Goods supply activities play an important role in promoting the consumption of goods by traders in the market, especially in the context of the global supply chain market. However, besides choosing a supplier, building a long term international goods supply contract requires contemplating many legal issues. Below, Viet An Law Firm would like to provide advice on drafting international long term goods supply contracts.

An international long term supply contract is an agreement between the buyer and the supplier in different countries, whereby the supplier commits to supplying goods to the purchaser at a certain price and transfer documents related to the goods, at the same time the buyer receives the goods and makes payment to the supplier.

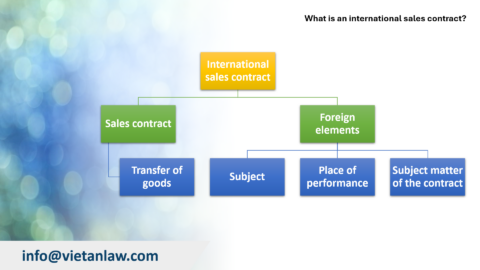

Compared to domestic goods supply contracts, international goods supply contracts have four differences:

The clauses of an international long term supply contract typically determine every element from how the goods are to be delivered, the terms of payment, and any other aspect of the relationship that the two Parties determine to be necessary.

A necessary basic provision of every contract is to determine the subject of the contract. Therefore, the Parties need to provide complete and accurate information about name, address, and headquarters.

Detailed goods information:

The Parties agree on the price currency, price level, and price calculation method.

The Parties agree on the currency unit for calculating the price. For international goods supply contracts, the currency unit is usually USD.

The Supplier shall provide the Purchaser with quotations of goods from time to time and notify the Purchaser of any price adjustment and the adjusted price shall apply to all/a shipment of goods delivered to or from time to time after the date of the increase price.

The Parties agree on the delivery location, delivery, and receipt time.

Delivery method: Waterway, road, rail or air.

The Parties can choose and include in the contract several delivery terms according to some common international practices in INCOTERMS such as FOB, CIF, DAP… The Parties should clearly state the INCOTERMS version and port name to avoid confusion during implementation. For example: FOB, Hai Phong Port, Incoterms 2020.

Because the contract is long term, the Parties agree on the delivery of orders. Each order, after confirmation from the Supplier, can be considered an independent contract. In this case, the Parties agree on a Framework Contract, which is specified in each delivery in the form of an appendix to the long term Goods Supply Contract. A framework contract is not outside the scope of regulation of the CISG. It is a long term contract that includes basic terms governing the relationship between the parties before each transaction takes place. Parties participate in many transactions with similar content. At this time, the framework contract acts as an original contract. After each transaction, the parties only need to create an appendix instead of making a new contract. Therefore, there needs to be a provision recognizing the inseparable binding relationship between these contracts to create a solid legal basis.

Note:

Payment currency: May or may not coincide with the pricing currency. In case there is no match, it is necessary to calculate the conversion rate.

Payment term: It is a necessary content of the contract, accordingly, parties need to agree on the payment term. For example: Payment must be made within 30 days from the date of issuance of the Supplier’s invoice. If the Buyer fails to pay or is late paying the goods according to the contract, the Supplier may:

Note: Parties should take into account that the calculation of interest is not legal under some legal documents, or they must comply with the maximum interest rate prescribed by law, or there are legal provisions on the calculation of interest. Pay interest for late payment. For example: Article 306 of the Commercial Law 2005; and Article 357 of the Civil Code 2015.

Payment method: This can be by bank transfer, cash, payment using documents such as L/C, D/P, or D/A, collection, wire transfer…

Payment documents: Clear regulations on payment when presenting sufficient documents, including a bill of exchange, invoice, C/O, quality inspection certificate…

The supplier guarantees legal ownership of the goods provided under the contract. Use or resale of the goods does not infringe the patent, design, copyright, trademark, or other intellectual property rights of any third party.

The Supplier shall not be responsible for any defects due to wear and tear or damage caused by willful wear, negligence, use under abnormal conditions, failure to follow the Supplier’s instructions, misuse, repair, or arbitrary changes by the Buyer or any other third party.

The Parties agree on penalties for violations of one Party’s obligations. It should be noted that fines for violations may be limited in some legal documents. For example, the Commercial Law 2005 stipulates a fine of no more than 8% of the value of the violated obligation.

Compensation is applied without the agreement of the contracting parties. It should be noted that the penalty level does not exceed the level of loss and lost profits that parties anticipated when entering into the contract.

Because the contract is long term, the contract term will usually last many years. The parties will agree on the terms of the contract and the deadline for each specific delivery stage.

Parties agree on when the contract takes effect. Normally, the contract will take effect on the date both Parties sign the contract. If the Parties do not sign at the same time, the contract will take effect on the date of the last signature.

Note: The contract term may be limited by applicable law. For example: The contract may be limited to a term of 5 years in cases where EU competition and anti-monopoly laws must apply.

The Parties can agree to terminate the contract when it is no longer effective or terminate the contract when one party fundamental breach of contract. For example: When the other party violates the contract and does not implement sanctions for the violation within 30 days after the request or when the other party dissolves or goes bankrupt.

The Parties need to stipulate the cases that, when occurring, make the contract impossible to perform, but are not responsible for, specifically when the following 3 factors are present simultaneously:

A force majeure event can be a war, accident, emergency, fire, natural disaster, or any other obstacle where the affected Party proves that the event is beyond the Party’s control. that cannot be foreseen at the time of the conclusion of the contract or cannot be avoided. That party shall notify without undue delay of this event and its effect on the Party’s ability to perform its obligations.

Because long term goods supply contracts have many different delivery dates, the parties also need to stipulate that force majeure events will only suspend this installment and that will there be any changes to subsequent installments.

The Parties need to agree on the applicable law to implement the contract and the applicable law to resolve disputes. For example: International treaties (as CISG 1980) National law (as Commercial Law 2005), International customs (as INCOTERMS 2020), and other soft law sources such as PICC. If the Parties do not agree, the dispute resolution agency will decide when a dispute occurs.

For dispute resolution, the parties agree on dispute resolution methods: Negotiation, conciliation, mediation, arbitration, court.

Above is some advice from Viet An Law Firm on drafting international long term goods supply contracts. If you have any further questions, please contact us for the best support!