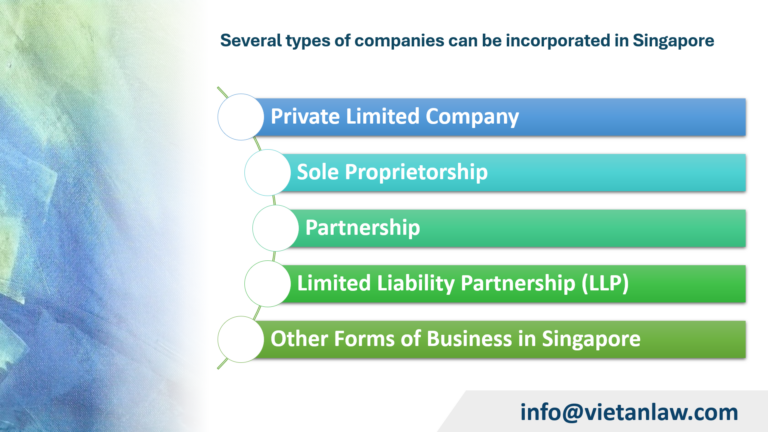

Singapore, with its dynamic and stable business environment, is one of the world’s leading economic centers. When deciding to set foot in this potential market, choosing the right type of business is one of the most important decisions. Singapore’s corporate legal system has many forms of businesses for investors to choose from, from small-scale private limited companies (Pte Ltd) to large-scale public companies, capable of raising capital from the public. Each type brings its own benefits and opportunities, helping businesses optimize their business operations, protect their assets and make the most of the government’s preferential policies. Viet An Law would like to introduce you to the types of businesses in Singapore through the article below, thereby making the most suitable choice for your business goals and strategies.

Table of contents

A Private Limited Company (Pte Ltd) is the most popular and flexible type of business in Singapore. It is an ideal choice for small and medium-sized businesses, as well as start-ups. Key features of the Pte Ltd type:

Sole Proprietorship is the simplest form of business in Singapore, where an individual owns and operates the entire business. This type is suitable for small businesses, just starting out, or individuals who want to do business independently. Main characteristics of the type of private enterprise:

A partnership is a form of business in which two or more people work together to do business, share profits, and are jointly responsible for the company’s debts. In Singapore, there are three forms of partnerships:

General characteristics of a partnership

A limited liability partnership (LLP) is a form of business that combines the advantages of a partnership and a private limited company. The main characteristics of the LLP type:

| Company Limited by Guarantee (CLG) | Variable Capital Company (VCC) | Representative Office | Branch | |

| Character | The responsibilities of members are limited to the level to which they have committed to contribute to the company in the event of the dissolution of the company. | VCC is a unique corporate structure, designed specifically for investment funds. It provides high flexibility in structuring and operating funds, suitable for various investment strategies such as venture capital, private equity, and real estate funds. | A representative office is not an independent legal entity but only an extension of the foreign parent company. This type is not allowed to engage in business activities, but can only carry out activities such as promoting the parent company’s products and services, market research, and communication. | A branch is an extension of a foreign parent company and is not an independent legal entity. The branch may engage in business activities but must strictly comply with Singapore’s regulations and have a close relationship with the parent company. |

| When should you register for this form | CLG is commonly used for non-profit organizations and associations | VCC is widely used in the field of investment fund management | Usually registered when the company wants the presence of a legal entity to understand the market before making a major investment decision. | Often used when the company wants to expand its business to Singapore. |

Choosing the right type of business in Singapore is an important decision, directly affecting the rights, obligations and development of your business. To make the right decision, you need to carefully consider the following factors:

If you need assistance in setting up a company, please contact Viet An Law Firm for quick support!