What issues need to be paid attention to when making an initial tax return? This is probably the question that many newly established businesses ask. And this procedure needs to be carried out by an accountant with solid professional skills. What if your business hasn’t hired an accountant? Please refer to the initial tax declaration service from Viet An tax agent to set up a complete initial declaration dossier for your business and use it throughout the operation period.

Table of contents

Immediately after receiving the business registration license, businesses need to make an initial tax declaration. It is both a right and an obligation that businesses need to fulfill to ensure the proper implementation of tax regulations throughout the operation period. At the same time, this is also the basis for establishing an accounting apparatus along with complete records and books to honestly reflect the situation of production and business activities.

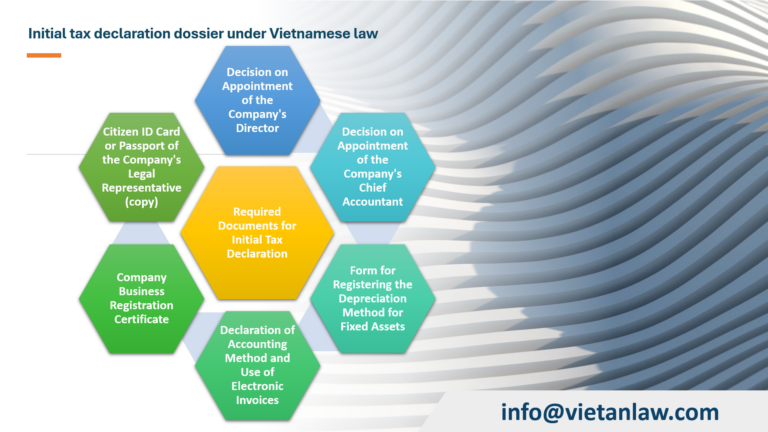

In the latest set of initial tax declaration dossiers, enterprises need to ensure to provide all the following data:

Proud to be an experienced unit in the financial accounting profession, Viet An tax agent with a team of experienced and skilled accountants is committed to ensuring that customers when using the initial tax declaration service complete the dossier and procedures in the most accurate way. From there, it serves as a basis for businesses to carry out accounting work and fulfill tax obligations on time.

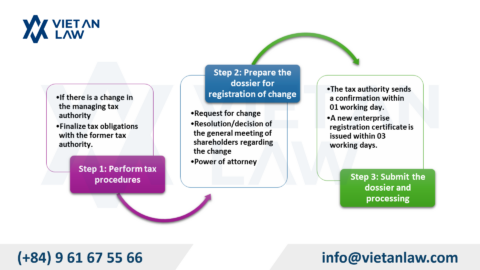

After completing the procedures for registering a business license and issuing a tax identification number, enterprises need to carry out the procedures for initial tax declaration. The job description includes the following main items:

The use of tax preparation services is initially a wise decision for business administrators. Because this work is not only accurate but also an extremely economical solution for newly established businesses without much experience.

Initial tax declaration is an important and necessary step for every business when receiving a business registration certificate. This needs to be done by qualified and skilled accountants. What if in the beginning your company did not have revenue but spent a significant amount of money to pay the salary of the accounting department? Using the initial tax declaration service for businesses at Viet An tax agent is a solution to help your business save costs and ensure accuracy.

If the first tax declaration is made by an experienced accountant, it will minimize the occurrence of errors, especially in urgent times.

Above is all the information related to the initial tax declaration service at Viet An tax agent. Please contact us if your business is newly established and is having difficulties in the tax declaration process!