must report when money transfer transactions involving domestic organizations have a value of VND500 million or more or equivalent foreign currency. For international transactions, the reporting threshold applies when electronic money transfer transactions have a value of USD1,000 or more.

The report must include complete information about the initiating and beneficiary organizations, the sender and the recipient, and details of the account number, amount, currency, purpose and date of the transaction. The information must be submitted electronically, ensuring accuracy and timeliness as required by the regulatory agency.

Circular No. 27/2025/TT-NHNN does not change the reporting value threshold but clarifies the responsibilities of electronic money transfer service providers in ensuring consistent and timely data and applying scanning and filtering technology to detect transactions with signs of risk.

Thus, compared with Circular No. 09/2023/TT-NHNN, this Circular only stipulates the obligation to report large-value transactions according to the form in Appendix I and does not mention transactions via deposit, withdrawal or automatic transaction machines, while Circular No. 27/2025/TT-NHNN has expanded the scope, covering transactions conducted through electronic transaction channels, contributing to tightening the anti-money laundering mechanism.

The new regulation shows the trend of increasing transparency and accountability in the money laundering risk management system, while creating a legal basis to link the direct responsibility of management levels with the effectiveness of anti-money laundering implementation at each organization.

Circular No. 27/2025/TT-NHNN stipulates that anti-money laundering content must be integrated into a separate part of the annual internal audit report. This report must be sent to the competent authority within 60 days from the end of the fiscal year. Specifically, according to Point c, Clause 10, Article 5 of the Circular stipulates:

This regulation demonstrates an effort to tighten internal control responsibilities in anti-money laundering work, while ensuring that state management agencies have a regular, complete and systematic source of information to assess the compliance effectiveness of organizations.

Importing and exporting precious stones worth over 400 million VND must be declared to customs

According to Article 11 of Circular No. 27/2025/TT-NHNN, individuals when exiting or entering the country carrying foreign currency in cash, Vietnamese Dong in cash, precious metals, gemstones or negotiable instruments with a value of 400 million VND or more must make a customs declaration and present documents as prescribed.

In which: Precious metals (except gold) include silver, platinum, silver or platinum handicrafts and jewelry, as well as alloys containing silver and platinum; precious stones include diamonds, rubies, sapphires, and emeralds; negotiable instruments with a value of VND 400 million or more.

This regulation both ensures transparency in circulation and contributes to controlling the risks of money laundering and cross-border terrorist financing.

When detecting a transaction of large value or suspicious signs, the reporting entity must report to the Anti-Money Laundering Department according to Article 6 and Article 7 of Circular No. 27/2025/TT-NHNN. The Anti-Money Laundering Department is the competent authority to receive reports on large-value transactions and suspicious transactions. Accordingly:

The provisions of Circular No. 09/2023/TT-NHNN previously required that reporting entities must submit internal regulations on anti-money laundering within 30 days from the date of promulgation or amendment, supplementation or replacement of internal regulations on anti-money laundering to the agency performing the functions and tasks of anti-money laundering under the State Bank of Vietnam.

However, from November 1, 2025, according to Circular No. 27/2025/TT-NHNN, this period has been shortened to only 10 days and the agency receiving internal regulations on anti-money laundering has also been changed as follows:

Circular No. 27/2025/TT-NHNN marks an important step forward in legalizing and technicalizing anti-money laundering work in Vietnam.

Above is the update of Circular 27/2025/TT-NHNN: new era for anti-money laundering in Vietnam. If you have any related questions or need advice on anti-money laundering regulations, please contact Luat Viet An for the best advice and support!