Occupational accidents, while undesirable, can occur unexpectedly, significantly impacting the health and income of workers. To safeguard the rights of workers and provide necessary support during such adversities, the State has established regulations governing monthly benefits for occupational accidents in Vietnam. To clarify the criteria for eligibility and the procedural requirements for receiving these benefits, Viet An Law will elucidate the latest regulatory framework concerning the occupational accident benefits system in Vietnam.

Table of contents

Occupational accidents are accidents that cause injury to any part or function of the body or cause death to workers, occurring during the labor process, and are associated with the performance of work and labor duties (Clause 8, Article 3 of the Law on Occupational Safety and Hygiene 2015).

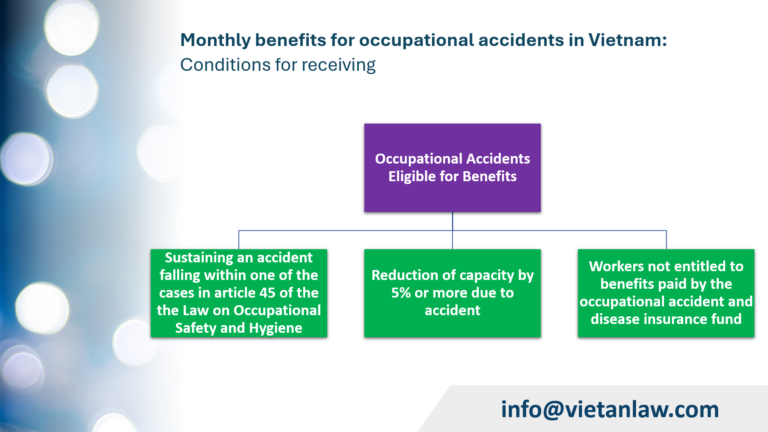

According to the provisions of Article 45 of the Law on Occupational Safety and Hygiene 2015, workers participating in occupational accident insurance are entitled to occupational accident benefits when the following conditions are met:

Under Clause 1, Article 49 of the Law on Occupational Safety and Hygiene 2015, workers who suffer a reduction in labor capacity of 31% or more are entitled to monthly benefits.

The monthly benefit levels are specified as follows:

In cases where injuries or illnesses recur, workers are entitled to reassessment of their reduced labor capacity, and the new benefit period is calculated from the month in which the Medical Examination Council concludes the assessment.

The benefit period: The benefit period is calculated from the month the worker completes treatment and is discharged from the hospital.

Moreover, according to Article 50 of the 2014 Social Insurance Law, workers who suffer a reduction in labor capacity of 81% or more and are paralyzed, blind in both eyes, have amputated or paralyzed limbs, or have a mental illness, are entitled to a monthly service allowance equivalent to the base salary.

Workers who are receiving monthly benefits for occupational accidents and relocating to a new place within the country and wishing to continue receiving benefits at their new place of residence must apply to the social insurance agency currently providing the benefits. Within 05 days of receiving the application, the social insurance agency is responsible for processing it; if the request is not granted, they must provide a written explanation stating the reasons.

Workers eligible for benefits prepare the dossier and submit it to the employing agency. The dossier includes:

Employing agency: Receives the dossier from the worker; prepares a proposal for resolving occupational accident benefits and submits it to the social insurance agency where the employing agency pays social insurance; in case the worker retires after the accident and requests the resolution of occupational accident benefits, the employing agency where the accident occurred prepares the dossier and transfers it to the social insurance agency responsible for paying pensions within 30 days from the date of receiving the complete dossier from the worker.

Submission methods:

Within 10 days from the date of receiving the complete dossier, the social insurance agency is responsible for resolving the occupational accident insurance benefits; if not resolved, a written response stating the reasons must be provided.

The employing agency receives the relevant documents in the registered form to hand over to the worker (directly at the social insurance agency or via postal services or via electronic transactions).

The worker receives the benefits through one of the following methods:

Workers can submit their dossiers at the district or provincial social insurance agency where they reside or where the company is registered to pay social insurance.

Do workers need to pay additional fees to receive occupational accident benefits?

No. The occupational accident benefit is paid from the Occupational Accident and Disease Insurance Fund contributed by the employer. Workers do not need to pay additional fees.

Yes. Monthly benefits are adjusted to increase according to the base salary. When the State adjusts the base salary, the benefits will automatically increase correspondingly.

If the company does not pay insurance, workers can still request compensation from the employer according to legal regulations. The compensation is usually equivalent to 1.5 to 3 months’ salary for each 1% reduction in labor capacity.

No. Only those who participate in compulsory social insurance are eligible for occupational accident benefits. However, they can request compensation from the employer if the accident occurs due to the company’s fault.

The benefit scheme is the responsibility of the company where the accident occurred, and it is calculated based on the salary at that company.

The above information is provided by Viet An Law Firm regarding the regulations on receiving monthly benefits for occupational accidents. If you need service support, please contact Viet An Law Firm for the quickest assistance!