Along with the rapid socio-economic development come challenges in tax management, ensuring fairness and transparency in tax obligations for business entities. To improve the legal framework and enhance the efficiency of tax management in this sector, the Government has issued Decree 117/2025/ND-CP, which specifically regulates the tax obligations of business households and individuals engaged in e-commerce. This Decree not only contributes to the transparency of tax collection but also demonstrates a modern management orientation, adapting to current digital business trends. In the article below, Viet An Law Firm will provide necessary information about E-commerce Tax for Households & Individuals in Vietnam under Decree 117/2025/ND-CP.

Table of contents

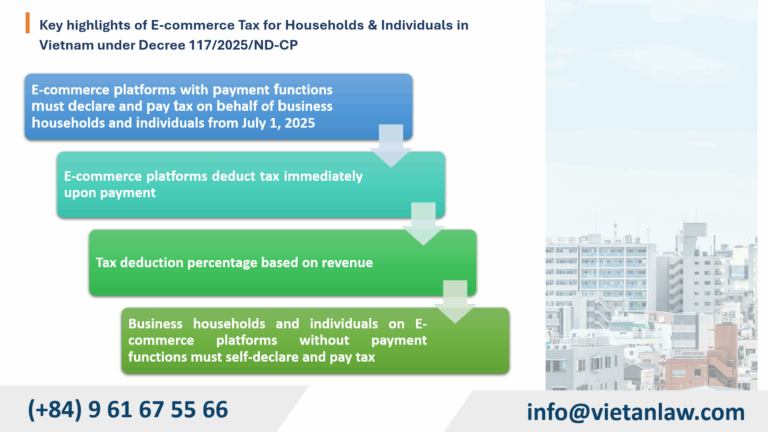

According to Clause 3, Article 11 of Decree 117/2025/ND-CP, starting from July 1, 2025, e-commerce exchanges with payment functions are responsible for declaring and paying Value Added Tax (VAT) and Personal Income Tax (PIT) on behalf of business households and individuals for goods sales and service provision conducted through their e-commerce platforms. Specifically:

Furthermore, Clause 4, Article 11 of the Decree clearly states: Sellers whose VAT and PIT have been deducted, declared, and paid on their behalf by the e-commerce platform operators do not have to declare and pay such tax.

According to Article 5 of Decree 117/2025/ND-CP, the time of VAT and PIT deduction is immediately upon confirming successful transactions and accepting payment. This means that as soon as revenue is generated, platforms with payment functions must proceed with deducting and paying tax on behalf of households and individuals.

According to Clause 2, Article 5 of Decree No. 117/2025/ND-CP, for e-commerce business activities of households and individuals, when e-commerce platforms with payment functions declare and pay tax on their behalf, the tax obligation is determined by direct deduction from the revenue generated from transactions.

Specifically, the applicable VAT and PIT rates are determined based on the revenue-based rate table issued in the Appendix accompanying the Decree, depending on the seller’s business sector.

The percentage (%) for calculating VAT is determined in accordance with the VAT Law. To be specific:

The percentage (%) for calculating PIT is determined in accordance with the PIT Law. To be specific:

If a business, household, or individual operates in multiple sectors, the deduction rate will be applied correspondingly to each activity if revenue can be separately identified. If revenue cannot be separated by sector, the highest rate among those types will be applied.

Additionally, the deducted and paid tax amount will be calculated on the entire revenue paid through the platform, regardless of the time of money transfer or goods receipt, to ensure consistency in determining tax obligations based on generated revenue. E-commerce platforms must deduct immediately upon transaction completion or as agreed with the intermediary payment organization.

According to the provisions in Chapter III of Decree 117/2025/ND-CP, if business households or individuals sell goods or provide services through e-commerce platforms that do not have payment functions, the responsibility for tax declaration and payment entirely belongs to the taxpayer – the business households and individuals.

Specifically, in Clause 2, Article 11 of the Decree, the Government stipulates that if an e-commerce platform does not perform payment functions, the “payment on behalf” tax declaration and payment mechanism is not applied. In this case, sellers must directly perform tax registration, tax declaration, and tax payment with the competent tax authority.

The tax obligations that individuals and business households must fulfill include:

To support tax management for the above group, Article 12 of Decree 117 also stipulates that e-commerce platforms without payment functions still have the obligation to provide periodic information to tax authorities, including a list of sellers, contact addresses, payment account numbers, generated revenue,… This information provision aims to serve inspection, supervision, and tax collection (if any) for cases that do not fully comply with tax obligations as regulated.

Furthermore, according to Article 13, business households and individuals, in this case, can choose to pay taxes electronically through the General Department of Taxation’s E-portal or through tax declaration support applications published by the General Department of Taxation. This contributes to simplifying administrative procedures and encouraging businesses to voluntarily comply with tax obligations in the e-commerce environment.

According to Article 11 of Decree 117/2025/ND-CP, business households and individuals selling goods and providing services through e-commerce exchanges are responsible for providing complete and accurate tax registration information and information related to business activities as required by tax authorities or through coordination mechanisms with e-commerce platforms. Specifically, they are responsible for:

According to Notice 08/TB-TMDT of 2025 on the change of the direct managing tax authority for foreign suppliers.

The details of the E-commerce Tax Sub-Department are as follows:

Based on Appendix I.A issue with Circular 32/2025/TT-BTC regulating invoice codes, the invoice code and receipt code issued by the E-commerce Tax Department is code 22.

Above is the advice of Viet An Law on the issue of E-commerce Tax for Households & Individuals in Vietnam under Decree 117/2025/ND-CP. Clients who have related questions or need legal support, please contact Viet An Law Firm for the best support!