On-site alcohol sales are a popular and widely used form of business activity among traders. In relation to this activity, business establishments must strictly comply with applicable legal regulations to ensure the effectiveness and lawfulness of their operations. As of July 01, 2025, the management and licensing of alcohol trading in Vietnam will undergo significant changes pursuant to Decree No. 139/2025/ND-CP, particularly concerning the authority to reissue on-site alcohol sales licenses. In this article, Viet An Law provides detailed information on the new business license for consumable alcohol reissuance in Vietnam, effective from July 01, 2025.

Table of contents

From July 01, 2025, Vietnam will officially implement a two-tier local government structure, comprising the provincial level and the communal level. Accordingly, the country will have 34 provinces and centrally governed cities and 3,321 commune-level administrative units.

The reorganization of administrative units necessitates a reallocation of authority among state agencies. Responsibilities previously held at the district level have been redistributed, either delegated down to the commune level or assigned up to the provincial level, depending on the nature and field of the task.

For the alcohol trading sector, under the management of the Ministry of Industry and Trade, the Government has issued Decree No. 139/2025/ND-CP to redefine the powers and responsibilities of local governments under the new two-tier structure.

In practice, on-site alcohol sales refer to the direct sale of alcohol for immediate consumption at the business location, such as restaurants, eateries, entertainment establishments, etc.

Therefore, on-site alcohol sales are understood to mean:

The activity of selling alcohol directly to consumers for immediate consumption at the point of sale.

Note: Alcohol does not include:

According to Article 18 of Decree No. 105/2017/ND-CP, traders selling alcohol for on-site consumption have the following rights and obligations:

According to clause 05, article 18 of Decree No. 105/2017/ND-CP, as amended by Decree No. 17/2020/ND-CP, traders selling alcohol for on-site consumption shall:

Pursuant to Article 14 of Decree No. 105/2017/ND-CP, as amended by Decree No. 17/2020/ND-CP, the conditions for engaging in on-site alcohol sales include:

Conditions for on-site alcohol sales

Pursuant to clause 07, article 16 of Decree No. 17/2020/ND-CP, before July 01, 2025, traders engaging in on-site alcohol sales are only required to register their on-site alcohol sales activity with the District-level People’s Committee through its Division of Economics or Division of Economics and Infrastructure at the locality where the business is located.

However, in accordance with Article 7 of Decree No. 139/2025/ND-CP, from July 01, 2025, onward, the competent authority for the registration of on-site alcohol sales shall be the Commune-level People’s Committee where the trader’s business establishment is located.

Reallocation of licensing authority

Pursuant to Article 27 of Decree No. 105/2017/ND-CP, as amended by Decree No. 17/2020/ND-CP, the reissuance of an on-site alcohol sales license applies in two cases:

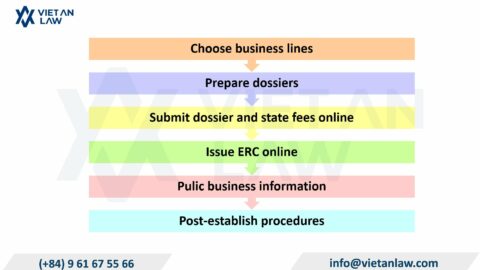

In both cases, the application dossier, licensing authority, and reissuance procedures shall be carried out in the same manner as for initial issuance, as follows:

Retail sale of alcohol without a valid license constitutes a violation of the law. This is explicitly stipulated in clause 01, article 07 of Decree No. 105/2017/ND-CP, which governs violations of regulations on alcohol trading. Conducting an alcohol business without a license or contrary to the contents of the license as prescribed in the Decree is deemed unlawful.

According to Article 06 of Decree No. 98/2020/ND-CP (on administrative penalties in the fields of commerce, production, trade in counterfeit and banned goods, and consumer protection), traders engaging in conditional business lines such as alcohol trading without the required license may be subject to an administrative fine ranging from VND 10,000,000 to VND 15,000,000.

The commune-level people’s committee chairperson shall have the authority to issue the sanction decision and record the administrative violation.

To avoid administrative penalties, businesses must submit an application for a retail alcohol sales license in accordance with the law.

Should you require assistance with the reissuance of a business license for consumable alcohol reissuance in Vietnam from July 01, 2025, please do not hesitate to contact Viet An Law for comprehensive legal support.