The economic cooperation between Vietnam and Taiwan has made significant strides in recent years, with direct investment inflows from Taiwan growing strongly. Up to now, Taiwan has become one of the major foreign investors in Vietnam. With a young, abundant workforce and competitive costs, along with a large and rapidly growing domestic market, Vietnam has become an attractive destination for Taiwanese investors. In addition, Vietnam’s favorable geographical location and investment incentives are also factors that attract Taiwanese businesses. This partnership brings many benefits to both parties. For Vietnam, Taiwan’s investment has contributed to creating millions of jobs, transferring modern technology and promoting socio-economic development. For Taiwanese businesses, Vietnam provides a stable business environment, a skilled workforce and the opportunity to access the Southeast Asian market. Viet An Law would like to guide you through the procedures for establishing a Taiwanese-invested company in Vietnam through the article below.

Table of contents

Depending on whether the investor is an individual or a legal entity, it will be necessary to provide the following additional documents:

| Investors are individuals | Investors are legal entities |

| · Copy of identity card/identity card or passport for investors who are individuals subject to consular legalization and notarized translation; | · A copy of the consular legalized business registration certificate and notarized translation;

· Copies of personal legal papers of the legal representative of the organization that is consularly legalized and notarized. |

Place of application: Department of Planning and Investment where the head office is expected to be located.

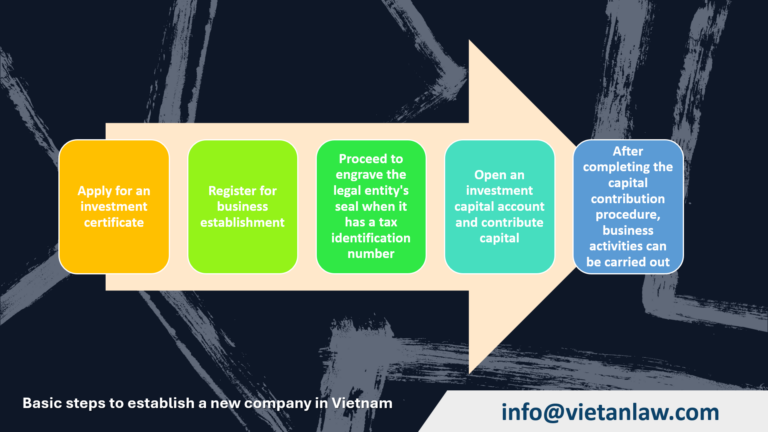

Processing order: Within 15 days from the date of receipt of a complete and valid dossier, the Department of Planning and Investment will issue an Investment Registration Certificate to the foreign investor. In case of refusal, the Department of Planning and Investment will reply in writing and clearly state the reason.

Place of application: Department of Planning and Investment where the enterprise is headquartered.

Duration: 03 – 06 working days.

Dossier of registration for purchase of contributed capital and shares of a Vietnamese company

Place of application: Department of Planning and Investment where the head office is expected to be located.

Processing order: Within 15 days from the date of receipt of a complete and valid dossier, the Department of Planning and Investment will issue a written confirmation of the purchase of contributed capital to the foreign investor. In case of refusal, the Department of Planning and Investment will reply in writing and clearly state the reason.

What form should be prioritized for establishing a Taiwanese-invested company?

– When deciding to invest, investors need to carefully consider between establishing a new economic organization and contributing capital to buy shares of an existing enterprise. If the goal is to have complete control of the business, build its own brand, and create a unique business model, then establishing a new economic organization is the right choice. However, if you prioritize quickly entering the market, taking advantage of available resources and sharing risks, then contributing capital to buy shares will be an optimal solution. The choice of investment form also depends on many other factors such as financial resources, business experience and long-term investment goals of each investor.

What is the minimum investment capital?

The Law on Enterprises 2020 and the Law on Investment in Vietnam do not specify the minimum charter capital. This is to create more favorable conditions for start-ups, small and medium-sized enterprises, and encourage entrepreneurship.

However, this does not mean that you can register the charter capital at too low a level.

So how to decide the level of investment capital?

Deciding on the appropriate level of capital will depend on many factors, including: