During the course of employment, there are many cases in which employees must temporarily leave work due to personal reasons or unforeseen circumstances. However, not all cases of leave are paid; in certain situations, the law provides that employees may take unpaid leave. In the article below, Viet An Law Firm will provide clients with information about the unpaid leave regulations for employees in Vietnam.

Table of contents

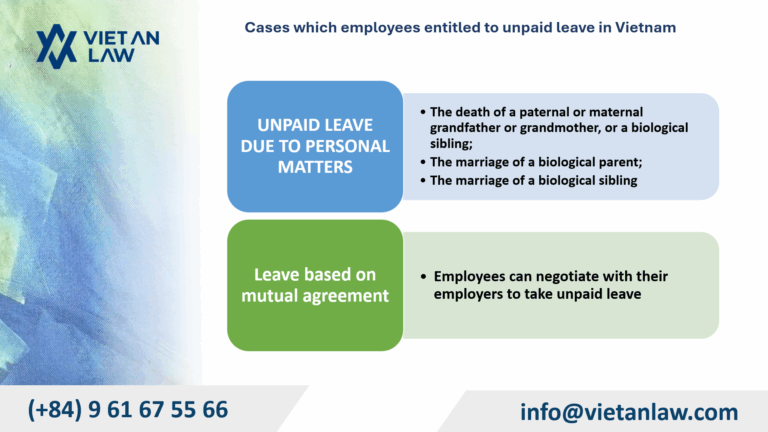

According to Article 115 of the Labor Code 2019, employees are entitled to unpaid leave in the following cases:

Cases which employees entitled to unpaid leave in Vietnam

Accordingly, employees are entitled to 1 day of unpaid leave in these cases and must notify the employer. The law does not stipulate a specific form of notification, so employees may inform their employers via phone call, email, text message,…

This regulation demonstrates a high level of humanitarian consideration, as it respects family relationships while ensuring flexibility for employees. Granting 1 day of unpaid leave in such situations is a reasonable measure, as it does not significantly disrupt the business’s operations while allowing employees to fulfill family obligations.

Note: An employee is entitled to take a fully paid personal leave in the following circumstances:

Additionally, employees can negotiate with their employers to take unpaid leave.

The law does not require a specific form for this agreement, so discussions may take place verbally, in writing, or through any other method, as long as the employer consents.

As analyzed above, the employer must allow unpaid leave in specific cases such as death or marriage of certain family members, and may not refuse these requests. However, the employee is only entitled to one day. For additional leave or leave for other reasons, the employee must negotiate with the employer.

There is no legal limit on the duration of unpaid leave based on mutual agreement, but both parties must consent. The employer has the right to refuse such requests without it being considered a violation of the law.

According to Clause 5, Article 33 of the Social Insurance Law 2024 (effective from July 1, 2025) if an employee receives no wages for 14 or more working days in a month, they do not have to pay social insurance for that month, unless there is an agreement between the employer and the employee to continue contributing, using the most recent month’s wage as the basis.

Do employees on unpaid leave still have to contribute to social insurance?

According to Clause 4, Article 65 of Decree 145/2020/ND-CP, periods included in working time as the basis for calculation of annual leave, but the total accumulated time may not exceed 1 month per year.

So, unpaid leave that is approved by the employer is still counted as working time for the purpose of calculating annual leave, provided it does not exceed one month per year.

An employer that has at least 10 employees shall have written internal labor regulations. According to Point a, Clause 2, Article 69 of Decree 145/2020/ND-CP:

“Article 69. Internal labor regulations

2. The labor regulations must not contradict labor laws and relevant laws. The primary contents of labor regulations include:

a) Specific working hours, rest periods in 01 day, 01 week; work shifts; beginning and ending time of shifts; overtime work (if any); special cases of overtime work; extra rest breaks; breaks between shifts; weekly days off; annual leave, personal leave, unpaid leave.”

A female employee is entitled to 06 months of prenatal and postnatal leave; the prenatal leave period shall not exceed 02 months.

According to Clause 3, Article 139 of the Labor Code 2019, after the maternity leave, if so demanded, the female employee may be granted an additional unpaid leave under terms agreed upon with the employer.

Thus, female employees can extend their leave without pay after maternity leave, but only if agreed upon with the employer.

According to Clause 1, Article 18 of Decree 12/2022/ND-CP:

“Article 18. Violations against regulations on working hours and rest periods

1. A fine ranging from VND 2.000.000 to VND 5.000.000 shall be imposed upon an employer for commission of one of the following violations:

a. Failing to grant personal leave or unpaid leave to employees under the regulations of law”

So, if an employer refuses unpaid leave in cases where employees are entitled to it under the law, they may face administrative penalties according to Decree 12/2022/ND-CP, with fines of: VND 2,000,000 to VND 5,000,000 for individuals; VND 4,000,000 to VND 10,000,000 for organizations.

Above is the advice of Viet An Law on the issue of unpaid leave regulations for employees in Vietnam. Clients who have related questions or need legal support about unpaid leave regulations for employees in Vietnam, please contact Viet An Law Firm for the best support!