Argentina is currently the third largest economy in the Latin American region and an active member of the MERCOSUR single market, Argentina offers many opportunities to consider for foreign investors who want to establish a company and expand their business. Argentina’s economy has sectors that are highly complementary strengths, especially in agriculture and the food industry, which facilitate two-way trade and investment exchanges. Moreover, laying a business foundation in Argentina can also open the door to access a wider market in the South American region. Viet An Law would like to guide customers through the procedure for establishing a company in Argentina through the article below.

Table of contents

Popular types of companies in Argentina that investors can refer to include:

Each type has unique characteristics that are suitable for the scale of operations, business objectives and different management needs of the enterprise. For example, S.R.L. is generally suitable for small and medium-sized enterprises with few members, while S.A. is suitable for larger companies with easier capital raising and share transfer capabilities. S.A.S. is a relatively new option that offers flexibility and simpler incorporation procedures, making it particularly attractive to startups and small businesses that want to get up and running quickly. This flexibility is reflected in many aspects including a very diverse capital structure, which allows for the regulation of different types of shares with separate rights and obligations. In addition, internal management and administration regulations can be agreed upon and adjusted by shareholders in the company’s charter more freely, without being bound by many rigid regulations such as the S.A.

For founders or shareholders who do not reside in Argentina, the appointment of a legal representative is a mandatory requirement. This representative (usually a lawyer or entrusted legal expert) will act as a legal bridge, carrying out all necessary procedures related to the process of company formation and registration at the Argentine authorities on behalf of foreign investors. In this case, you need a written authorization. In order for this document to be legally valid in Argentina, it needs to be consularly legalized. If the investor’s country is a member of the Hague Convention on Consular Legalization, the document only needs to be certified with an Apostille stamp. In the case of non-members, the document will need to be legalized through the consular process at the Argentine Embassy or Consulate in that country. Finally, once legalized, this authorization document is required to be translated into Spanish by a certified notary translator in Argentina to ensure accuracy and legality when submitted to the authorities. The appointment of a legal representative ensures that the process of establishing the company takes place in accordance with the provisions of Argentine law.

This is a mandatory procedure to ensure that your intended business name is unique and not confusing with any company that has been previously registered in Argentina. The inspection and implementation of the reservation procedure for the company name will be carried out at the Inspector General of Justice (Inspección General de Justicia – IGJ) if the company’s headquarters are located in Buenos Aires. For provinces other than Buenos Aires, this procedure will be carried out at the respective public registry of that province. Currently, the majority of these agencies have allowed the inspection and reservation of company names through online portals. Name reservations are important to ensure that when submitting an official application, the name you choose will not be duplicated and approved.

The initial charter capital contribution is a mandatory requirement when establishing a company in order to create the necessary financial resources for the business to start operating and demonstrate the commitment of members/shareholders. Regulations on the minimum capital level and time of capital contribution differ depending on the type of company chosen:

This initial capital contribution, at least the required 25% at the time of incorporation, should be required to be deposited into an escrow account in the name of the company in the process of incorporation at the National Bank of Argentina (Banco de la Nación Argentina) or another commercial bank authorized by the business registry.

The first thing to do is to publish the Publication of the Establishment Newspaper (Publicación en el Boletín Oficial). This is a mandatory legal requirement in Argentina to widely announce the birth of a new business. This notice must be published in the Official Gazette of the country (Boletín Oficial de la República Argentina). The content of the notice published in the Official Gazette includes basic information and a summary of the main points of the company’s charter, such as the name of the company, the type of company, the address of the head office, the main operational objectives, the identities of the founding members/shareholders, etc charter capital, and operation term (if prescribed). The publication of the Official Gazette confirms the publicity and transparency of business information, and is one of the required documents in the dossier submitted to the registry.

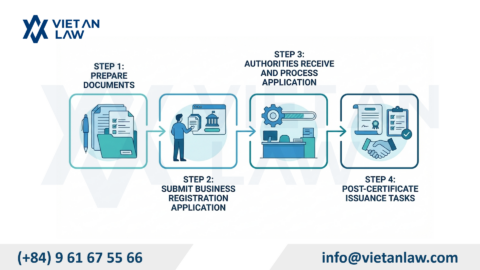

The dossier includes the following documents:

This set of documents will be filed at the Inspector General of Justice (Inspección General de Justicia – IGJ) if the company is headquartered in Buenos Aires City. If the company’s headquarters are located outside Buenos Aires, the dossier will be filed at the corresponding public registry of that province (e.g., Dirección Provincial de Personas Jurídicas). This filing is usually filed directly by the company’s legal representative or by an authorized attorney. After receipt, the registry will check the validity and completeness of the dossier in accordance with the law. If the application meets all the requirements and is approved, the registry issues a Certificate of Business Registration (Certificado de Inscripción).

However, obtaining a Business Registration Certificate is only a step in completing the legal establishment procedure. In order for the company to officially enter into business, issue invoices and fulfill financial obligations, the next step is to apply for a Tax Identification Number (Clave Única de Identificación Tributaria – CUIT). The company needs to apply and apply for this CUIT code at the Argentine Federal Tax Authority (Administración Federal de Ingresos Públicos – AFIP). The company needs to file specific forms as required by the AFIP, such as Form 185 for S.R.L. companies. The registration of a CUIT code is a prerequisite for the company to be able to carry out all legal economic activities, including signing contracts, opening corporate bank accounts, issuing value-added invoices (IVAs), and declaring and paying federal, provincial, and municipal taxes.