A single-member limited liability company (LLC) is a business owned by an organization or individual. The company owner is responsible for the company’s debts and other property obligations within the company’s charter capital. Whether a business of this type during its operation properly and fully complies with legal regulations depends greatly on the qualifications and understanding of legal issues of the owner. Understanding that difficulty, Viet An Tax Agent always accompanies business owners of single-member limited liability companies to provide timely support and legal advice, avoiding unnecessary risks. Post-establishment tax procedures are the first task that any business of any type must perform.

Viet An Tax Agent commits to implementing quickly and promptly, avoiding risks for businesses.

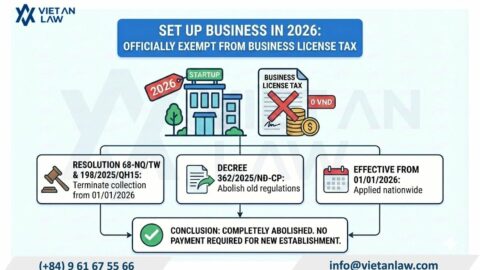

According to Point c, Clause 1, Article 1 of Decree 22/2020/ND-CP, from February 25, 2020, license fees will be exempted in the first year of establishment or production and business activities (from January 1 to December 31) for:

During the license fee exemption period, small and medium-sized enterprises that establish branches, representative offices, or business locations will be exempt from license fees during the period.

Therefore, if the company is established on August 1, 2021, the company will be exempt from license fees in 2021.

Currently, there are many units providing digital certificate services. Businesses can choose reputable suppliers or have consulting services to support businesses quickly and promptly such as Fpt, Viettel, Vnpt, Efy, Newtel, Misa,…

Business owners need to carry out post-establishment procedures as soon as they receive the Enterprise Registration Certificate. If you are unclear about the procedure or need a form to submit to the tax authority, business owners should immediately contact Viet An Tax Agent for advice and support.

If you require tax services after establishing a single-member LLC, please contact Viet An Law Firm – Tax Agent for the best support.